Register to continue reading for free

US Retail: Will retail go back to the trend?

Retail Sales in shoe stores started the year with a decreasing trend, putting an end in some recovery registered in the last months of 2020, especially when the stimulus checks started reaching the households. E-commerce is on an upward cycle, however, is not clear if the net result will be a good one, as its growth is taking place at the expenses of brick and mortar. Once again, as in other geographies already analysed in the past weeks, Consumer Confidence seems to be on a good track, translating the feeling that mass vaccination will knock COVID-19 soon. The question is: will retail go back to the trend?

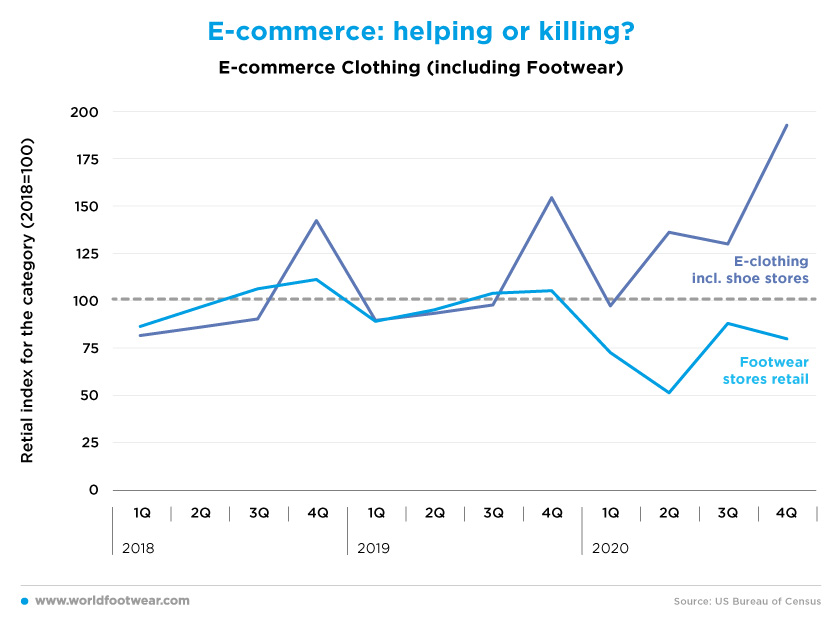

E-commerce: helping or killing?

Back in November 2020 COVID-19 was hurting hard again the US and, as a result, footwear retail suffered a relapse of eight percentage points (pp) in the fourth quarter over the previous quarter. This resulted in a new opportunity for e-commerce to win market share against physical retail: eight additional pp for the online business for each pp lost by stores.

As Diane Sullivan, Caleres’ Chairman and CEO put it they “achieved a 40% increase in e-commerce sales via rapidly growing owned websites, succeeding at Famous Footwear a significant increase in year-over-year earnings despite a modest decline in fourth quarter sales”.

Continued acceleration of the digital business has also been pointed out by Richard Johnson, Chairman and Chief Executive Officer, as the basis of the “strong bottom-line results in the fourth quarter” delivered by Foot Locker.

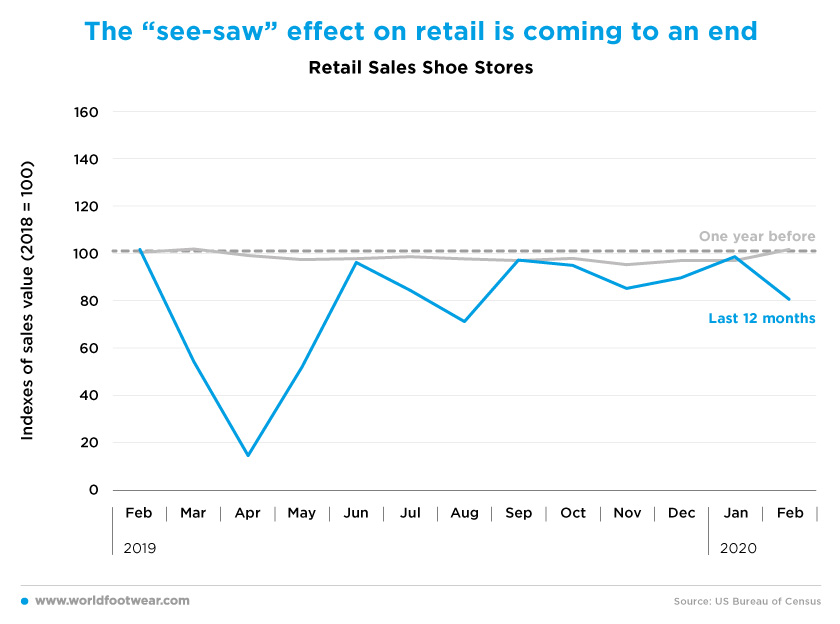

The “see-saw” effect on retail is coming to an end

Retail sales of shoe stores (seasonally adjusted) have been recovering since November 2020 through January 2021, in which they almost kicked again the 2018 baseline as the stimulus payments to households (from the December pandemic-relief package) were spread out. We shall see when data is available for the first quarter 2021, how much of the gained share will e-commerce maintain for its own.

But in some sense Blake W. Krueger, Wolverine’s Chief Executive Officer, was already anticipating it when he said that the company delivered “better-than-expected results for the fourth quarter and is poised to drive an accelerated recovery over the next twelve to eighteen months. The owned eCommerce revenue grew 50% in 2020, and further investment in this area is planned to enable [worldwide] growth of 40% in 2021”.

In February 2021 footwear retail has lost roughly 20 pp, in a typically quiet month for retail sales before the spring selling season, and with very cold temperatures and winter storms undermining retail in some parts of the country. However, this time, COVID-19 was not behind the performance of retail sales.

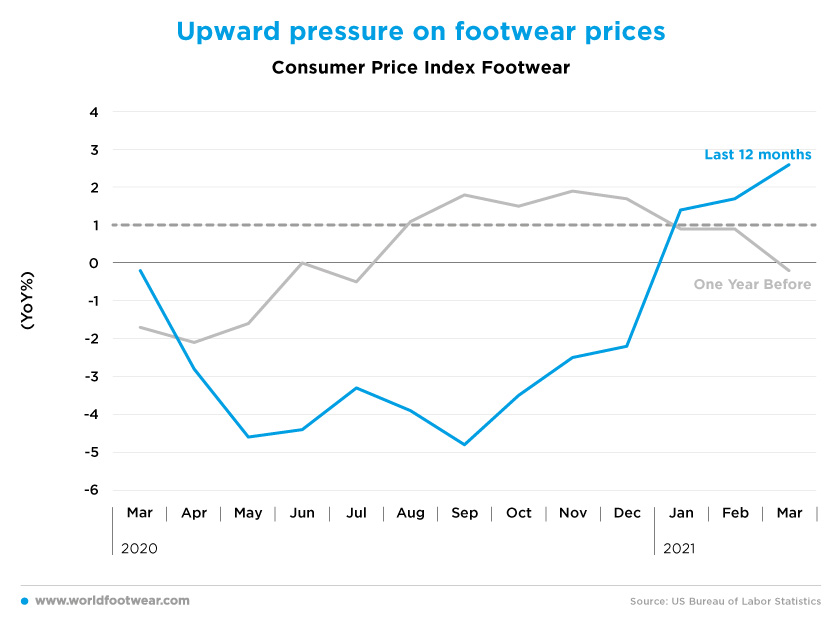

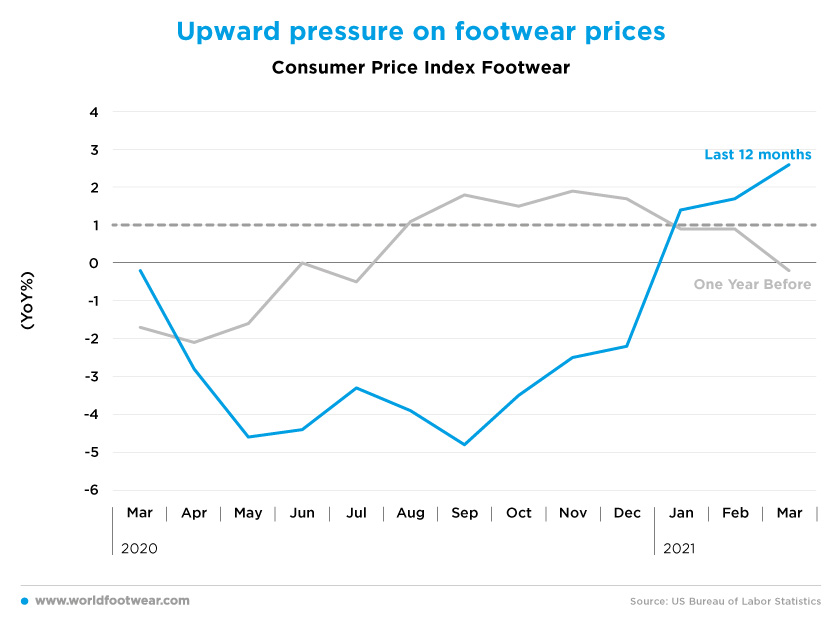

Upward pressure on footwear prices

As the data is still not being available for March, the advanced figures for Clothing and Accessories instead show a Year-on-Year (YoY) growth rate of more than 18% in this category, with a new mega-stimulus package approved on top of warmer weather and vaccine acceleration.

Commenting on its first quarter, Edward Rosenfeld, Chairman and Chief Executive Officer at Steve Madden declared that results “significantly exceeded their expectations” as the “revenue performance in the retail segment increased 7% based on the strength of exceptional growth in the digital business”.

Footwear sales acceleration in March is also anticipated by a quarterly sustained increase of its consumer price index contrasting sharply with the seasonal pattern of the previous year.

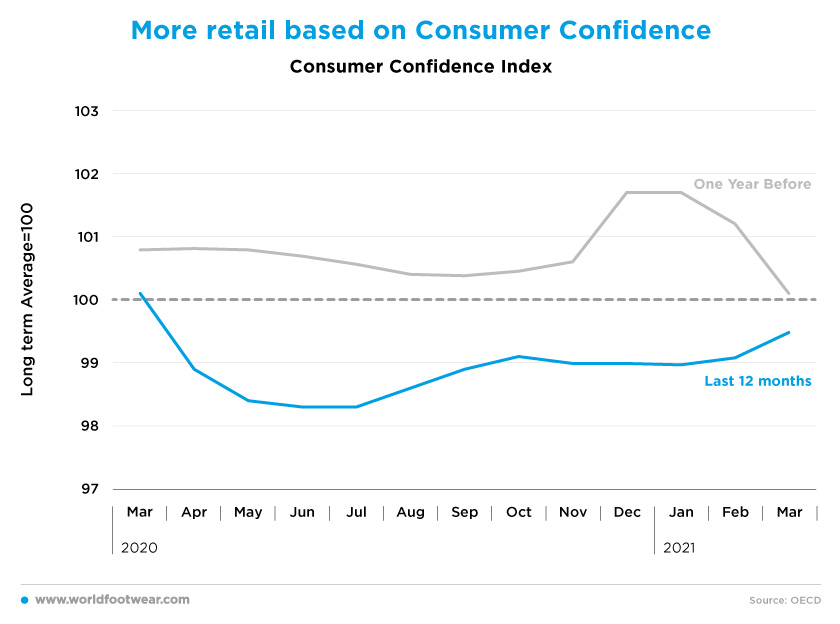

More retail based on Consumer Confidence

Last but not the least, let us look into the Consumer confidence indicators (by OECD, seasonally adjusted). Although not yet up the long-term baseline, the Consumer Confidence Index is once again showing some recovery in February and March 2021. The University of Michigan’s consumer confidence indicator in April goes in the same direction.

This means the consumer believes that with mass vaccination, the COVID-19 pandemic will be knock out sooner than later. And that seems to indicate that the pre-COVID trend will resume soon. The question being: with what extent? As e-commerce is taking a bite on brick and mortar, it is still unknown if total footwear retail (online + offline) is going to grow or not.