Register to continue reading for free

US Retail: expectations on the rise for the last quarter

The summer months have brought relief to footwear retailers, as sales in the category now appear to be on an upward trend. Although consumers remain cautious, the slowdown in employment and inflation is somehow starting to lift their spirits and retailers are showing signs of restocking. As the winter holidays approach, and despite question marks over the geopolitical turmoil and the upcoming presidential election, it’s safe to say that expectations are on the rise

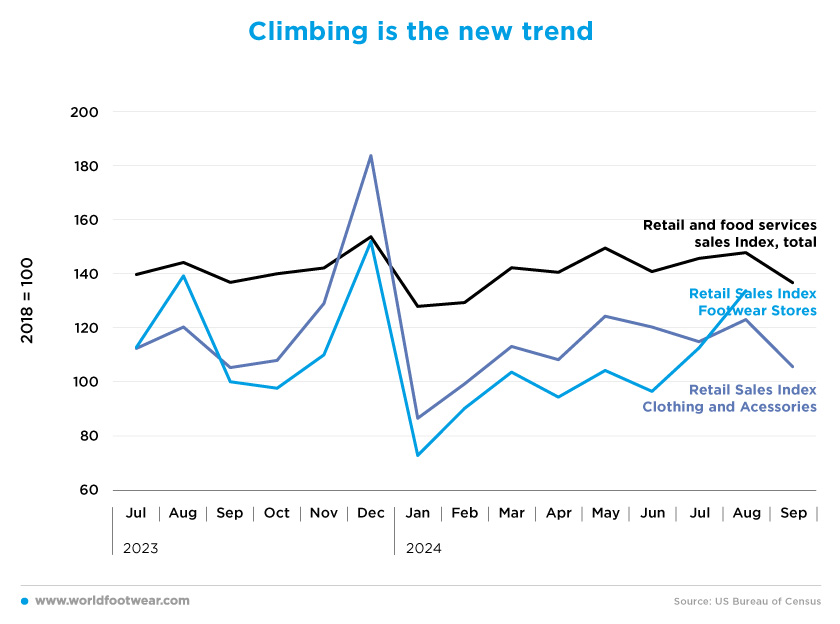

Climbing is the new trend

After the sharp fall in footwear sales from December 2023 to January 2024, sales seem to be climbing at a good pace, especially in the last few summer months. Overall, footwear retail sales have increased by 83% since the beginning of the year, and are now outpacing the retail sales of clothing and other fashion items. As for the US economy as a whole, after a sluggish summer, September showed a slight decline of 7.5% month-over-month, but remained at the same level as September last year.“After seven consecutive months of gains, consumers pulled back a bit in September, which is historically a soft month for retail sales,” the President and CEO of the National Retail Federation (NRF), Matthew Shay, said. “Due to geopolitical tensions, uncertainty regarding election outcomes, anticipation of the port strike and lingering inflation in services, shoppers showed caution. However, year-over-year gains showed consumers were still spending on household priorities” (nrf.com).

As the winter holidays (Thanksgiving and Christmas), which typically bring consumers back into the stores, approach, retailers are now hoping for an increase in consumer spending. According to the National Retail Federation’s latest consumer survey, conducted by Prosper Insights & Analytics, the average consumer is expected to spend a record 902 US dollars on gifts, food, decorations and other seasonal items for the upcoming winter holidays (nrf.com).

Online fashion & retail footwear remain divided

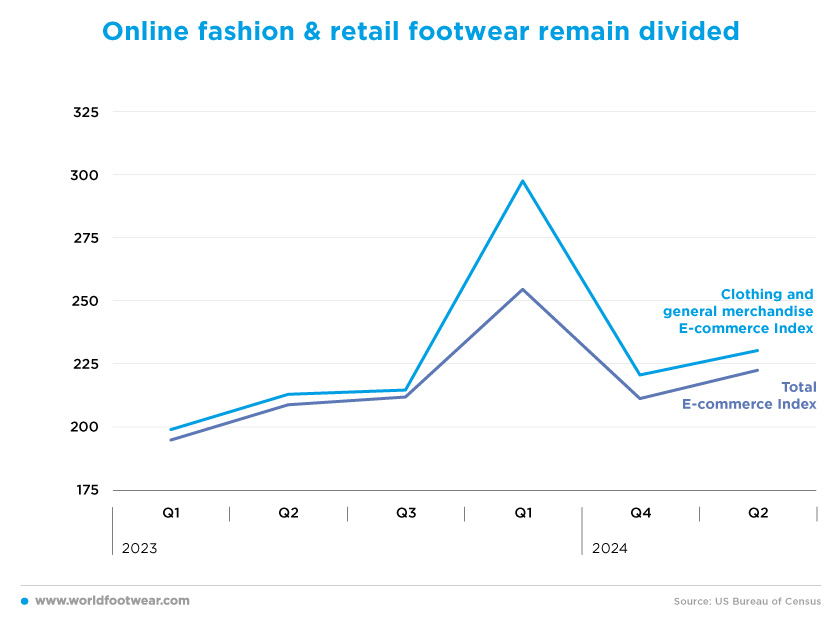

When it comes to online shopping, fashion still holds the top position. At its peak last year, fashion e-commerce was three times higher than pre-pandemic levels. The second quarter of 2024 recorded a 4.4% increase from the previous quarter and an 8.2% increase compared to the same period in the previous year, with the trend pointing to new highs by the end of the year.In footwear, online is still on the rise and is becoming more and more “the way”. Genesco, one of the largest US footwear retailers, reported that, in the second quarter of its current fiscal year, e-commerce sales increased by 8% while comparable store sales decreased by 4%, with e-commerce sales accounting for 22% of retail sales, up from 21% last year (Genesco.com).

In the second quarter, total e-commerce grew by 6.6% year-over-year, with e-commerce penetration of total US retail sales in this period growing by almost 1% from the previous year. The Census Bureau of the Department of Commerce estimates that US retail e-commerce sales totalled 291.6 billion US dollars in the second quarter, bringing total retail sales to approximately 1.827 trillion US dollars (digitalcommerce360.com).

Stability on the way

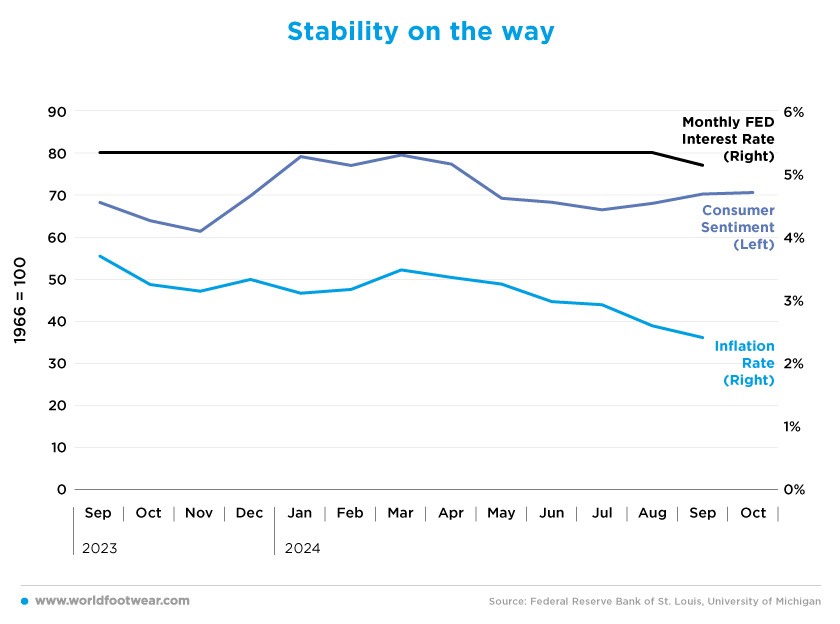

Economic indicators are sending clear signals to US policymakers and consumers. Hurricane Helene and the turmoil in the Middle East have shaken consumer sentiment, but the expectation of more Fed cut rates keeps consumers hopeful that the budget squeeze will ease.After thirteen months of stable high interest rates, the Federal Reserve finally lowered rates, starting with a 2-percentage point cut to 5.1% in September and pointing to a downward path. The cut came as no surprise as the US economy has been incredibly resilient and is finally showing signs of a slowdown in employment and inflation, with the latest reading at 2.4%, very close to the 2% FED target.

All these factors seem to be having a positive impact on consumers. “Despite economic headwinds, 70% of holiday shoppers feel their financial situation is better than or the same as this time last year, signalling measured optimism among consumers,” commented ICSC President and CEO Tom McGee.

However, while “interest rate cuts and easing inflation are taking some pressure off holiday shoppers”, “other macro factors – like geopolitical turmoil and the upcoming presidential election – are still at play”, he warned (fdra.org).

Hopes for the future

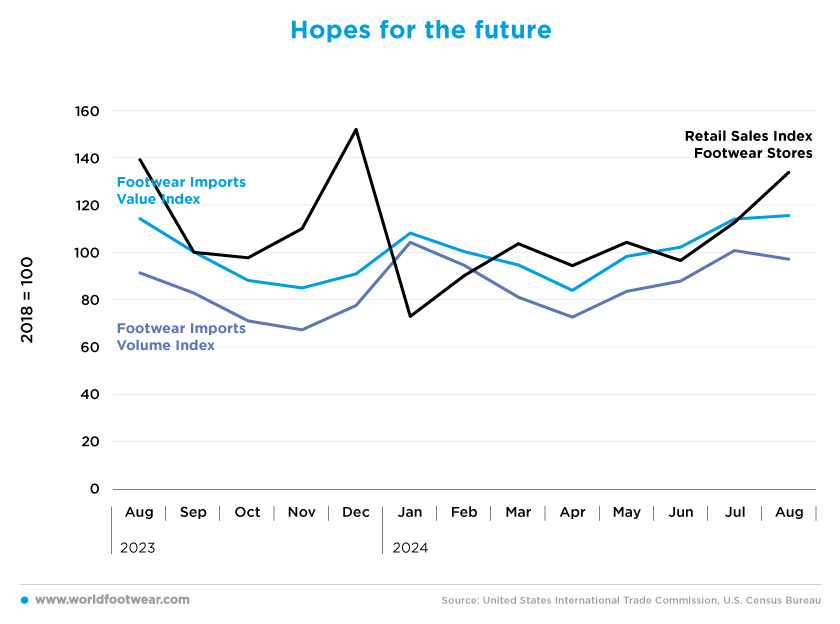

As footwear retail sales increase and consumers become more willing to spend, it’s up to retailers to keep themselves stocked. Since the beginning of the year, a total of 1.4 billion pairs (17.8 billion USD) have been imported at an average price of 12.3 US dollars. This represents an increase of 2% in value over the same period last year.Since April, the total value of footwear imports has been rising and there is no sign of a slowdown (up by 37.6% between April and August). Retailers are hoping that Black Friday, Thanksgiving, and Christmas will bring consumers into their stores, so they need to make sure that their stocks levels can cope with demand.

“Consumers continue their quest for value this holiday season, bringing the potential for renewed life to a graying Black Friday,” said Marshal Cohen, chief retail advisor for Circana. “It is up to manufacturers and retailers to keep holiday spirits high with deals that deliver that sense of value and inspire demand in the absence of new and innovative products” (fdra.org).

In general, there is a lot to watch out for in the coming months, from Black Friday and the winter holidays to the unfolding of the presidential election. All these factors will weigh on the judgement and future behaviour of importers, retailers and consumers.