Register to continue reading for free

UK Retail: challenging times may be ahead after disappointing fourth quarter in 2023

Retail sales of clothing and footwear disappointed in the last quarter of the year after a promising start on Black Friday. This is not particularly surprising given that prices in the category fell more slowly than overall prices and items remain relatively more expensive, making consumers more cautious in their choices. There are some long-term positive signs for retailers when it comes to consumer confidence, but there are likely to be some bumps in the road in the meantime

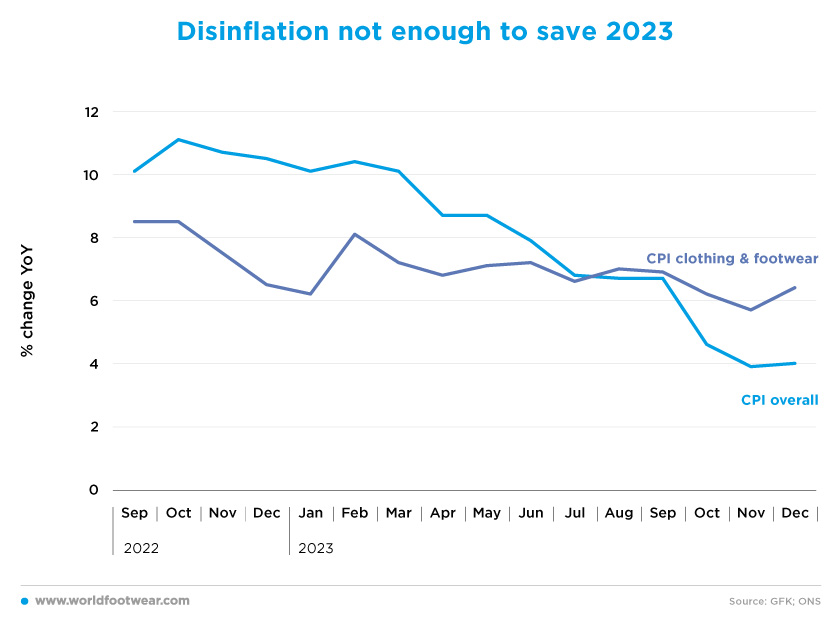

Disinflation not enough to save 2023

If we compare the change in consumer prices of the Clothing & Footwear category with the change in Overall Consumer Price (by ONS), we note that there’s been a striking difference since October last year. Although both rates have been on a downward trend, clothing and footwear prices have fallen by 2.5 percentage points through December, while general prices have decelerated by more than 7 percentage points from about 11% to 4%.

Commenting on this lower inflationary environment compared to October last year, Paul Martin, UK Head of Retail, KPMG, said, “There is no doubt that the last 12 months have taken a toll on confidence and their ability to spend. Coupled (now) with a higher interest rate environment, dwindling COVID savings and the heating coming back on, beleaguered consumers are thinking very carefully about how they spend their money” (brc.org.uk)

The point is that despite the continued fall in CPI inflation, it remains above target, and the UK economy is feeling the effects of 14 consecutive interest rate hikes by the Bank of England in its battle against inflation (businessoffashion.com).

In addition, the rate of price change for fashion has been higher than the overall rate since August, with the gap widening to 2 ½ percentage points year-over-year in December. Clothing and footwear are now more expensive in relative terms, making consumers even more cautious in their choices.

The final retail account for 2023, with December sales growth up by just 1.7% on 2022, led Paul Martin to conclude once again that, “the festive feel-good factor was lacking this year, disappointing many retailers”, among which fashion retailers, as “Christmas shoppers ditched clothing”, even though many retailers rolled out promotions that lasted longer and were deeper than last year (brc.org.uk).

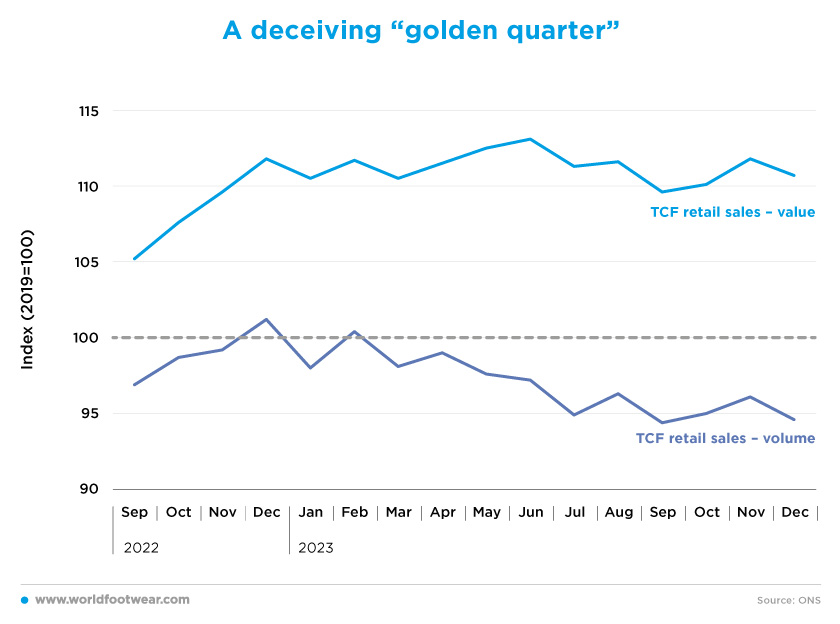

A deceiving “golden quarter”

Looking at the Textile, Clothing and Footwear (TCF) Retail Sales Index (at current prices and seasonally adjusted, by ONS), the performance in 2023 was rather disappointing. In contrast to the steady increase in the last months of 2022, the trend has been almost flat, closing one percentage point lower in December than a year earlier. However, as the prices in the category have almost always risen between 6% and 8%, TCF retail sales in volume terms have tended to fall, losing more than 6 ½ pp in December year-over-year.

The “golden quarter” of the year, from October to Christmas, is when retailers expect to make most of their annual profits. But apparently, it was a flop in 2023.

UK retail sales in stores and online fell to 0.3% in October, the lowest level since February 2021 when Covid restrictions were in place, frustrating expectations from both economists and retailers. “It was another poor month for household goods and clothes stores with these retailers reporting that cost of living pressures, reduced footfall and poor weather hit them hard”, said Heather Bovill, deputy director for survey and economic indicators at the ONS (bbc.com).

At that time, according to Samantha Phillips, a partner at McKinsey, such a performance might have been a “sign of shoppers holding out for Black Friday bargains and other festive promotions.” (businessoffashion.com). As a result, many retailers tried to give sales a much-needed boost in November, by anticipating the start of Black Friday, to “avoid discounting in December”, as Mike Watkins, head of Retailer and Business Insight, NielsenIQ (brc.org.uk), suggested.

“While this had the desired effect initially, the momentum failed to hold throughout the month, as many households held back on Christmas spending”, noted Helen Dickinson, Chief Executive of the British Retail Consortium. (brc.org.uk). The result for November was once again weak sales growth of 2.7% year-over-year, and margins far from protected, despite “footfall recovering to its highest performance levels since July”, as commented by Andy Sumpter, Retail Consultant EMEA for Sensormatic Solutions (brc.org.uk).

Finally, in December, total retail sales rose by only 1.7% year-over-year, with non-food sales (including clothing & footwear) falling year-over-year. Andy Sumpter summed it up as follows: “Many may have been waiting for a last-minute Christmas trading rush that never came” (and) “the overall downward year-on-year trajectory in-store visits in December - usually the crescendo of the Golden Quarter – will have come as a blow (to them)” (brc.org.uk).

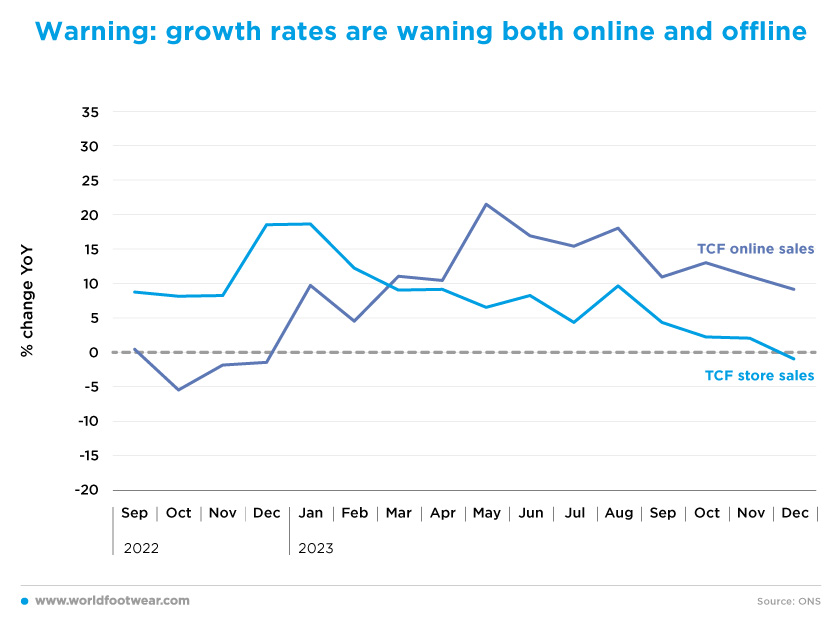

Warning: growth rates are waning both online and offline

Looking more closely at TCF retail sales (at current prices) in stores up to 2023, the growth rate converged to zero in the last quarter. However, the growth rate of TCF online sales has also been on a downward trend since May, falling 12 ½ percentage points to 9% year-on-year in December. The rapid slowdown in both growth rates is a warning to clothing and footwear retailers that bad times may be ahead for everyone. Perhaps it’s no longer just about the channel.

The online retailer ASOS forecasted a drop in sales ranging from 5% to 15% in fiscal 2024, which reflects a 12.2% decline year-over-year in group revenue, with Pippa Stephens, senior apparel analyst at GlobalData pointing to “younger consumers flocking to more affordable competitors” (just-style.com).

The footwear company Clarks has announced that it is cutting more than 100 jobs in response to economic headwinds and the cost-of-living crisis that has seen British consumers tighten their belts in response to soaring inflation while expecting “tougher trading conditions to continue into next year” (shoeintelligence.com).

In addition, the British Retail Consortium, based on the upward trend in retail insolvencies in the third quarter of 2023, suggested that if interest rates are kept higher for longer, “higher insolvencies are increasingly inevitable in 2024”, and even added that pure play or niche (specialised) retail businesses would be the most likely victims, extrapolating from what has happened since the start of 2021 (brc.org.uk).

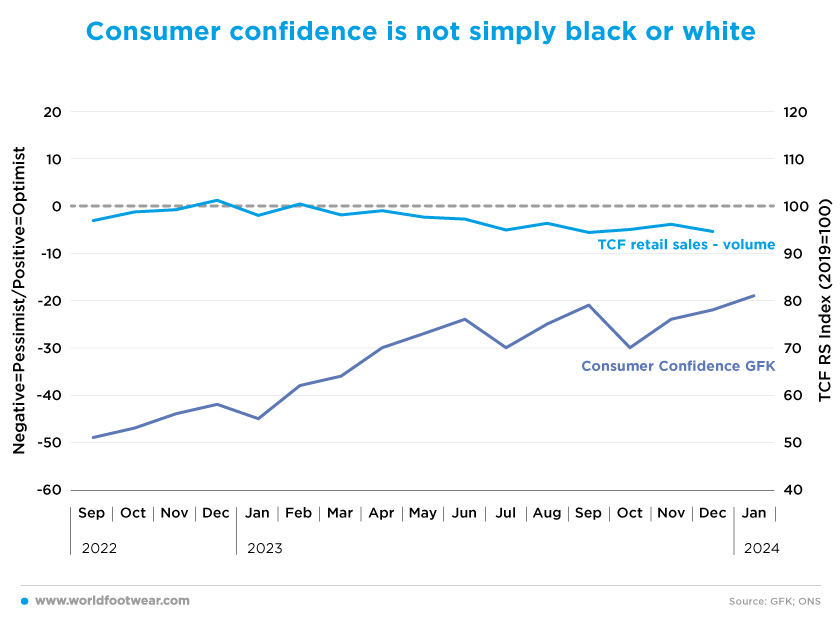

Consumer confidence is not simply black or white

Given that the long-term average for UK consumer confidence (according to GfK) is minus 10, December’s sentiment is not only below the optimistic limit but also some 10 points below the long-term average. This could explain why the volume of both total retail and TCF retail is still declining and below the 2019 baseline.

For forecasting purposes, however, the steepness of the uptrend in confidence is just as important in taking the pulse of consumers. A significant improvement over the 25 points of pessimism in the twelve months to January may be enough to feed expectations of better times ahead for the retail sector.

As Joe Staton, client strategy director at GfK explained, the “slow but persistent movement towards positive territory for the personal finance measure looking ahead (which best reflects financial optimism and control over personal budgets) is an encouraging sign for the year to come, despite the severe cost-of-living crisis still impacting most households” (reuters.com).

Combined with the likelihood that “average wages will (continue to) rise more quickly than the CPI (due to) negligible increases in goods prices”, Gabriella Dickens, of Pantheon Macroeconomics, concluded that “looking ahead, we think a recovery in real incomes will cause retail sales to rebound” (businessoffashion.com)

On the contrary, although consumer confidence has clearly improved, most market observers believe that the upside risks to the retail sector will prevail in the coming months. The British Retail Consortium has been persistent in highlighting these risks.

“Looking ahead to 2024, retailers will have to shoulder many new cost pressures, including a rise to business (interest) rates, as well as costs from other new regulations. These combined with the biggest rise on record to the National Living Wage will mean retailers will have less capital to invest in lowering prices for their customers”, said Helen Dickinson. Paul Martin, from KPMG, added: “Retailers can expect to see significant downward pressures on demand in the opening months of this year, which will ease off by Spring if the economic conditions continue to improve and confidence slowly returns.” (brc.org.uk).