Register to continue reading for free

UK Retail: are the winds starting to blow in retailers’ favour?

Despite a slight upturn in sales of Textile, Clothing and Footwear in March, a number of factors, including an early Easter, poor weather and the high cost of living, soon led to a visible lack of demand. This will most likely lead to a decline in the number of footwear imports, breaking the growth trend seen in the first quarter of the year. On the bright side, inflation is at its lowest since November 2021 and the economy seems to be picking up, so there is room for some improvement in consumer sentiment. With the UK on the brink of a General Election and a series of sporting events promising to bring people onto the streets, are the winds starting to blow in retailers’ favour?

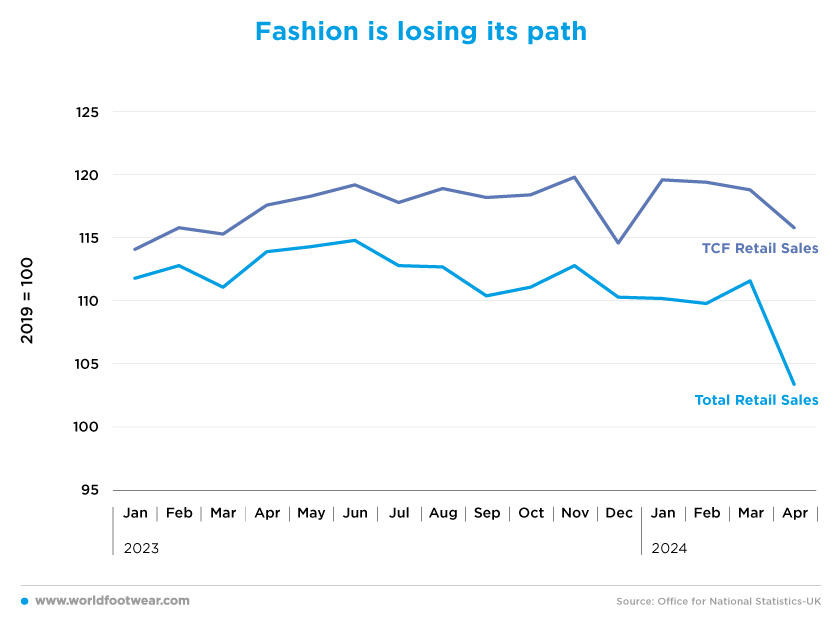

Fashion is losing its path

Fashion was already struggling when compared to total retail sales in 2023, but its losses intensified in the first quarter of the current year. After a slight upturn in March (up by 0.5% year-over-year), sales of Textile Clothing and Footwear plunged by 7.3% month-over-month in April and by 9.2% year-over-year.

Linda Ellett, UK Head of Consumer, Retail & Leisure, KPMG, said: “The positive sales growth seen in March was short-lived as the impact of an early Easter and continued wet and chilly weather saw April retail sales fall (…)”. Other reasons for this lack of demand were identified by Kris Hamer, Director of Insight at the British Retail Consortium, who commented that the “sales volumes saw a significant decline in April, falling for the third time in five months as the gloomy, wet weather combined with the cost-of-living squeeze dampened spending” (brc.org.uk)

But clothing and footwear retailers are not alone, as sports equipment, furniture, games and toys stores were among the most affected retail sectors (Office for National Statistics data). Confirming the ONS data, the survey that Barclays and the British Retail Consortium published earlier this month showed that consumers held back on spending in April (reuters.com).

To make matters worse, the country seems to be the black swan for most brands, with profits growing worldwide, but the opposite happening in the UK markets. Régis Schultz, Chief Executive Officer of JD Sports Fashion, said: “From a geographical point of view, all regions grew revenue in the period other than the UK (…) UK revenue declined 8.3% to £3,510.2m” (otp.tools.investis.com).

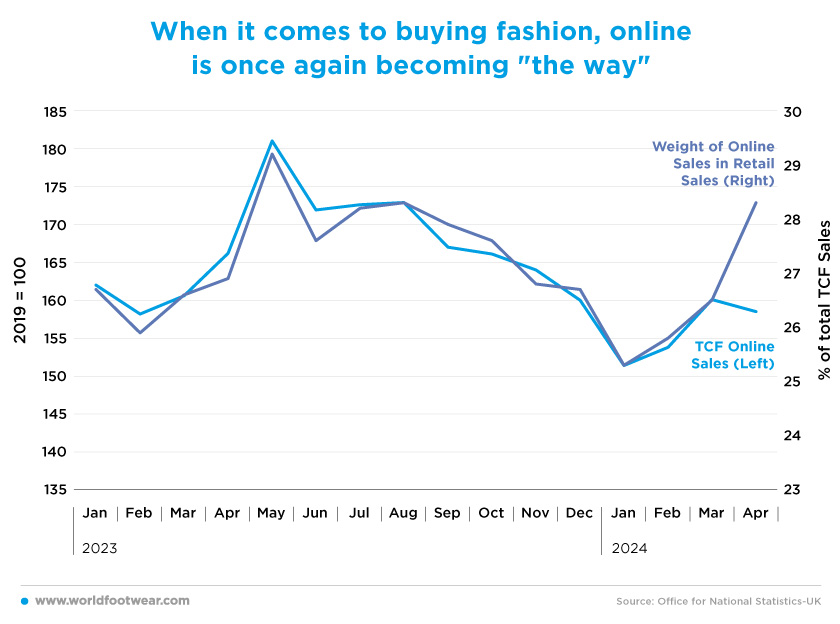

When it comes to buying fashion, online is once again becoming “the way”

Over the first quarter of the year, after nine months of decline, online sales of Textile Clothing and Footwear reversed course and showed a new upward trend. Still, it all came to a halt as the month of April showed a decline of 1% as compared to the previous month and a decline of 4.6% as compared to a year before. Although to a lesser extent, overall online fashion sales were affected by the same factors as retail sales (less than half of the impact).But in other news, online fashion sales are increasing their weight on the overall TCF retail sales. The online share of total retail sales is once again on the rise, with April alone showing an increase of 6.8% month-to-month and 5.2% year-on-year. The same trend was seen last year when the weight of online fashion sales showed the same trajectory in the first five months of 2023, but it all came down abruptly in the following months. The question now is whether the same will happen again in 2024.

Linda Ellett, UK Head of Consumer, Retail & Leisure, KPMG, pointed out that “Health, personal care, beauty and computing continued to sell well, whilst women’s and children’s clothing also saw small increases in sales. After nearly three years, things may have turned a corner for online retailers, with year-on-year sales growth across most categories, including toys and baby equipment and house textiles” (brc.org.uk).

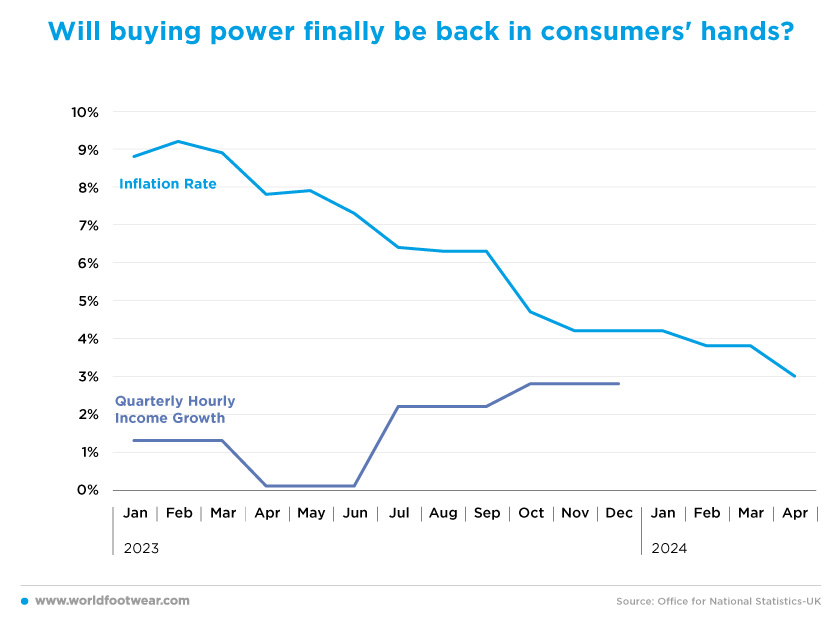

Will buying power finally be back in consumers’ hands?

Inflation (calculated based on the Consumer Price Index by ONS) has fallen for 13 consecutive months and continues to move towards the Bank of England’s 2% target. Most recently, April registered a significant drop of 0.8% month-over-month and 4.8% year-over-year.

This indicator is officially at its lowest level since November 2021. With these results, there is some improvement in consumer sentiment, as they see store prices returning to “normal levels”. According to a UK retail industry body, the cost of furniture, televisions, other non-food items like clothing and footwear, and alcoholic beverages have fallen.

“The last few years have been a period of upheaval. COVID, the cost crunch, and a flat economy aren’t fertile conditions for trading. Consumer spending has been in a funk and retail insolvencies are at a ten-year high”, commented David Lonsdale, Director of the Scottish Retail Consortium. “However, there are grounds for cautious optimism. Unemployment is low. Shop price inflation is now a third of overall CPI inflation. Average wages are growing in real terms”, he added.

In reality, household consumption in the UK is still back to pre-pandemic levels in adjusted-for-inflation terms (similar to some other European countries), but with wages showing signs of outstripping inflation, maybe consumers will feel they have regained their buying power and spending will increase again.

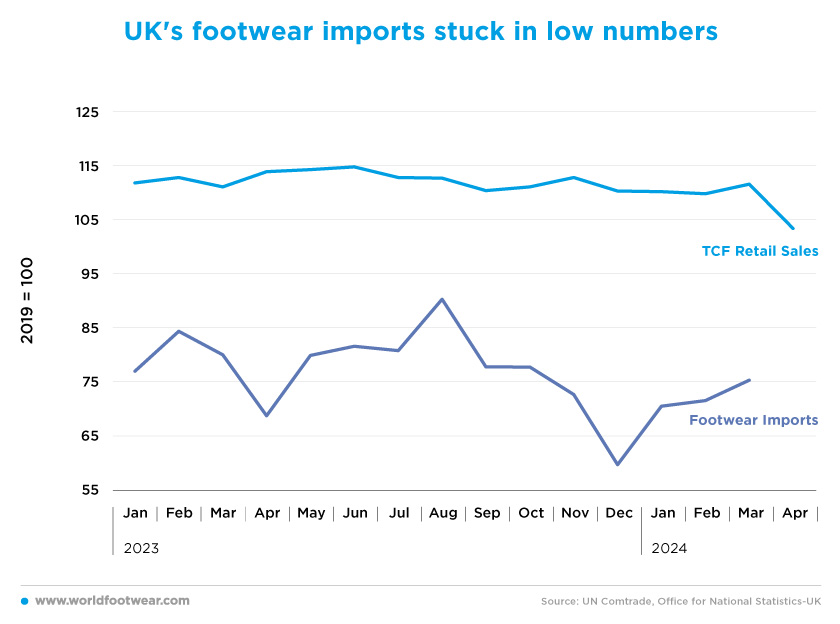

UK’s footwear imports stuck in low numbers

Following the decline in footwear imports seen in the last three months of 2023, March was the third consecutive month of growth in UK footwear imports. Data for April and May is not yet available, but a decrease is expected as imports are directly correlated with retail sales, which fell by 4.6% in April as previously analysed. The value of footwear imports in the UK is well below pre-pandemic levels, with the average value of imports in the last 15 months 23% lower than in 2019.The main reason for these low figures is that retailers’ costs remain very volatile. “This is particularly true when it comes to statutory costs such as the hikes in business rates and national living wage, and a welter of regulatory measures. This comes as retailers shell out more to combat thefts, whilst incurring higher transportation costs for importing goods, which would normally be routed via the Red Sea”. All this makes trading profitably difficult (brc.org).

But there may be a light at the end of the tunnel, as several analysts and economists see reasons for optimism in the coming months. Starting with the expectation of better weather in May, the approach of major events such as the 2024 Soccer European Championship, the Wimbledon tennis tournament, Taylor Swift’s Eras Tour, and the Olympics, which will hopefully bring customers to the streets and turn things around after a very disappointing start to 2024.

On the economic front, the Bank of England has seen inflation approaching its 2% target faster than expected, and there are expectations that interest rates could be cut and spending could pick up again as consumers see their purchasing power improving.

In addition, the General Election in the UK is fast approaching, and political parties are keen to ensure that their manifestos detail how they will support the economy. Retail is vital to local economies and employs more than 3 million people, so if the government wants to boost growth and jobs in left-behind regions, it needs to unlock retail investment right across the country.

“The economy may be improving, but the health of the sector remains fragile, with major investment held back by many until there are clear signs that consumer confidence has turned into spending”, warns Linda Ellett, UK Head of Consumer, Retail & Leisure, at KPMG (brc.org.uk).