Register to continue reading for free

Spain Retail: will the positive momentum hold up?

Fashion retail sales were generally positive from July to November 2024, but will this trend continue? While we await official data on year-end sales, the negative footwear inflation seen in October and November, combined with a rise in consumer confidence, may have helped to boost spending. And with import figures showing that retailers were stocking up, let’s hope the holidays were the reason, as a recent dip in retail confidence could be just the bad news the sector didn’t need to hear at the start of the year

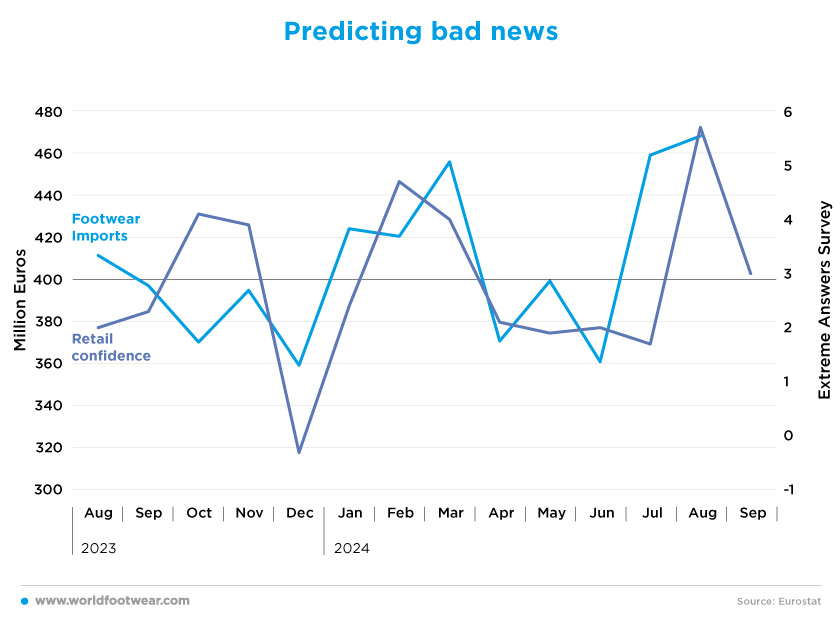

Will it hold up?

The behaviour of retail sales in Spain has been far from stable over the past twelve months, as since November 2023, fashion retail sales in Spain have shown three different periods. The first was between November 2023 and February 2024, when the average monthly growth was 1.5%. Then came a darker period, between March and June, where the average monthly growth was minus 1.8%. Finally, over the last 5 months (except for September), fashion retail showed a positive figure again, with an average of 0.5% (the last reading in November 2024 showed a monthly increase of 0.2%).David García, director of the Catalan Fashion Cluster, said that “the sector has shown an extraordinary ability to adapt to changing environments such as those experienced in recent months. The main challenge for the future of most of the brands involved is to try to increase the value of fashion sales, rather than volume” (revistadelcalzado.com).

The question now is whether the sector has ended the year with negative or positive growth. Let us hope that the combination of Back Friday and Christmas helped retailers.

But fashion is no further from the overall reality that most Spanish retailers have been living. Total retail sales in Spain have been showing small month-on-month changes and most of the time are bouncing between a positive and a negative month. The best month of the year was August due to the number of tourists in the country during the summer holidays, which helped retail sales grow by 2%, especially after falling 1.1% in the previous month (June).

As for the last two readings, there are signs of a slowdown, with October showing a monthly growth rate of only 0.2%. Still showing a growth rate above zero is a great sign of the resilience of the Spanish economy after the negative impact of the catastrophic floods in October.

As for the future, Inditex, the world’s largest listed fast-fashion retailer, said the holiday shopping season had got off to a good start. However, “While the figures are not too bad (right now), they do not meet the company's growth line and show a bigger slowdown than we estimated”, said XTB analyst Javier Cabrera, adding that next year brings new risks such as US trade tariffs likely to drive inflation up (reuters.com).

But when it comes to volatility, online takes the crown. Since October 2023, the month-on-month behaviour of online retail sales has been between minus 3.4% and 5%. As expected, all the months below zero were after huge peaks in sales, with the best months of 2024 being March, June and September (with 5%, 2.7% and 3.5% respectively).

At the moment, we are still waiting for the official figures for November, but it can be speculated that after the small increase of 0.6% in October, Black Friday will push the monthly growth rate to higher figures, as 74% of Spaniards take advantage of Black Friday offers to do their Christmas shopping, mainly motivated by economic savings (81%). This behaviour consolidates the event as a key moment for retail, especially for fashion (19%), second only to technology (25%) (fashion united.es).

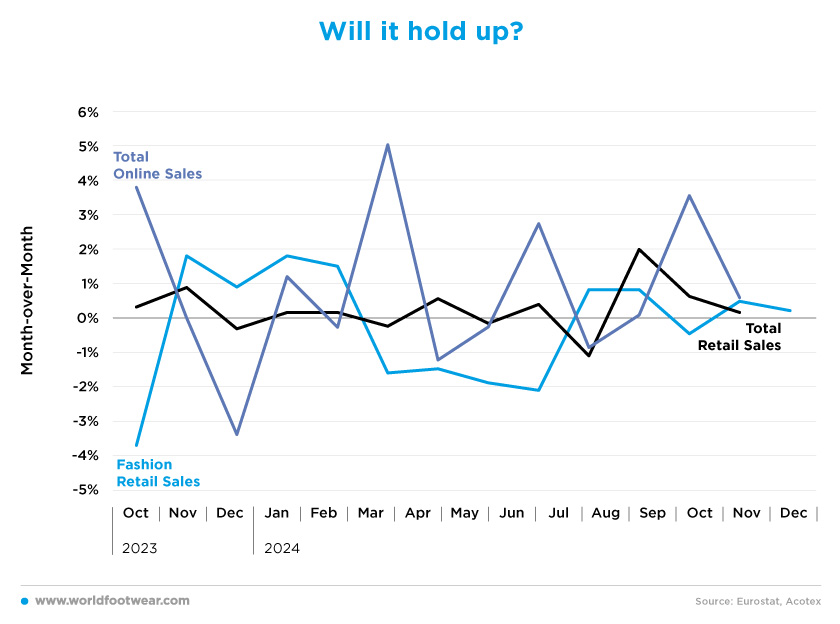

Discounted value

Dealing with high inflation is tough, but at least it means the economy is active, as below-zero inflation can be an even greater challenge.The Spanish economy finally hit the European Central Bank’s target in September, with inflation at 1.7%, which contrasted with the high figures for the fashion and footwear sectors (4.6% and 2.4% respectively). Since then, the rate has been falling. The country’s economy picked up again last month, but footwear and fashion posted negative inflation rates for the second month in a row. Below-zero inflation is good for attracting consumers (it acts like a big discount sale), but when it becomes a persistently negative number, it is a warning sign.

Looking at monthly growth, it's clear that women’s footwear was the most inflationary, rising by 0.3% last month. Meanwhile, the price of infant and children’s footwear rose by 0.2% and men’s footwear fell by 0.2%. More generally, the fashion sector, which includes the clothing and footwear sub-sectors, recorded a price increase of 0.2% in November 2024 (revistadelcalzado.com).

The truth is that two months of negative inflation rates for footwear may indicate that retailers of these goods are having a hard time selling their goods, so much so that prices need to be even lower than last year.

However, “the evolution of the price of raw materials, the rising cost of transport and the increase in costs associated with the new environmental requirements demanded of companies will generate slight increases in prices in the sector in the next six months, in a context of moderating inflation”, a survey from the ARTE group business association said (reuters.com).

Therefore, from a consumer point of view, it’s time to take advantage of this discounted value in footwear purchases before prices start to rise again.

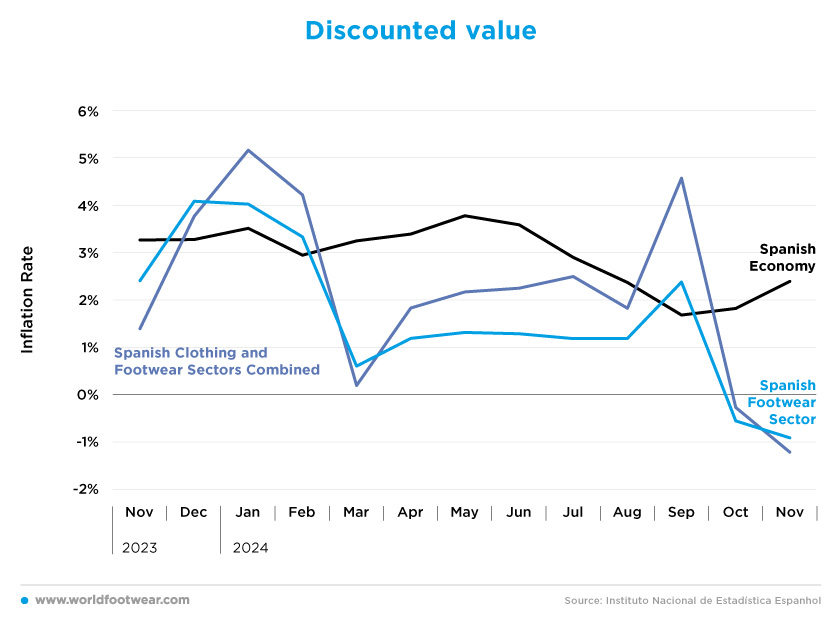

Turnaround on the horizon

Over the past twelve months, consumer and retailer confidence has shown signs of a turnaround.Retailers have been fairly static in their vision of the future, with positive hopes in every month of 2024 (always with a score between 1.7 and 5.7), mainly because most companies expected a more stable global economic environment and positive results from planned commercial actions (reuters.com).

As for consumers, the picture is a little gloomier, but there are some signs of light at the end of the tunnel. Consumer confidence has been negative for a couple of years, but from January to September, it rose from minus 18.6 to minus 12.3 (an increase of 34%).

Consumers are now getting more hopeful about the future, and retailers are still showing above zero numbers. This combination, together with the holiday season, could finally bring consumers back out onto the high street and boost retail sales.

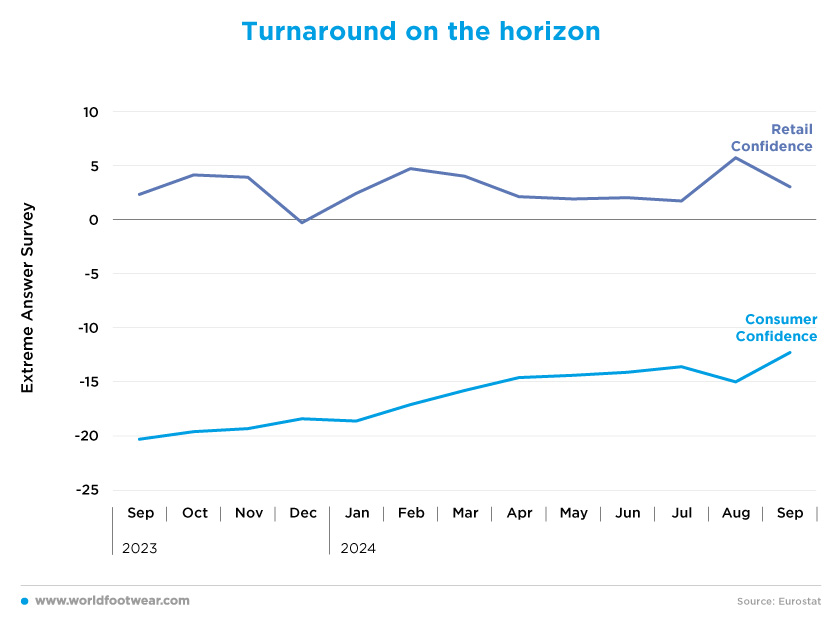

Predicting bad news

For most of the year, importers have been one step ahead of retailers. Each time importers have increased footwear imports, they seem to be a month ahead of retailers. In the first half of last year, a total of 3.359 million euros worth of footwear was imported into Spain (equivalent to a total of 356 million pairs of shoes). According to Revista del Calzado, the main suppliers of footwear to Spain were, in order of value, China (-6%), Vietnam (+28.6%), Italy (+7.7%), Indonesia (+11.1%) and Belgium (+57.7%).In particular, the best months were March, July and August (with 456, 459 and 468 million euros imported, respectively). Knowing that footwear sales have been struggling since August, we can expect bad news when the official figures for recent months are released. Data on retail confidence and falling sales means that stocks are rising and therefore there is less need to import newer products. However, there is the possibility that retailers were stocking up for Christmas in the hope that their sales expectations would be met.

So far, looking at the latest trends, importers may have to keep trying to predict the future and adjust their orders.