Register to continue reading for free

US Retail: it’s all about the prices

There are signs that footwear retail sales could rise moderately in the near term, but this will all depend on future price behaviour. On the one hand, the CPI suggests that the risk of renewed price rises is well contained, but on the other hand, retailers continue to manage excess inventories, so their pricing power may not be more evident until 2024. Perhaps better news comes from consumers’ inflation expectations for the next 12 months, as they seem to believe that they will get a break from inflation, which usually leads to more discretionary demand

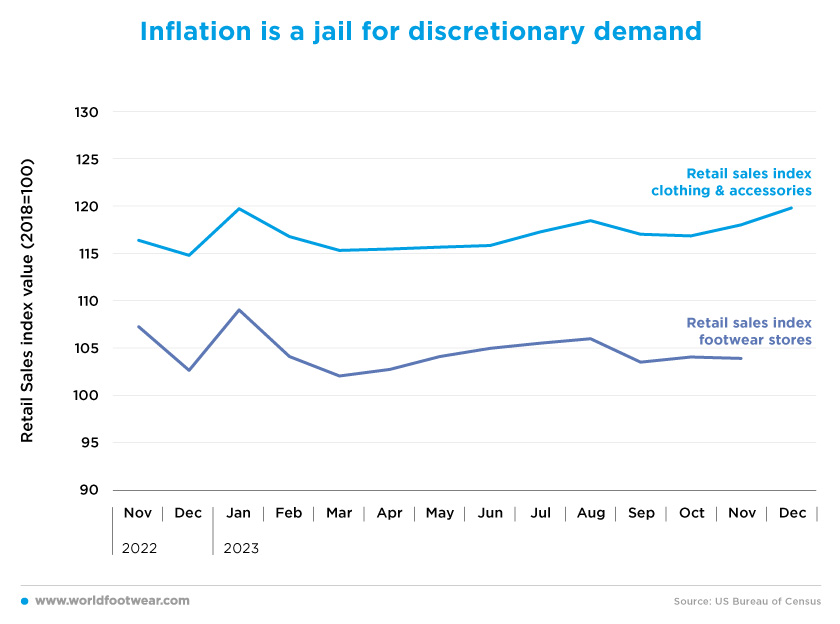

Inflation is a jail for discretionary demand

The Shoe Store Retail Sales Index (seasonally adjusted, by the US Census Bureau) was on an upward trajectory from March to August, and after a dip in September, it appears to have stabilised at 4 percentage points above its 2018 baseline, 3 percentage points lower year-over-year in November. Although there is a one-month lag for footwear, its trend is very similar to that for Clothing & Accessories, which resumed growth in November and closed 5 percentage points higher year-over-year in December. So, it’s reasonable to assume that footwear sales could also rise moderately.

However, based on the negative year-over-year growth in November compared to the previous nine months, the Footwear Distributors and Retailers of America (FDRA) suggests that “retail sales may struggle to gain much traction in the coming months” and expects retail footwear demand “to remain flat-footed well into 2024”.

The development of retail sales will therefore mainly depend on future price behaviour. The previous WF Retail Flash edition highlighted the apparent pause in the US disinflation process in June. If such a reversal in the price trend is confirmed, the opportunities for retail in general and discretionary demand in particular will again be at stake.

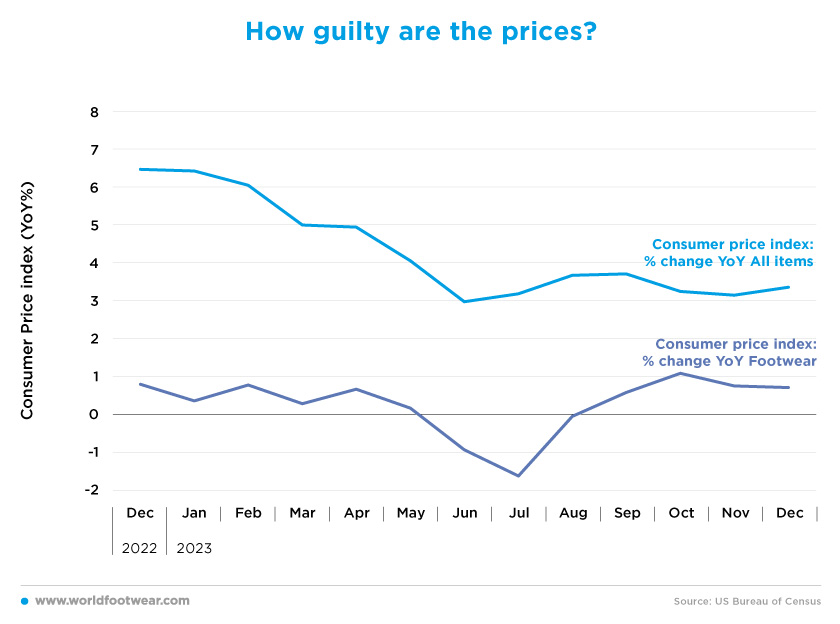

How guilty are the prices?

Looking more closely at what happened, both general and footwear prices increased in the three months following their trend reversal, before stabilising again towards the end of the year. In December, the All Items CPI (by US BLS) rose by 3.4%, 3 percentage points lower than a year earlier, while the footwear CPI rose by only 0.7%, slightly lower than a year earlier. So, the risk of renewed price increases seems well contained and the fears of some retailers are clearly exaggerated.

Gary Raines, chief economist at FDRA, argues that “over the long term, average import costs for footwear tend to rise or fall in step with retail footwear prices”. Last year's data shows a “modest change in annual retail footwear prices in 2023”, while “the average landed cost of footwear also was little changed in 2023”. As a result, he expects that “import costs will continue to retreat well into next year, suggesting retail footwear prices will (not) go appreciably higher anytime soon” (footwearnews.com).

By contrast, Steve Lamar, president and CEO of the American Apparel & Footwear Association (AAFA) is far from satisfied with such low figures, claiming that they are “another painful reminder” that inflation in the footwear sector is not letting up any time soon and calling for “more action by the Administration and Congress to help rein in inflationary pressures by eliminating regressive shoe tariffs and addressing new threats posed by logistics concerns in Suez and Panama” (footwearnews.com).

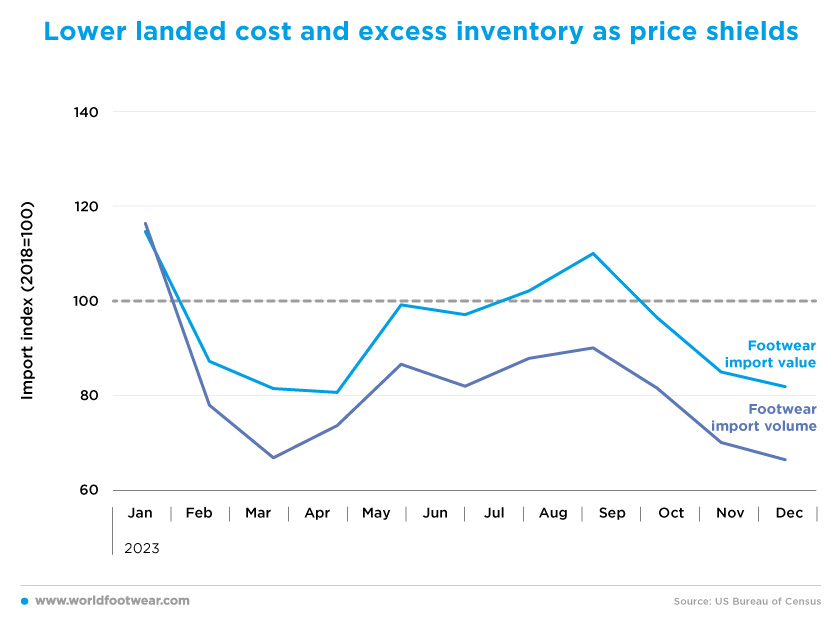

Lower landed cost and excess inventory as price shields

Since the beginning of 2023, the volume of imports has followed a downward trend (not seasonally adjusted, by USITC), due to an apparent overstocking in the trade (in November the annual average decline was 26%). And the value of imports followed suit, as average import costs also fell over the year.

Looking ahead, Gary Raines says that although inventories “have declined considerably over recent quarters as footwear imports have sharply fallen”, they are still “relatively high” (and they) “will decline further, as footwear demand will remain dull well into 2024 and imports go on fading” until “the market returns to equilibrium”.

At the same time, both lower imports and inventories will help to “return some margin and pricing power to footwear retailers deeper into the year.”

Commenting on the recent difficulties in the North American market in its second quarter report, Nike said that its revenue was down by 3% in North America, with wholesale sales down by 9% in the region. Nike CFO Matthew Friend told analysts that “part of the reason for the decline were actions taken to cut down on inventory excesses in the region”. The company also sent out warning signals about the cautious consumer demand environment in North America, which is likely to have affected the stock prices of its retailers (footwearnews.com).

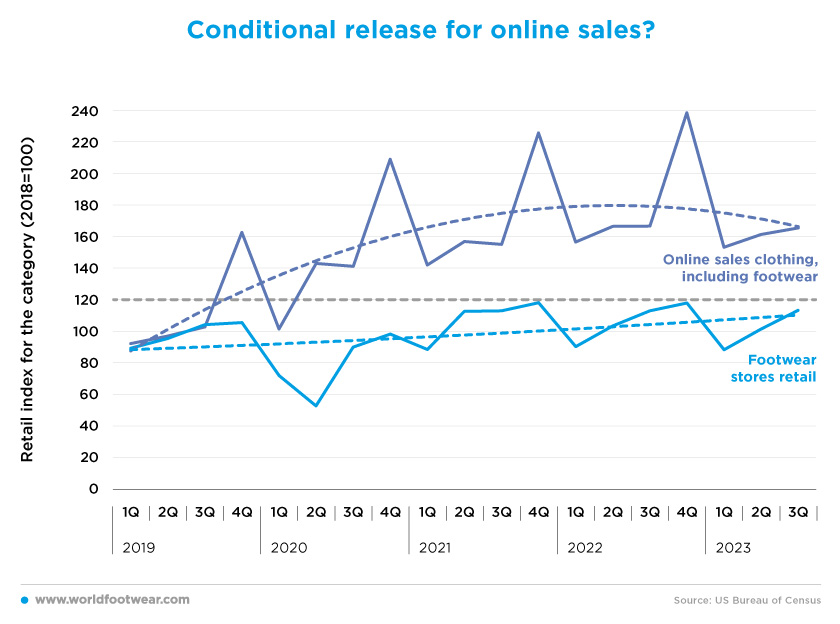

Conditional release for online sales?

Contrary to our forecast in the last edition of WF Retail Flash, the Clothing E-commerce Index (including footwear, not seasonally adjusted, by the US Bureau of Census) lost 5 percentage points in the third quarter, as compared to the same quarter last year, repeating the deceleration path of the first half of 2023. Data for the final quarter is not yet available. Considering such online sales evidence for the November-December period, and despite the negative growth from the first 3 quarters of the year, online clothing sales in the fourth quarter became (apparently) released from the “price prison”.

However, according to Adobe Analytics, US e-commerce sales grew by 4.9% over the November-December holiday sales period, with apparel and fashion being the second-largest category. Not without resorting to discounts “and flexible payment methods to entice shoppers”, added Vivek Pandya, lead analyst at Adobe Digital Insight (footwearnews.com).

For the same period, the Mastercard SpendingPulse showed a 3.1% year-over-year increase in retail sales (in-store plus online), while apparel was up by 2.4% year-over-year, both driven by “healthy job creation and easing inflation pressures”, said Michelle Meyer, the chief economist at the Mastercard Economics Institute. Online retail sales were up by 6.3% year-over-year, while in-store sales were up by a more modest 2.2% year-over-year (footwearnews.com).

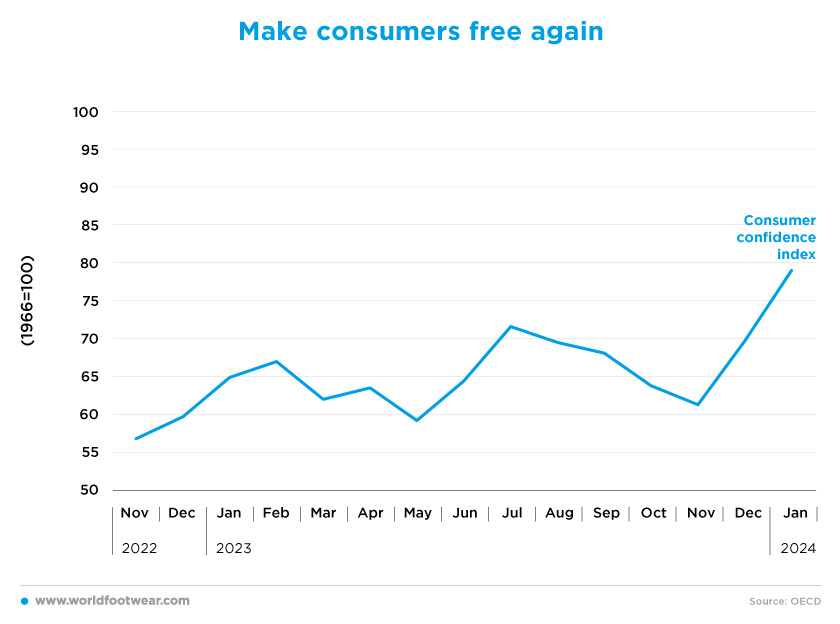

Make consumers free again

In addition to its upturn, the Consumer Confidence Index (not seasonally adjusted, by the University of Michigan) accelerated its year-over-year pace in the last three months from 4.5 points in November to more than 14 points in January, reaching its highest level (79 points) since July 2021.

“Rising prices, in general, remain the top issue affecting consumers”, said Dana Peterson, the chief economist at the Conference Board in Washington. “That’s why it is of critical importance for consumer spending, and in particular on discretionary categories, the fact that consumers’ inflation expectations over the next 12 months were the lowest in three years” (reuters.com).

Consumers are beginning to believe they are about to be released from the prison of inflation, and discretionary demand for fashion will be their prize in 2024.