Register to continue reading for free

US Retail: there’s still a great deal of uncertainty

There are still no solid signs of a recovery in the footwear retail sector. Despite mirroring last year’s trend, sales are consistently lower than in 2023, and footwear imports continue their downward trajectory. This may suggest that prices have not yet reached a level where consumers will bite. The truth is that the US economy has made great progress and inflation has eased considerably, but not enough to reassure consumers, who are still uncertain about what will happen next. And when that happens, discretionary items always pay the price

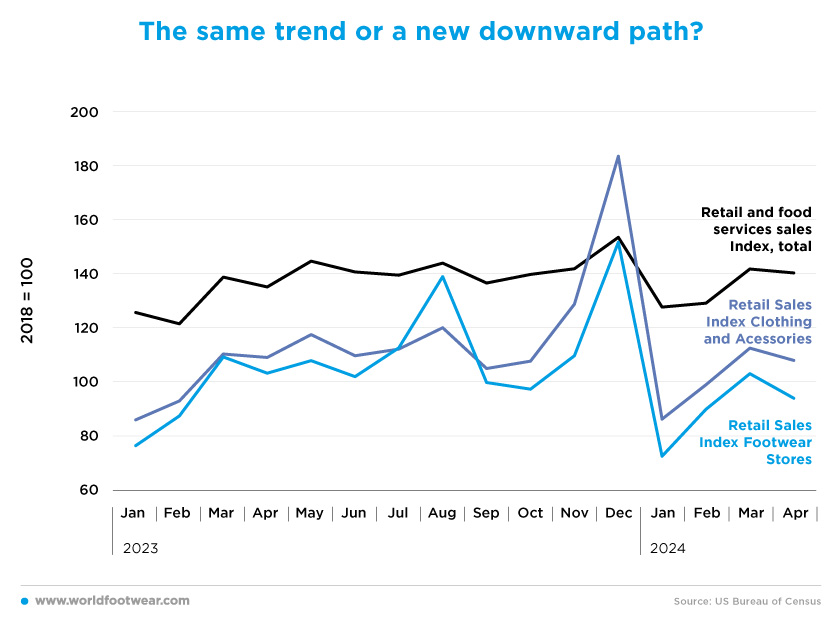

The same trend or a new downward path?

Total retail sales in the US economy fell in January, with both Clothing and Footwear retail sales showing more drastic declines, down by 52% from the previous month. But that’s not the worst, as some seasonality is to be expected. The problem is that both went below what was seen last year in January 2023.Then, February and March showed monthly increases, “as tax refunds and job growth put more money in shoppers’ pockets”, according to the National Retail Federation Chief Economist Jack Kleinhenz, but April changed the picture as it did last year, with footwear retail sales down by 8%, a bigger drop than the one seen in the same period in 2023.

So far, in the first four months of 2024, the fashion retail sectors appear to be following the same trajectory as last year, but with lower numbers. “The road to retail stability will be a bumpy one, as changes associated with seasonality combined with extreme year-over-year sales comps will bring more spending shifts for marketers to navigate”, said Marshal Cohen, chief retail industry advisor at Circana.

“The good news is that if the price is right, the consumer will bite”. A recent consumer survey found that 40% of consumers made an immediate purchase rather than delay because of a discount offer. More than 8 in 10 consumers say they will buy a product now if the current price is a good deal compared to typical pricing; the urgent need for a product ranked second. (…) (fdra.org).

The question is now whether sales will pick up as they did in 2023 or whether 2024 will have its own downward trajectory.

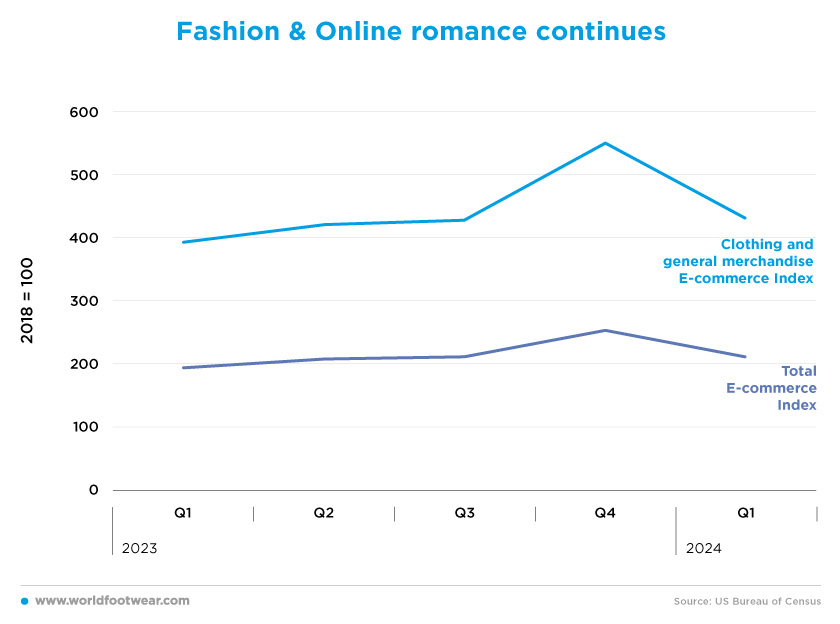

Fashion & Online romance continues

Over the last five quarters, fashion has remained the leading sector in online sales. The US Census Bureau’s E-Commerce indexes show that Clothing and General Merchandise (including footwear and accessories) still outperform Total E-Commerce of goods, meaning that when it comes to online shopping, fashion goods are showing a bigger increase when compared to the 2018 baseline.Despite a 25% decrease in e-commerce of fashion goods in the first quarter of 2024, as compared to the previous quarter (fourth quarter of 2023), the reality is that the same index is 11% above what was seen in the same period of 2023 (first quarter of 2023).

There’s a chance, however, that online is doing more damage to the high street than we can see with the naked eye. Analyst Michael Lasser made headlines in 2020 when he predicted that 100,000 stores could disappear by 2025, with apparel being the hardest-hit sector. The prediction was based on e-commerce driving growth in retail and forcing retailers to rationalise their store footprints.

In 2022, the estimation had been scaled back to 50,000, with around a quarter of all e-commerce purchases expected to rely on a store for fulfilment. But Lasser still expects retail sales to grow in the 4% range, in line with the average growth rate between 2002 and 2020, and e-commerce penetration to increase from 21% in 2023 to 28% in 2028.

He concluded by saying that as e-commerce penetration is driven by third-party players such as Temu and Shein, which don’t even have a physical presence in the US, “there will be just less need for stores” (footwearnews.com).

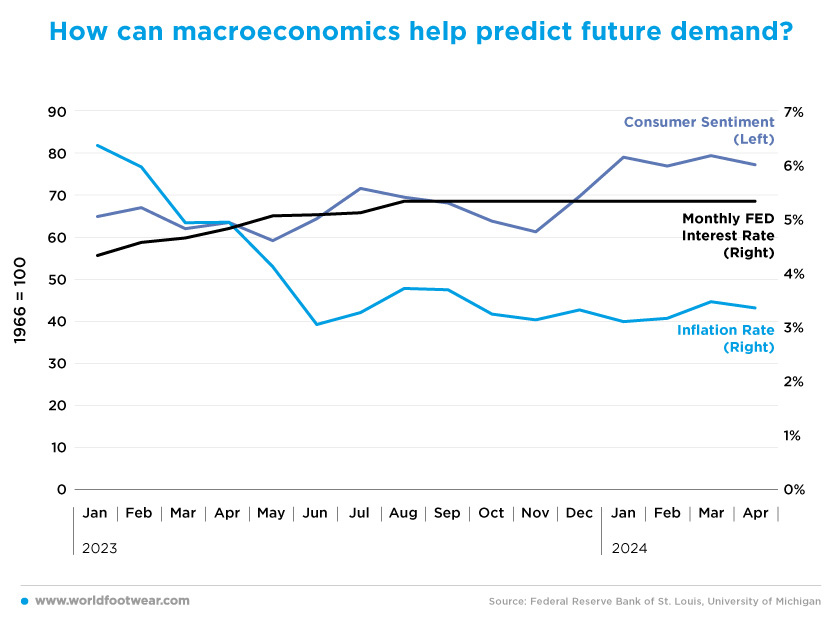

How can macroeconomics help predict future demand?

In order to try to predict future demand, most economists tend to look at the macroeconomic environment and for a while, it seems that things have been stagnant in the US.Since the beginning of 2024, the Consumer Sentiment Indicator (by the University of Michigan) has shown monthly readings above those of 2023 because “consumers’ behaviour and spending power are tied to their financial health, and the consumer sector looks good at the moment”, said Jack Kleinhenz, Chief Economist at the National Retail Federation. However, each time consumer sentiment has risen slightly, it has fallen back to the previous level the following month, suggesting that consumers are still unsure about what will happen next.

Two of the economic variables that most influence consumer sentiment are the inflation rate and the Federal Reserve interest rate, and the reality is that there is a lot of expectation surrounding these issues. Inflation in the US has been between 4% and 3% since June 2023 and has proven difficult to bring down to the FED’s 2% target. As a result, interest rates have remained high and stable at 5.3% since August 2023.

Fed Chairman Jerome Powell stated last month that the economy has made “considerable progress” and that inflation “has eased substantially”. However, the Federal Reserve held interest rates steady in June and pushed out the start of rate cuts to perhaps as late as December.

“No one can accurately forecast what surprises the next year might hold, but the foundation of the economy is relatively sturdy and still on a sustainable path,” Kleinhenz said, adding that the continuing recovery remains “highly reliant” on consumer spending. “Barring unexpected shocks, it should continue growing in 2024, although not spectacularly” (fdra.org).

But, so far, it looks like “consumers intent to spend on most essential items grew”, and they are pulling back on discretionary items, particularly travel and hospitality-related categories (mckinsey.com).

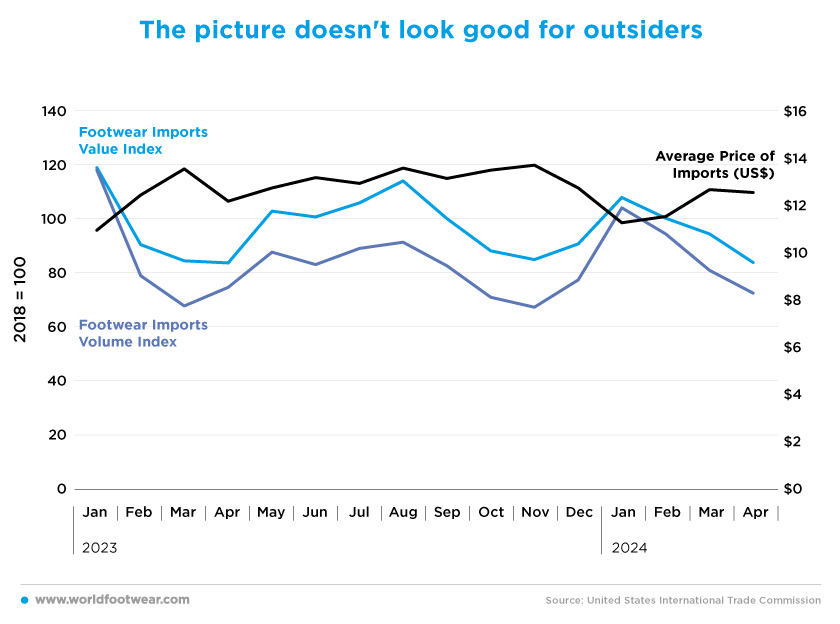

The picture doesn’t look good for outsiders

Since January, footwear imports have been on a downward road that doesn’t seem to have a stop sign. At the beginning of the year, imports bounced back from the end of 2023, increasing by 19% in value in January 2024, but it seemed to be just a fling. Since then, they have fallen by more than 22% in value and 30% in volume. Imports also fell in the first 3 months of 2023, but things picked up again in April, but the same didn’t happen this past April.Looking at the average import price, it can be said that the type of footwear that is losing imports is probably the cheapest, as the value and quantity of imports are falling, and the average price has risen by 1.28 US dollars so far this year.

Footwear prices rose by 1.5% year-over-year in March and 1.4% in April, the strongest month for sixteen months. “The increases were mainly driven by the price of men’s footwear which grew by 4.6% and 4% respectively (the biggest leaps in 20 months). Compared to the prior year, women’s footwear prices sank by 1.9% and children’s footwear prices rose 0.8%.”

The higher men’s footwear prices, up by 2.5% year-to-date, as compared to the same period in 2023, come as the pattern of declining shoe duties moderates, pointed out the chief economist at FDRA Gary Raines. FDRA also predicts that men’s shoe prices will continue to rise in 2024. Meanwhile, the cost of men’s footwear imports is down by 8.6% since the start of the year, and is on track to hit its steepest annual drop in over 35 years.

“While these duties paid have declined year-over-year for several months, the rate of decline has moderated over recent months, buoying these recently higher retail prices,” Raines said. “If duties on men’s footwear imports begin to expand again, men’s retail prices may climb even faster, costing consumers and crimping retailers’ and importers’ margins” (footwearnes.com).