Register to continue reading for free

Sustainability: consumers care but aren't prepared to pay more

Sustainability is one of the most discussed topics of the moment, so in the first edition of the World Footwear Business Conditions Survey we have asked our experts about sustainability and consumers

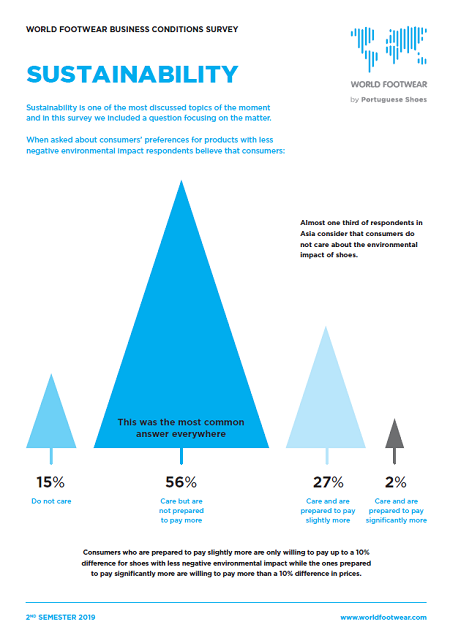

When asked about consumers’ preferences for products with less negative environmental impact 56% of the respondents believe that consumers prefer shoes with less negative environmental impact but only if that does not result in higher prices. Which means that the majority of the experts taking our survey believes that consumers care about sustainability but are not willing to pay more for that.

This will add extra challenges to companies and brands, as there is expectation that the effort towards sustainability should be on them.

According to the same survey 15% of the respondents believe that consumers simply won't care about sustainability, which represents a high percentage, considering all the mediatic attention this subject has been having on the news and on social networks in the most recent months, resulting in many companies announcing several measures to tackle the environmental issues.

This percentage is even higher, if we look into the results by continent and into Asia in particular:

Almost one third of respondents in Asia consider that consumers do not care about the environmental impact of shoes.

29% of the respondents of the survey believe that consumers are prepared to pay more for shoes with less negative environmental impact. 27% believe they will only be willing to pay slightly more (up to a 10% difference for shoes with less negative environmental impact) while 2% believe that consumers are prepared to pay more than a 10% difference in prices.

About the Business Conditions Survey

In 2019 the World Footwear has created the World Footwear' experts panel and is now conducting a Business Conditions Survey every semester. The objective of the World Footwear Experts Panel Survey is to collect information regarding the current business conditions within the worldwide footwear markets and then to redistribute such information in a way it will provide an accurate overview of the situation of global footwear industry.

The first edition of this online survey was conducted during the month of December 2019 and 183 valid answers were obtained, with 48% coming from Europe, 21% from Asia, 20% from North America and the remainder from other continents. One third of the respondents are involved in footwear manufacturing (manufacturers), one quarter in footwear trade and distribution (traders) and 40% in other footwear-related activities such as trade associations, consultancy or journalism, amongst others.

You can download the full report here: