Register to continue reading for free

UK Retail: the future is not looking very bright

Textile, Clothing and Footwear (TCF) sales have held their own in the final quarter of the year, showing resilience to the drag from overall retail sales. However, the sticky above-target inflation in the UK over the past year is a cause for concern as wages fail to keep pace. In addition, the higher costs for retailers predicted in the last Budget may leave them with little choice but to raise prices and cut jobs. As much as imports have shown some stability, the future for the retail sector is not looking very bright at the moment

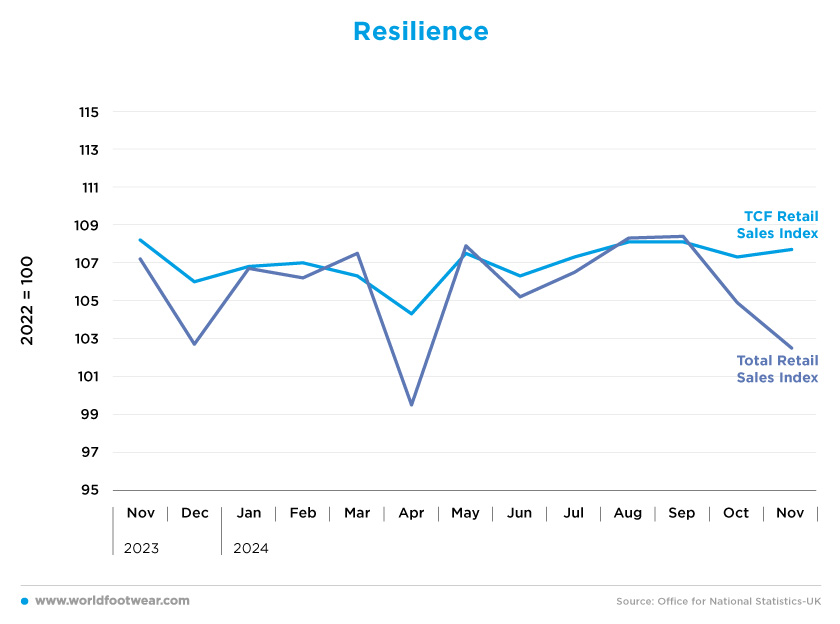

Resilience

The best adjective to describe the last 12 months for retail sales of Textile, Clothing and Footwear (TCF) is resilience. The fashion sector has been able to maintain a consistent level, while overall retail sales in the UK have suffered drastically in some months.April was the worst month for sales in 2024, with TCF sales down by 2% month-on-month and overall retail sales even worse, down by 7%. However, when taking seasonality into account (using month-over-month rates), June saw the biggest fall, with TCF retail sales down by 4.1% year-over-year.

From January to November, only August, September and October showed year-over-year increases (0.5%, 1.8% and 0.6%, respectively). In addition, the later timing of Black Friday in 2024 meant that it fell into December, rather than November figures, while the reverse was true in 2023. This artificially depressed November figures and improved the December figures (brc.org.uk).

Despite this, TCF’s sales have held their own in the last few months of the year, and have not been dragged down by the downward trend in overall retail sales. The truth is that looking ahead, 2025 “won't be all smooth sailing for the retail giants, as the sector gears up to battle imminent tax hikes” Hargreaves Lansdown equity analyst Matt Britzman stated (reuters.com). Let’s wait and see if the TCF sector can stay afloat.

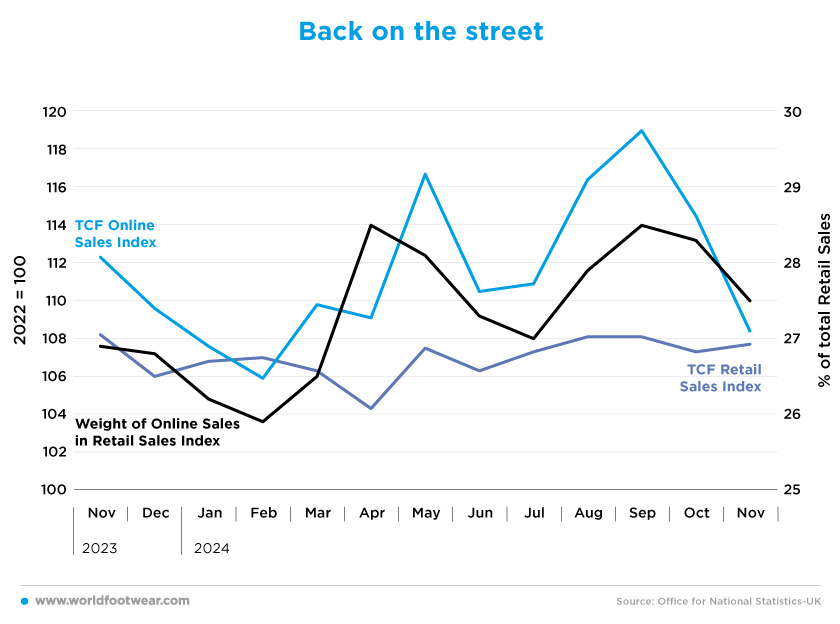

Back on the street

Meanwhile, online sales have taken a hit, while TCF retail sales have held steady. This may suggest that consumers are returning to the streets despite the winter months already underway. But let’s take a look back.

The share of online sales in total TCF sales rose sharply in April and, after a dip in the summer months due to the good weather, reached 28.5% in September. Compared to the 2022 figure, online has so far performed much better than physical retail, but this may be about to change.

Since September, online sales have fallen sharply (down 9% from September to November), while TCF sales have remained fairly stable. The convergence point may come in the next few months, but this will depend on the willingness of consumers to go out shopping despite the cold weather.

Nevertheless, this doesn’t change the fact that “following a challenging year marked by weak consumer confidence and difficult economic conditions, the crucial ‘golden quarter’ failed to give 2024 the send-off retailers were hoping for”, Helen Dickinson, Chief Executive at the British Retail Consortium, said (brc.org.uk).

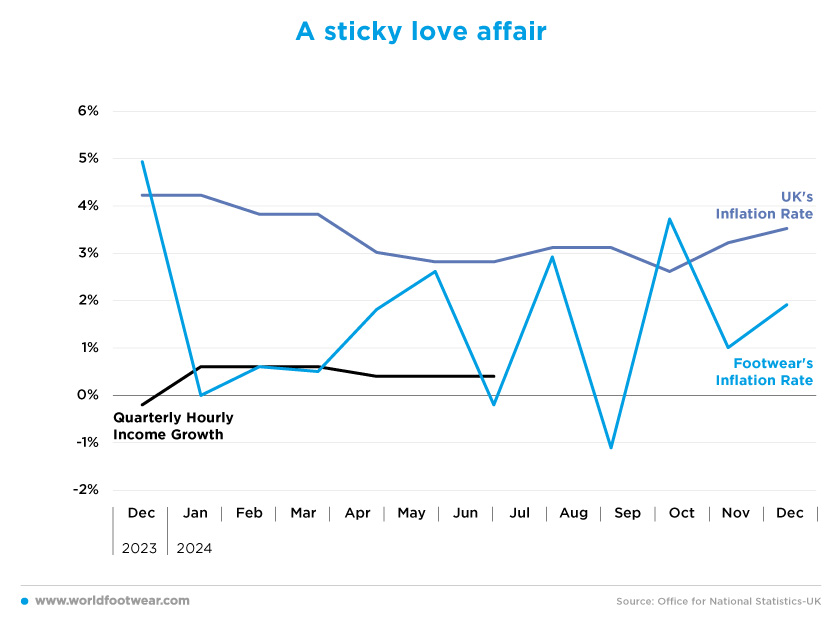

A sticky love affair

The country’s economy has been having a sticky love affair with inflation. Despite the measures taken by the BoE (Bank of England), inflation hasn’t reached target levels for some time. In the first three quarters of this year, inflation fell slowly, hitting a low of 2.6% in September, but the picture changed quickly, and inflation is back on the rise, with the latest reading in November at 3.5%.Footwear has seen some ups and downs, ranging from minus 1.1% in August (mainly due to summer discounts) to 3.7% a month later. The average inflation rate for footwear so far this year is 1.4%, which may indicate a decline in demand, as the target level is 2%. But that doesn’t mean prices are falling – it means they are rising more slowly. In any case, the overall economy is running at an average of 3.3%, which points to a possible contractionary policy in the future.

The main problem with this sticky above-target inflation is that wages are not keeping up. Quarterly growth in hourly earnings was well below inflation in the first two quarters of the year (0.6% and 0.4% respectively), taking purchasing power away from consumers.

On top of this, according to the British Retail Consortium, “higher employer national insurance contributions, higher National Living Wage, and a new packaging levy will heap pressure on an industry that is already paying more than its fair share of tax. With retailers doing all they can to absorb existing costs, two-thirds of CFOs report they are left with little choice but to increase prices, and reduce investment in jobs and shops”. This may prove to be a challenge for retailers in the coming months.

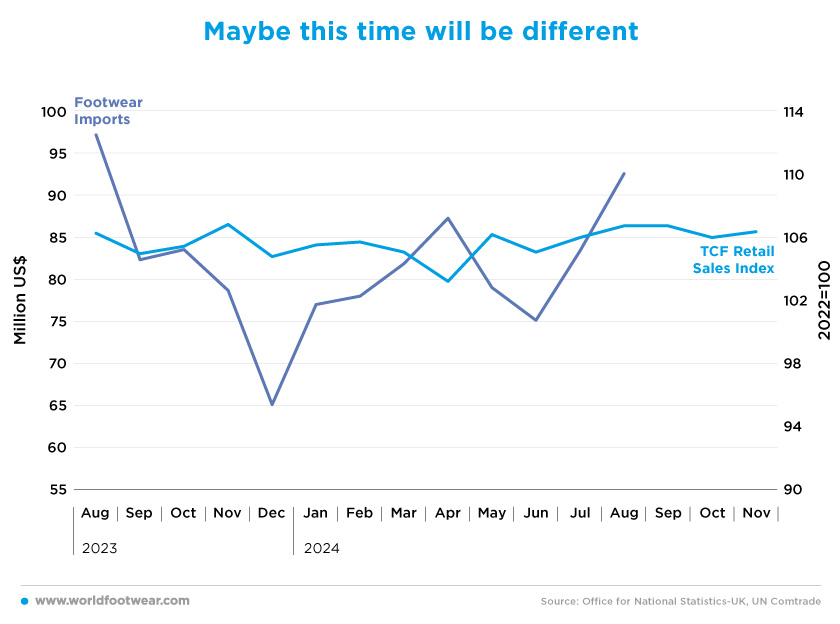

Maybe this time will be different

So far this year, a total of 3.4 billion US dollars’ worth of footwear has been imported into the UK, with the biggest month being August as in 2023 (477 million imported US dollars, down 4.7% in 2023).Apart from the drop in May and June, importers have been able to recover since the end of last year. However, imports over the first 8 months of the year are still 6.5% below what we saw in 2023, and there are still doubts as to whether this year’s picture will resemble that of 2023.

In 2023, after the record month of August, imports fell very sharply until December. With stores all stocked up in September for the Black Friday, will imports now show an increase due to the run-up to Christmas? “If not, retailers will be feeling the squeeze from both sides as reduced revenues are met with huge additional costs next year” (brc.org.uk).