Register to continue reading for free

US Retail: fuzzy outlook for the year 2025

While footwear sales are expected to have ended 2024 on a high note, overall retail sales were more subdued than in the previous year, suggesting that consumers were cautiously optimistic throughout the year. However, rising inflation in the final months of the year appears to have made them wary again and import figures suggesting that retailers will need to stock up again may be hard to come by, as the tariffs imposed by the Trump administration on goods from Mexico, Canada and China have caused some instability. While the outlook for 2025 is not negative, it is certainly not euphoric

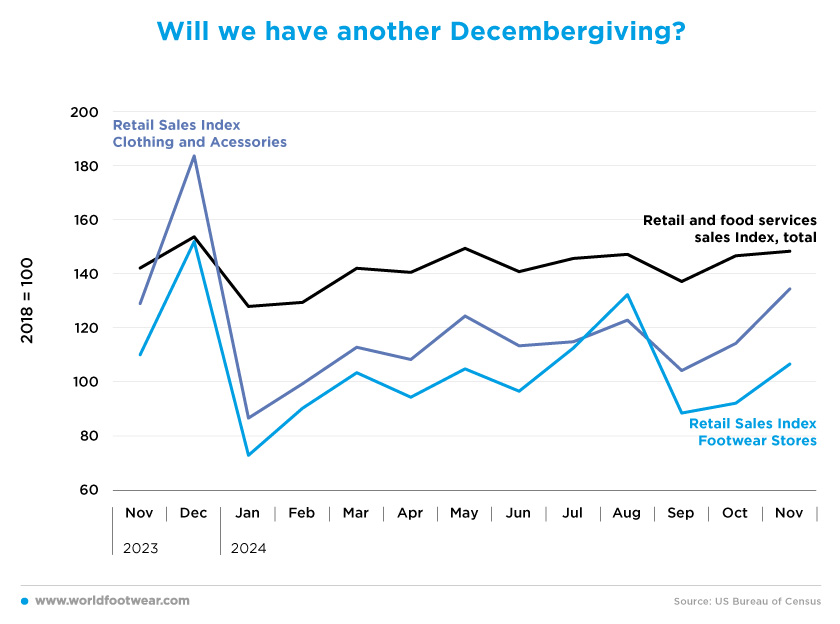

Will we have another Decembergiving?

After the decline at the beginning of the year, footwear and clothing retail have slowly increased again, as they did in 2023.

Footwear sales peaked slightly in August, as footwear retail sales showed a 17% monthly growth, but were still 5% lower than in August 2023. In September, sales returned to February levels, with footwear retail sales showing a 33% monthly decline.

October and November brought better news for retailers, but with Black Friday and Cyber Monday falling later this year, plus the Thanksgiving and Christmas shopping season, December figures are expected to bring a spike like last year, when footwear retailers saw monthly growth of 38%, traditionally making it the best sales month of the year.

The overall retail sales of the US economy fluctuated up and down throughout the year, but the reality is that the level of sales in the first eleven months of 2024 was 4.7% lower than in the same period last year, representing the contraction in consumption felt by every retailer and producer.

The overall retail sales of the US economy fluctuated up and down throughout the year, but the reality is that the level of sales in the first eleven months of 2024 was 4.7% lower than in the same period last year, representing the contraction in consumption felt by every retailer and producer.

According to a research report by Bain & Co.’s retail team, nominal US retail sales will grow by 4% year-on-year in 2025. “That equates to around 5.2 trillion US dollars in estimated total sales in 2025,” the authors said. “It’s a strong outlook, given a stagnant consumer outlook, tempering inflation, negative [year-over-year] employment trends, diminishing consumer savings, rising credit card delinquencies, elevated non-discretionary costs and potential trade disruptions” (footwearnews.com).

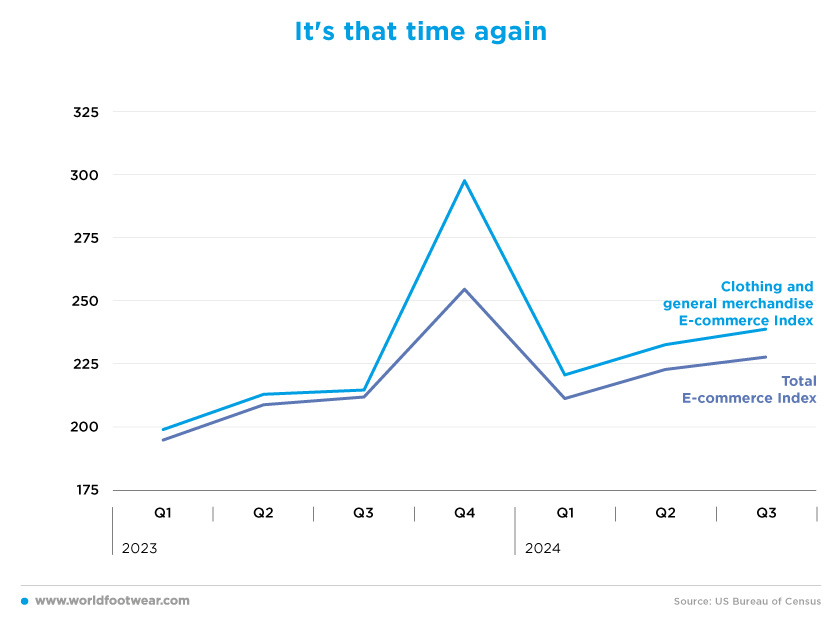

It's that time again

Thanks largely to Black Friday on online platforms, the fourth quarter of the year has historically been a tsunami of sales.The fourth quarter of last year saw a 38.6% increase in quarterly e-commerce sales of clothing and accessories and the data available so far for 2024 shows a slight increase in sales. In fact, the first three quarters of the year show a cumulative growth of 7.5% for online sales, but data from retail sales of clothing and accessories show a decline in 2024. These figures suggest that shoppers are increasingly likely to buy their fashion goods online.

As for 2025, the Bain advisers said they expect growth to be driven by a 10% increase in non-store sales, “while in-store sales will see modest 2% gains, led by general merchandise, apparel, and health and personal care stores” (footwearnews.com).

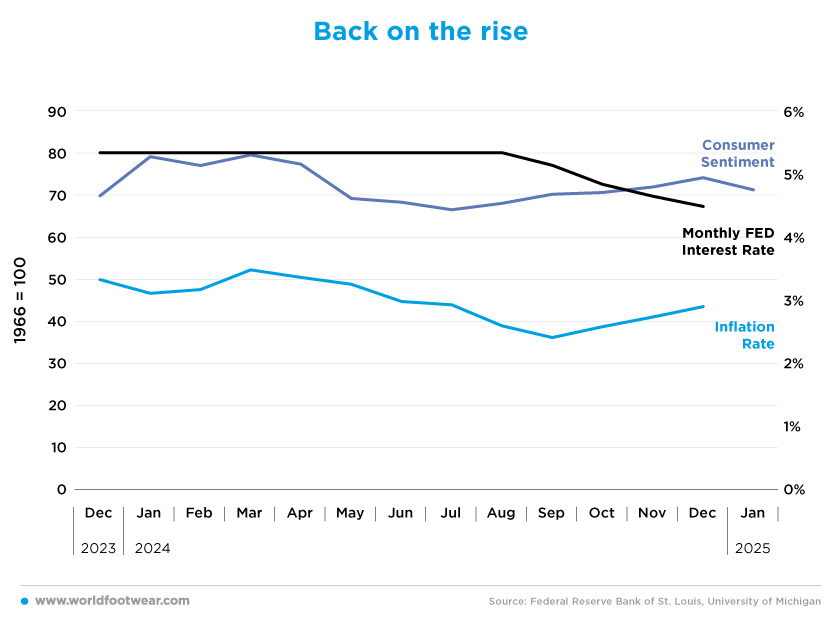

Back on the rise

Inflation has proved way stickier than the FED expected it to be. The FED has kept interest rates fairly stable at 5% and this has shown results, with inflation falling by 0.7 percentage points from January to September. However, as soon as rumours of rate cuts started to circulate, consumer sentiment started to rise and with it, inflation. The FED’s key interest rate was set at 4.5% in December, which can justify the deviation from the inflation target of 2% (the inflation rate closed at 2.9% in December).Meanwhile, shoe prices showed little movement this year, with data from the Footwear Distributors and Retailers of America (FDRA) showing footwear prices rose a modest 0.7% from 2023, the second consecutive year of little change. “We see this lack of price pressure for footwear owing to a combination of factors witnessed last year, from footwear imports growing faster than demand to lower average import costs to a stronger dollar”, Gary Raines, chief economist at FDRA, told FN (footwearnews.com).

The drop in interest rates has made consumers more optimistic again, with consumer sentiment rising 11.4% from July to December. But the start of the New Year has made consumers more cautious. With the rise in inflation over the past 3 months, the FED will have to react, and consumers are already expecting it, with inflation control being one of the main concerns, the interest rate may rise again.

“Views of current labour market conditions fell for the first time since September, while assessments of business conditions weakened for the second month in a row”, said Dana Peterson, the chief economist at the Conference Board. “Additionally, references to inflation and prices continue to dominate write-in responses” (reuters.com).

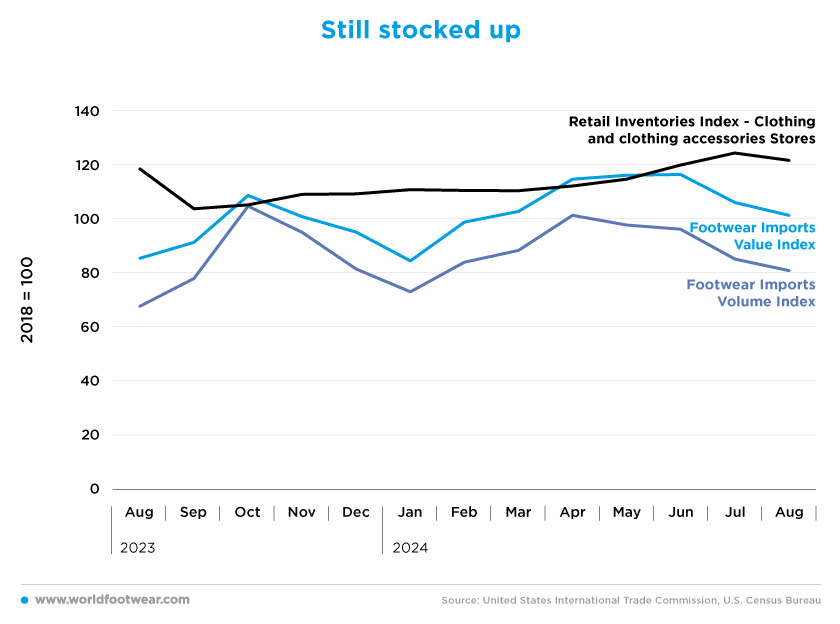

Still stocked up

In the first eleven months of 2024, US footwear imports reached 24.8 billion US dollars, a total of almost 2 billion pairs of shoes. This represents a 6% increase in value over last year. With sales down on last year but imports up, it is easy to understand the high levels of inventory that retailers are currently holding.However, the same level of inventories was seen at the end of 2023 and that hasn’t caused importers to reduce their demand. The average import price this year is 0.3 US dollars less than last year (12.9 and 12.6 US dollars in 2023 and 2024, respectively), which means consumers are willing to spend less on each pair of shoes.

Still, December is expected to bring a reduction in inventories. After lower imports in October and November and the Thanksgiving and Christmas shopping season, retailers may need to replenish their inventories, which could increase demand.

As for 2025, the picture is blurry. In response to the tariffs imposed on Mexico, Canada and China by the Trump administration last Saturday, Matt Priest, CEO and President of the Footwear Distributors and Retailers of America (FDRA) association stated that “over the past few years, hardworking Americans have faced high inflation and high costs across the board”. “Tariffs (will) drive up prices for consumers, and quite simply, that means higher prices on necessities like shoe”. The American Apparel & Footwear Association has also expressed concern over the full tariffs placed on goods from the US’s three largest trading partners.