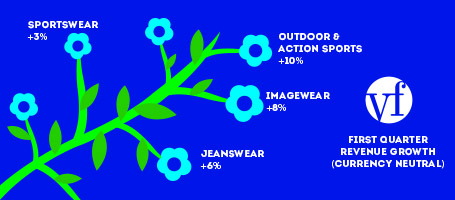

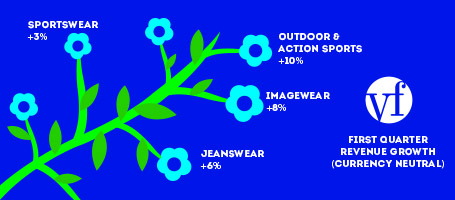

VF Corporation with revenue growth

Revenue in the segment Outdoor & Action Sports up by 2% (+10% in currency neutral). International revenue down by 5% (up by 9% in currency neutral)

“We remain confident in the year ahead, the fundamental strength of our business, and the significant momentum we see across our diverse portfolio of brands”, stated Eric Wiseman, VF Chairman, President and Chief Executive Officer, adding: “The proven strength of VF’s growth strategy, driven by consistent execution and solid operational discipline, has led us to increase our expectations for full-year currency neutral earnings per share growth putting us on track to deliver another record year to shareholders.”

Revenue rose by 8% on a currency neutral basis, including growth in the Outdoor & Action Sports, Jeanswear, Imagewear and Sportswear segments, in international and direct-to-consumer businesses. On a reported basis, revenues increased 2% over similar quarter in 2014.

First quarter revenue for the Outdoor & Action Sports segment was up by 10% on a currency neutral basis (up 2% in reported basis) reaching 1.6 billion US dollars.

First quarter currency neutral revenue for The North Face brand rose 7% (up 1% reported), including a 2% increase (up by 13% in reported terms) in direct-to-consumer business. By region, the brand’s revenue was up at a mid single-digit percentage rate in the Americas, up at a high single-digit rate (down low double-digit reported) in Europe and up at a low double-digit percentage rate in the Asia Pacific region.

Currency neutral revenue for the Vans brand in the first quarter was up by 16% (increasing by 8% in reported terms) including balanced growth in its direct-to-consumer and wholesale businesses. Revenue in the Americas region was up at a high-teen percentage rate (up mid-teen reported), up more than 45% in the Asia Pacific region and up at a mid single-digit rate (down low double-digit reported) in Europe.

First quarter revenue for the Timberland brand was up by 10% on a currency neutral basis (flat reported) including a 16% increase (up by 6% in reported terms) in its wholesale business. In the Americas region, revenue was up at a high-teen percentage rate driven by significant wholesale growth. In Asia Pacific, revenue in the first quarter was up at a high single-digit rate (up low single-digit reported) and in Europe, the Timberland brand was up at a low single-digit rate (down mid-teen reported).

Jeanswear revenue increased 6% in the first quarter (up 1% in reported basis) totaling 700 million US dollars. Revenue for the Americas region improved at a mid single-digit percentage rate. In Europe, revenue was up at a mid single-digit percentage (down mid-teen reported) and in Asia, revenue increased at a high single-digit rate.

Imagewear revenue was up 8% (up by 7% reported) totaling 283 million US dollars in the first quarter driven by strong demand for the Red Kap brand.

Sportswear revenue increased 3% in the first quarter totaling 136 million US dollars, driven by low single digit growth in the Nautica and Kipling brands revenue.

The Contemporary Brands segment first quarter revenue was down by 7% (down by 11% in reported terms) totaling 88 million US dollars, reflecting ongoing challenges in demand for the sector.

International revenue, on a currency neutral basis, was up by 9% (declining 5% in reported terms) in the first quarter. Revenue in Europe was up 4% (down by 14% in reported terms) and in the Asia Pacific region it increased by 17% (up 13% reported). Revenue in the Americas (non-US) region was up by 16% (up by 4% in reported terms). On a reported basis, international revenue was 40% of total VF first quarter sales compared with 43% in the same period of 2014.

Revenue rose by 8% on a currency neutral basis, including growth in the Outdoor & Action Sports, Jeanswear, Imagewear and Sportswear segments, in international and direct-to-consumer businesses. On a reported basis, revenues increased 2% over similar quarter in 2014.

First quarter revenue for the Outdoor & Action Sports segment was up by 10% on a currency neutral basis (up 2% in reported basis) reaching 1.6 billion US dollars.

First quarter currency neutral revenue for The North Face brand rose 7% (up 1% reported), including a 2% increase (up by 13% in reported terms) in direct-to-consumer business. By region, the brand’s revenue was up at a mid single-digit percentage rate in the Americas, up at a high single-digit rate (down low double-digit reported) in Europe and up at a low double-digit percentage rate in the Asia Pacific region.

Currency neutral revenue for the Vans brand in the first quarter was up by 16% (increasing by 8% in reported terms) including balanced growth in its direct-to-consumer and wholesale businesses. Revenue in the Americas region was up at a high-teen percentage rate (up mid-teen reported), up more than 45% in the Asia Pacific region and up at a mid single-digit rate (down low double-digit reported) in Europe.

First quarter revenue for the Timberland brand was up by 10% on a currency neutral basis (flat reported) including a 16% increase (up by 6% in reported terms) in its wholesale business. In the Americas region, revenue was up at a high-teen percentage rate driven by significant wholesale growth. In Asia Pacific, revenue in the first quarter was up at a high single-digit rate (up low single-digit reported) and in Europe, the Timberland brand was up at a low single-digit rate (down mid-teen reported).

Jeanswear revenue increased 6% in the first quarter (up 1% in reported basis) totaling 700 million US dollars. Revenue for the Americas region improved at a mid single-digit percentage rate. In Europe, revenue was up at a mid single-digit percentage (down mid-teen reported) and in Asia, revenue increased at a high single-digit rate.

Imagewear revenue was up 8% (up by 7% reported) totaling 283 million US dollars in the first quarter driven by strong demand for the Red Kap brand.

Sportswear revenue increased 3% in the first quarter totaling 136 million US dollars, driven by low single digit growth in the Nautica and Kipling brands revenue.

The Contemporary Brands segment first quarter revenue was down by 7% (down by 11% in reported terms) totaling 88 million US dollars, reflecting ongoing challenges in demand for the sector.

International revenue, on a currency neutral basis, was up by 9% (declining 5% in reported terms) in the first quarter. Revenue in Europe was up 4% (down by 14% in reported terms) and in the Asia Pacific region it increased by 17% (up 13% reported). Revenue in the Americas (non-US) region was up by 16% (up by 4% in reported terms). On a reported basis, international revenue was 40% of total VF first quarter sales compared with 43% in the same period of 2014.