Register to continue reading for free

Spain Retail: retailers and consumers have shown themselves resilient at the end of 2022

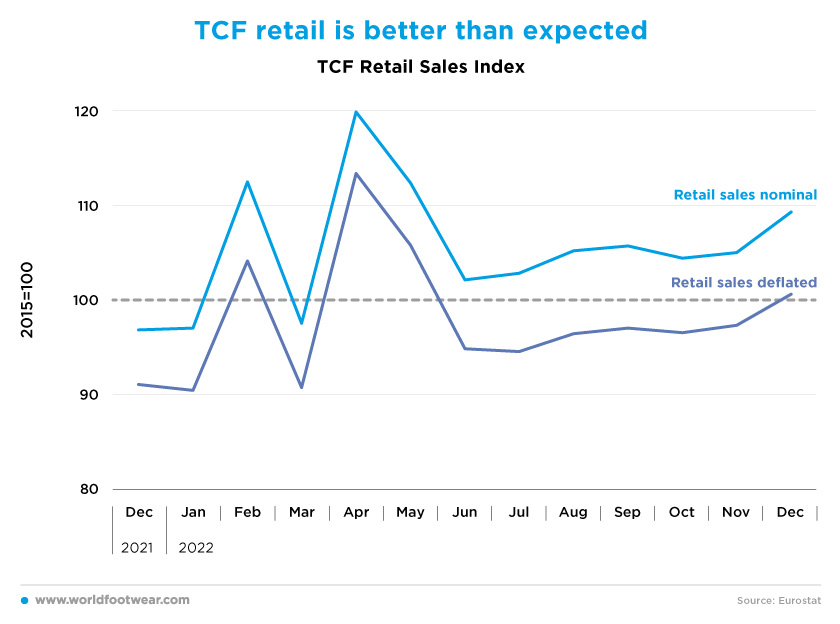

The Textile, Clothing, and Footwear (TCF) retail sales index has improved in the fourth quarter of last year and several companies in the category appear to be less fearful about 2023, especially after their positive annual results. Moreover, retailers’ and consumers’ confidence indicators are showing that despite some lingering pessimism due to the challenging macroeconomic environment, things won’t get necessarily worse in the short term.

TCF retail is better than expected

The steady progress of the Textile, Clothing, and Footwear (TCF) Retail sales index (by Eurostat) since our previous World Footwear Retail Flash, closing at 13.5 percentage points (pp) up year-over-year in December pushed forward the doubts on its consistency.

According to the barometer prepared by the Business Association of Textile, Accessories and Leather Trade (Acotex), “fashion retail trade grew by 13.8% last year, as compared to 2021, given that the autumn-winter campaign, in general, has been good due to the rise during the Christmas shopping period”. The association underlines, however, “we are still far from pre-pandemic sales and there are still many sales to recover”, amidst “a lot of uncertainty as to how they will evolve”, thus concluding that it foresees a complex year ahead (revistadelcalzado.com).

Despite that, many companies in the category are less fearful about 2023, especially after their full-year performances in 2022. To name a few in the footwear sector, Castañer reported an increase of 35% year-over-year in its retail and direct-to-consumer sales (fashionunited.es), while Martinelli, the Spanish footwear company owned by the Pikolinos group, posted a sales increase of 54% in 2022, forecasting a revenue jump of 20% for 2023 (modaes.com).

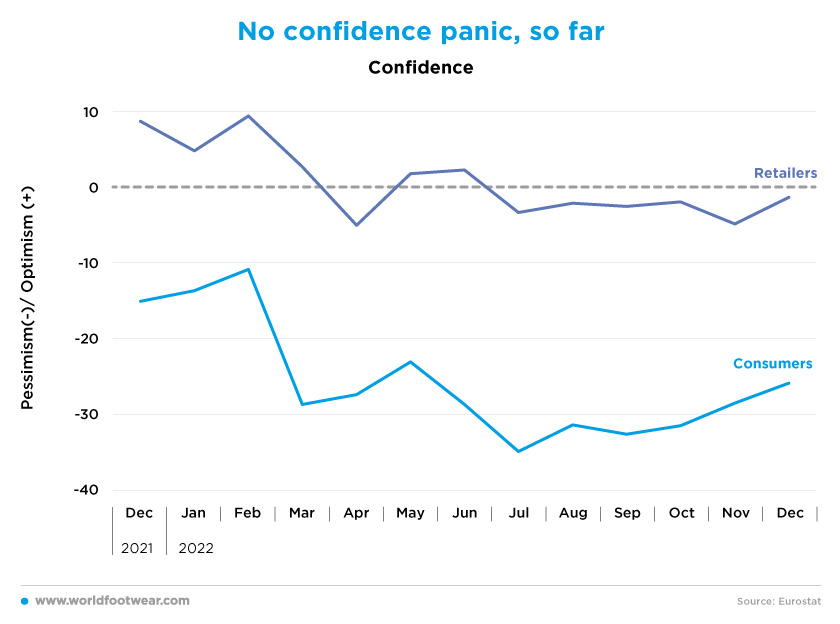

No confidence panic, so far

Looking into the confidence indicators (by Eurostat), the evidence hints there aren’t yet reasons for panic. Albeit still alive, retailers’ pessimism is too close to neutral to allow us to suggest that things will soon get worse. On the consumers’ side, while still very far from happy, they have also climbed 10 pp in the confidence staircase since July.

Reporting on Spanish consumer confidence, the economic and financial analysts from ING (think.ing.com, November) explained that “falling inflationary pressures and energy prices that are well below their peak levels led to a cautious rise in consumer confidence in November. However, this is not enough to prevent a contraction [of the Spanish economy] in the fourth quarter”. But “the less tight energy markets and a faster-than-expected drop in inflationary pressures are likely to ease the winter contraction, allowing Spain to narrowly avoid a recession”. Meanwhile, in December, consumer confidence went up again.

Furthermore, as the Financial Times (ft.com) noticed, “Spain’s economy expanded more than expected at the end of last year, in a sign of resilience in the face of high inflation and rising borrowing costs”.

However, better is not synonymous with optimism. “The household savings rate is down and already close to its long-term level, reducing the cushion against price, interest rate, and tax base rise, factors for which wage rises would not compensate. Inflation will continue to point downwards as the ECB's measures take effect, but will still double the 2% target”, reported the consultancy firm Metyis (metyis.com).

Footwear retail between winter sales and inflation amnesia

The increase of about 6 pp year-over-year of the overall consumer prices in December (by INE-National Statistics Institute) became a somewhat distant memory for Spanish consumers. Its impact in terms of confidence was most likely accommodated, as the index remained more or less the same from June through December.

This is why the TCF retail shows no persistent losses since June, even though footwear, in particular, followed an upwards price trend (3.7 pp year-over-year closing in December).

Moreover, with the winter sales underway, no retreat is expected shortly. “According to a study by SaleCycle, the most popular products during the sales will be clothing, footwear and perfumes, in this order. Thus, 76% of Spaniards who take advantage of the discounts in this sales period will buy clothes; 46% of them, footwear” (revistadelcalzado.com).

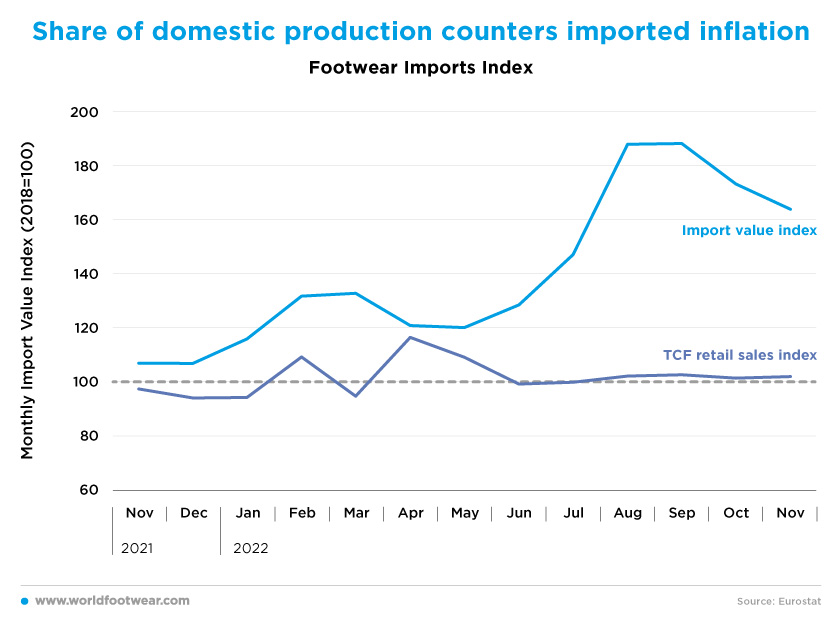

Share of domestic production counters imported inflation

Data on the value of footwear imports, although delayed as compared to retail, appears to contradict retailers’ mood.

A very steep slope of the trend for one year now, quite in contrast with the retail development, could translate either large increases in volume (which is good) or in prices (which is bad), or both. In Spain, footwear import price increases are at stake, going from 19% in August (top volume imports of the period) to 46% last November.

According to the Federation of Spanish Footwear Industries (FICE) analysis of the footwear imports in the first nine months of 2022, “there was an annual increase of 28.2% in pairs and 43.7% in value. When compared to 2019, imports in pairs are already the same and are 26.6% higher in value. The average import price has risen by 27%, as compared to pre-pandemic data” (es.fashionnetwork.com).

Effectively, retailers’ concern with margins was not translated into dramatic pessimism because Spain is one of the biggest producers of footwear, and footwear import price increases have only a moderate impact on the average footwear consumer price.

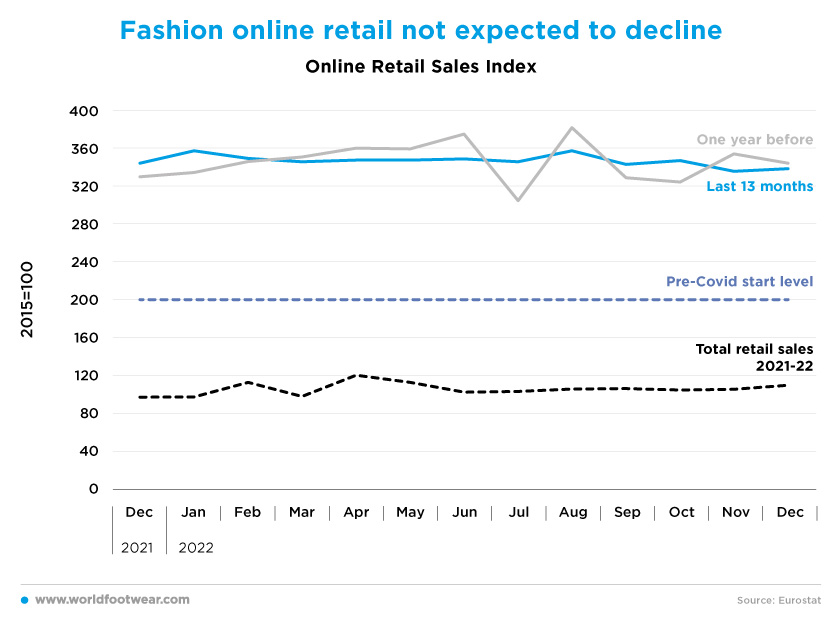

Fashion online retail not expected to decline

For the last 13 months, closing in December, the online retail index evolved between the 340 and 360 range, stopping the pandemic-induced volatility of the previous two years. Compared to the pre-pandemic levels, this suggests a sustainable jump in online retail in the country of around 140 to 160 points in two years. Official statistics are not yet available to allow us to assess whether TCF retail performed equally well.

Still, according to the Euromonitor forecasts (modaes.com) “fashion e-commerce in Spain continues to grow, albeit at an increasingly slower pace” (…) [following] “the global trend of deceleration after the growth it experienced in the pandemic years(…): in 2023, online sales of clothing and footwear in Spain are expected to grow by 7.8%, followed by a 1.5 percentage point slower rise in 2024, namely of 6.3%”.

There is also some piecemeal information available from companies in the category going in the same direction. Francisco Sanchez, an executive from the fashion company Cuplé says that “after the 2020 peak, online sales have stabilized and now account for 30% of the company's turnover”, adding some rationale to explain that “online is more scalable; with the new paradigm, there are shops that are more profitable than online, but they are less scalable, so, in the aggregate, a greater weight of e-commerce means a higher margin” (modaes.com). Castañer management stressed that its online channel sales “have continued to increase in a range of 22%” (fashionunited.es). And the fashion Tendam Group President and CEO, Jaume Miquel, reported that “the company's digital sales grew by 15.4% in the period compared to 2021, but by 126.3% compared to 2019”, accounting already “for 18% of its total turnover” (es.fashionnetwork.com).