Register to continue reading for free

UK Retail: bad odds for retail should consumer confidence remain on the floor

The Textile, Clothing, and Footwear (TCF) by the ONS stood above the 2019 baseline in the last two months of 2022, no doubt sustained by Christmas sales. But forecasts for the coming months are not so positive. The strain on household budgets due to the cost-of-living crisis will prove to be a challenge for retailers as well because while ongoing inflation will make sales appear to be rising, volumes will decline. Consumer confidence may be key in this equation. Even if it slightly improved in December, it was the first time in the GfK’s consumer confidence survey in the nearly 50-year history that a run of nine successive months of -40 pp or worse occurred. Should this continue, the odds are not good for retail

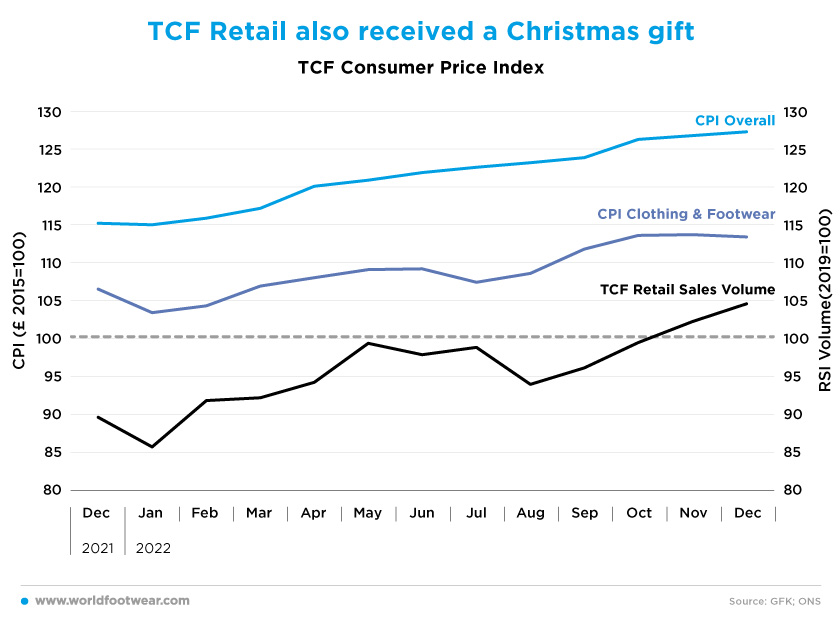

TCF Retail also received a Christmas gift

With COVID-19 out of the picture, skyrocketing consumer prices have become the key driver of retail numbers. No consumer or retailer can remain indifferent to the 11.1% peak hit in October, a record score in the UK in 41 years.However, the retail sales index for Textile, Clothing, and Footwear (TCF) by the ONS, after discounting for the price increases, has been recovering since August, standing well above the 2019 baseline in the last two months of the year. The truth is that, unlike the overall CPI, the TCF prices stabilized in the last quarter of the year, with footwear prices even losing some 2 ½ points since October. This helped to sustain demand, boosting the sales growth of the category.

Helen Dickinson, CEO of the British Retail Consortium (brc.org.uk) described the situation clearly when she said “after an exceptionally challenging year, which saw inflation climb and consumer confidence plummet, the uptick in spending over Christmas gave many retailers cause for cheer. Many consumers braved the cold snap and the strikes to ensure friends and families got the gifts they wanted, with (…) warm clothing and boots (…) selling well. (…) Retailers are juggling big cost increases while trying to keep prices as low as possible for their customers”.

Still, Kenny Wilson, Chief Executive of Dr. Martens, pointed out that the footwear brand “was still seeing inflation in the cost of supplies “across the board”, from the oil-based product used to make its soles, to leather and energy”, and added, “we will only put prices up to cover inflation. This year we put prices up for the first time in two years, and it will cover inflation next year”.

But in a fiercely competitive market like TCF, not everybody can follow the same flow. “Some well-known names went under in 2022, [as] the clothing brands M&Co and Joules”, which, according to the retail analyst Richard Lim, were only the ‘tip of the iceberg’ compared to the number of firms he expects will find themselves in trouble in early 2023 (bbc.com).

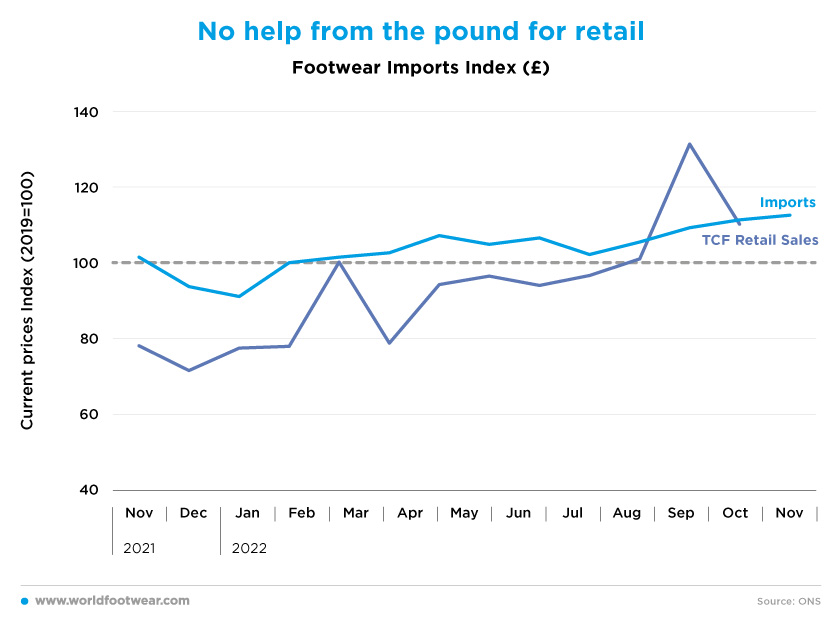

No help from the pound for retail

As of November, the value of footwear imports (according to the latest ONS data) has also been progressing upward for a year, seemingly even more accelerated than TCF retail itself.

Yet, a faster increase in the value of imports in the category cannot be taken as a clue that downstream retail will follow. Although both series are at current prices, import prices are reflecting immediately and fully the poor external value of the Pound for most of 2022.

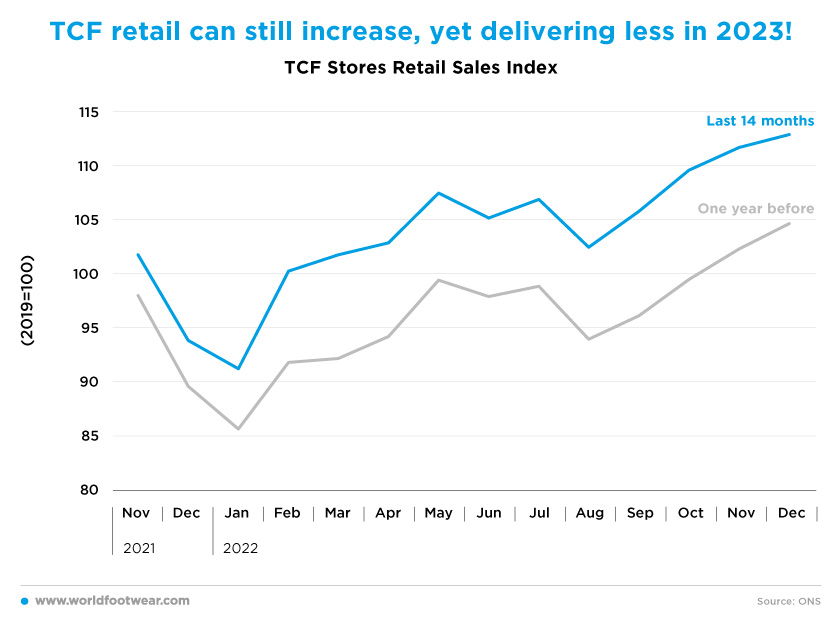

TCF retail can still increase, yet delivering less in 2023!

The gap between TCF retail in nominal and deflated (volume) terms is expected to reduce in 2023, albeit a turning point in volume alone is most likely to follow the overall pattern of household consumption.

“Despite the positive outcome for retail destinations in December, it is indisputable that the strain on household budgets due to the cost-of-living crisis is likely to begin to tell in January, and that the first quarter of 2023 will be challenging for retail”, commented Diane Wehrle, marketing and insights director at Springboard, predicting that “footfall in January is likely to be circa 20 percent lower than in December” (fashionunited.uk).

Kris Hamer, Director of Insight, at the British Retail Consortium, in turn, believes that “the first half of the year is likely to be challenging for households and retailers. Ongoing inflation will make sales appear to be rising, but we expect falling volumes as consumers continue to manage their spending”. According to the BRC analysis, “sales are expected to pick up in the second half of 2023 as inflation slows, and consumer confidence improves, with the growth of 3.6% to 4.7% compared with 1% to 2.3% in the first half. Non-food sales will move from decline to growth” (brc.org.uk).

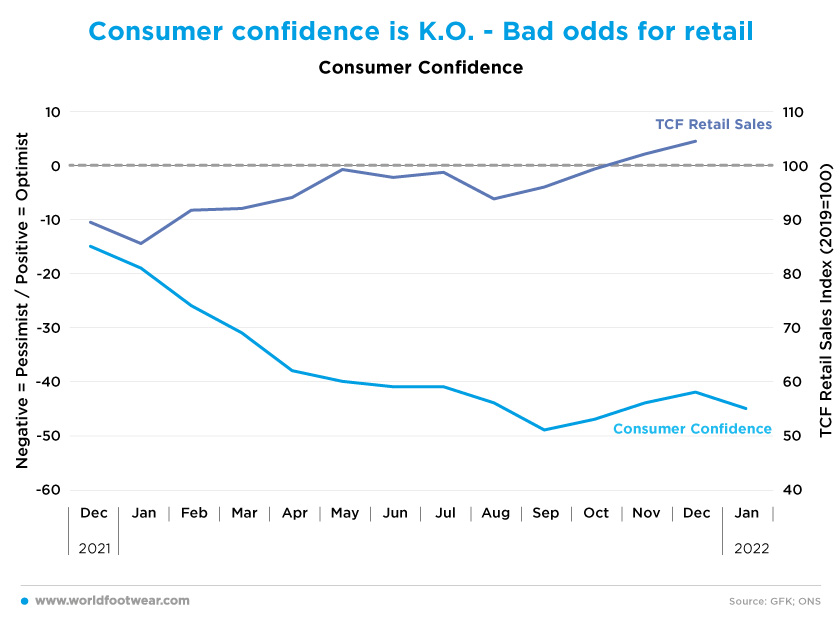

Consumer confidence is K.O. - Bad odds for retail

The improvement in the Consumer Confidence Index (by GfK) in the quarter of 2022, with an overall confidence gain of 7 percentage points, might have been beneath the simultaneous TCF retail relief.

But following previous reasoning of Joe Staton, client strategy director at GfK (reuters.com) about the December score (-42 percentage points), in which he noted it was the first time in the survey's nearly 50-year history that a run of eight successive months of -40 percentage points or worse occurred while considering even more signs of recession, “it is unlikely [to] see a rebound in confidence anytime soon with no immediate prospect of fiscal good news”.

Turning this into retail prospects, a recent KPMG study highlighted that “the chief cause of the UK’s current recession is a fall in consumer confidence” because “consumers are unable to spend at normal rates. (…) Even if inflation eases slightly if nothing is done to restore consumers’ confidence in their ability to spend on ‘non-essentials’, they will be unlikely to free up funds for some time” (consultancy.uk).

Should this be true, and if the Consumer Confidence Index records again in January a score under the minus 40 percentage points red light, it cannot represent goods news for the clothing and footwear retail sales index to come.

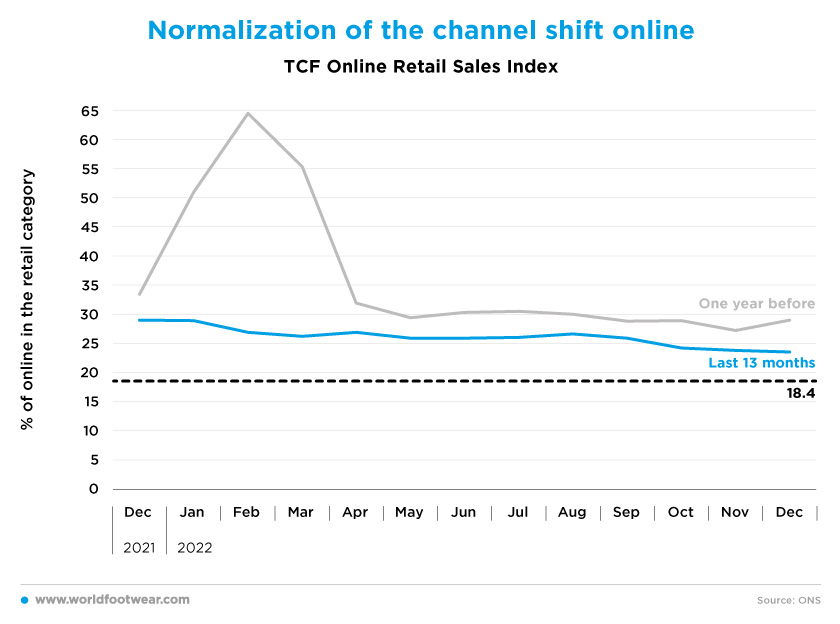

Normalization of the channel shift online*

Furthermore, the TCF internet retail sales (ONS data) went on to lose share in the overall TCF retail in the last three months of the prior year, in fact, a loss of 5 ½ percentage points in a year at the December closing.

Some argue that the share loss was due to one-off events. For instance, the footwear brand Hotter Shoes stressed the impact of the extended heatwave and postal strikes in the UK in the first half results (shoeintelligence.com), while higher competition from the high street recovery from 2021’s COVID-19 lockdowns and Omicron fears, with a number of online fashion sellers experiencing year-on-year sales fall in November of more than 10%, is also to be considered (theguardian.com). Moreover, others, like ASOS, reported a decline in sales of 8% in December, blaming the delivery market (asosplc.com).

*John Lyttle, Boohoo group CEO (www.boohooplc.com)

*John Lyttle, Boohoo group CEO (www.boohooplc.com)