Register to continue reading for free

UK Retail: good signs for the run-up to Christmas

The cold weather in July did not bring good news for the UK retail sector, but the following two months spiced things up again. Fashion retail sales appear to be back on track with the wider economy, as continued falling inflation has led to lower prices. Consumers are still reluctant to spend given the difficulties of recent years, but the challenge for retailers is now to keep up and not fall behind again in order to boost demand in the months leading to Christmas

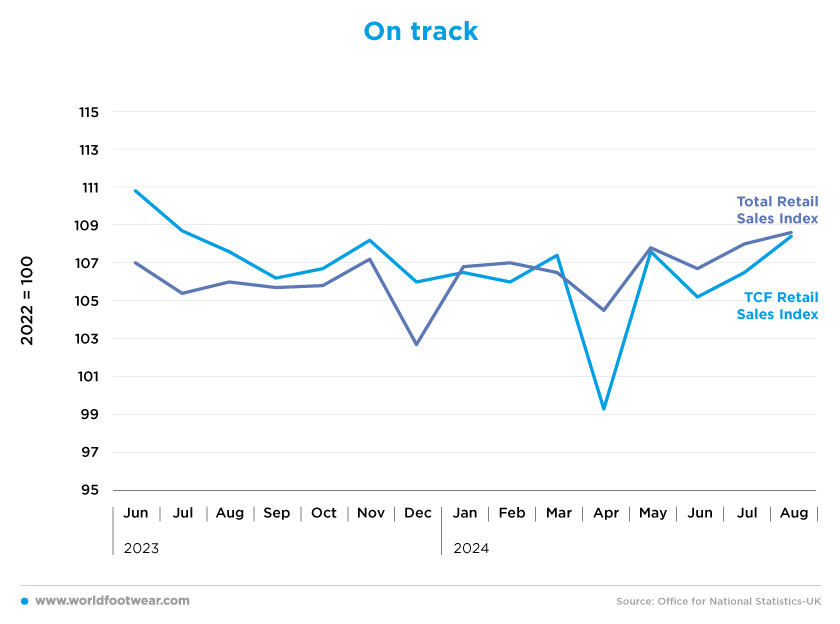

On track

At the start of the second quarter of 2024, textile, clothing and footwear hit rock bottom, with figures similar to those seen at the end of 2021. There was a clear downtrend throughout 2023, but things seemed to be under control in this year’s first quarter. But then the downfall came. In April, sales of fashion goods fell by 8.4% year-on-year and by 7.5% monthly. After a strong recovery in May, June saw a decline in most retail sectors, mainly due to a colder-than-usual month and high household costs.According to Helen Dickinson OBE, Chief Executive of the British Retail Consortium (BRC), “Retail sales performed poorly in June as the cooler weather during the first half of the month dulled consumer spending. Sales of weather-sensitive categories such as clothing and footwear, as well as DIY and gardening were hit particularly hard, especially compared to the surge in spending during last June’s heatwave” (brc.org.uk).

Fortunately, the following months of July and August spiced things up again. August recorded small increases compared to the previous year (around 1% for TCF - textiles, clothing and footwear - and 2.5% for the economy as a whole) but there is still hope for retailers. As for the near future, although official figures are yet to be released, Linda Ellett, UK Head of Consumer, Retail & Leisure at KPMG said that “September saw modest, but welcome, sales growth for retailers”.

In particular, she continued, “Children’s clothing, footwear and accessories saw a boost from the start of the school year, with household budgets feeling slightly less constrained for some parents compared to last year. Similarly, the return to work after the summer holidays also led to an upturn in adult clothing and footwear sales” (brc.org.uk).

Overall, fashion retail sales appear to be back on track with the wider economy, and the main task is now to keep up and at least not fall behind again. Retailers have always welcomed an autumnal boost, but this year it’s particularly important to end the year on a positive note in the months leading up to Christmas.

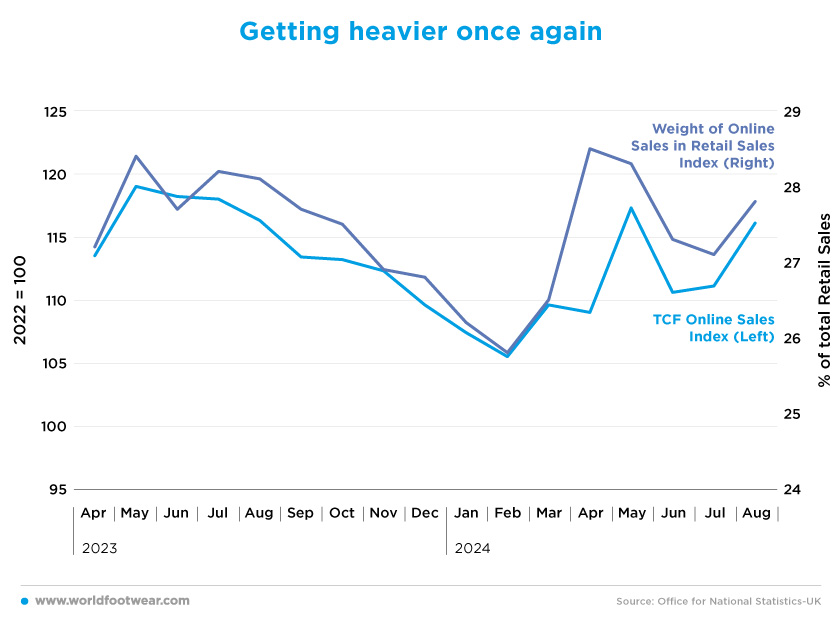

Getting heavier once again

It’s not news that online sales are growing every day in most global markets, but traditional retailers need to stay strong and continue to fight for their place. Online sales fell for eight consecutive months July 2023 to February 2024, declining by around 10.6% over this period and thereby reducing the weight of online sales in overall UK economic sales.But at the start of the second quarter of the year, April sales figures showed a boom in e-commerce, reaching figures like the peak seen in last year’s summer. After the figures had fallen again, as expected, the weather started to get better in the spring and summer. By the end of August, online sales accounted for 27.8% of total retail sales.

Over the past two years, online sales have kept their weight relatively constant, fluctuating between 25.8% and 28.5%, not even close to the 50.3% seen in 2020 (pandemic peak). Before COVID online sales represented around 18% of total sales, now that things seem to be stabilising, the figures we see are around 10 percentage points higher, which can be attributed to some customers getting used to it. It’s clear that online is here to stay.

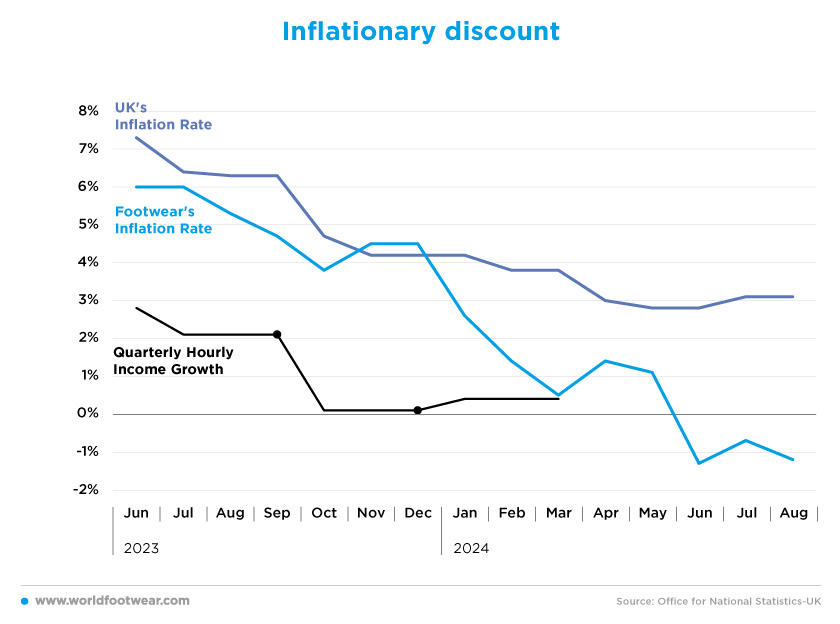

Inflationary discount

British inflation held steady in August and July after more than fourteen months of monthly decreases. Over the past twelve months, the country’s all-items inflation rate has fallen from 6.3% to 3.1%, a decrease of 50%. But what we are seeing in the footwear sector is even more impressive.Since June 2024, footwear has experienced negative inflation rates, the so-called deflation, meaning that footwear prices this summer were around 1% lower than last year’s ones. The latest figure for August shows that while UK inflation is around 3.3%, footwear prices in the UK are showing negative inflation of 1.2%.

“Shop prices fell into deflation for the first time in nearly three years”, said Helen Dickinson. “This was driven by non-food deflation, with retailers discounting heavily to shift their summer stock, particularly for fashion and household goods. This discounting followed a difficult summer of trading caused by poor weather and the continued cost of living crunch impacting many families”, she explained (brc.org.uk).

For the time being, retailers will try to keep prices down with attractive promotions, but their focus will remain on boosting demand in the months leading up to Christmas. As for households, they will be pleased to see that prices of some goods fall into deflation, helping them to better plan their household budgets for the rest of the year.

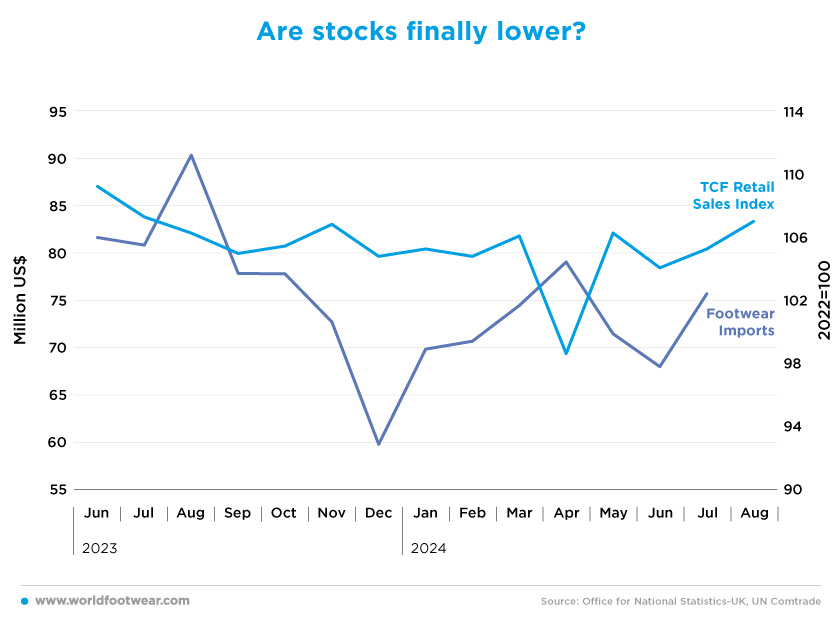

Are stocks finally lower?

Compared to last year, the UK’s footwear imports have fallen considerably. Combining the months of June and July, footwear imports by British retailers in 2024 were 11.6% lower than last year’s, a decrease of 18 million dollars. Ongoing tensions in the Middle East have led to disruptions in the Red Sea and, since December 2023, several shipping companies have opted to divert ships around the Cape of Good Hope to avoid the Suez Canal, increasing transport costs.Without an official figure for footwear imports in August, we can only speculate on how things will turn out. Firstly, let’s remember that August last year was the biggest month for importers, with 90 million dollars of footwear imported, and, secondly, that July and August were good months for fashion sales recovery, suggesting a possible increase in retailer confidence and better hopes for future demand.

Another factor that deserves some attention is the exchange rate of the pound, which has strengthened over the past year and may slowly increase the purchasing power of retailers, thanks to falling UK inflation and interest rate cuts by the UK central bank.

Looking ahead, retailers will most likely need to replenish their stocks to meet demand in future months, such as the Christmas holidays in December, when consumer activity is expected to increase.

However, let’s keep in mind that despite good signals from the new government and the easing of pressure on household finances, with petrol and energy costs and shop price inflation all continuing to fall, consumers remain reluctant to spend. We’ll have to wait and see if retailers’ optimism about the golden quarter actually translates into good news.