Register to continue reading for free

Spain Retail: a case for optimism

Despite a decline in fashion sales in January, February bucked the trend, and the data points to a stable performance for the sector in 2025, with online taking the lead. Although the deflation in the apparel and footwear sectors is not good news, retailers in general remain optimistic about the future - as shown by the import data - supported by the economic growth the country has experienced and is expected to continue to experience

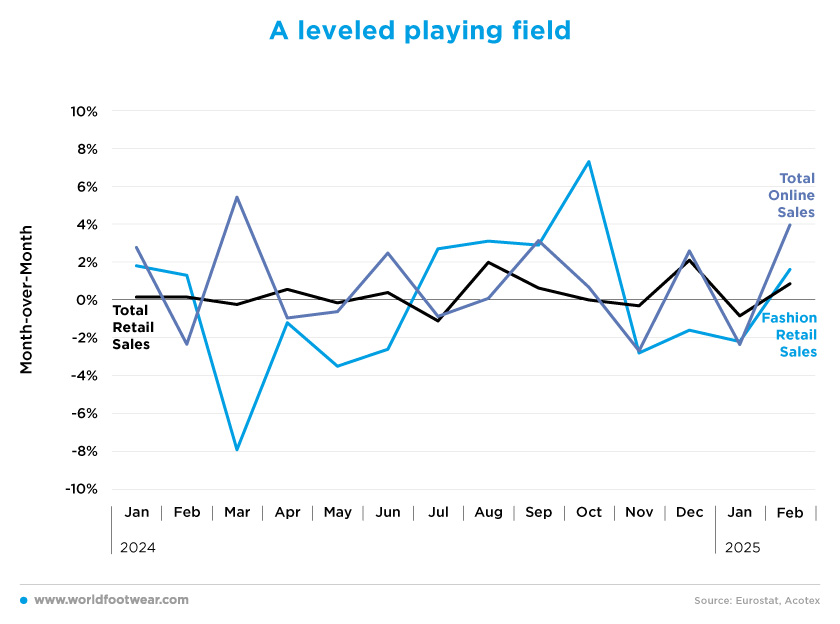

A leveled playing field

After the recovery of 2024, the fashion sector now seems to be on par with the total sales of the Spanish retail sector. The online sector tends to lead the way in terms of the largest monthly variation, meaning that when sales decrease, the decrease is more pronounced online, and when there is an increase, it also tends to be larger.The start of the year so far has brought mixed feelings to the fashion retail sector, which includes clothing, footwear and accessories, with January being the third consecutive month of decline at 2.2%, while February halted the downward trend with a rise of 1.6%.

However, if we only look at online sales of footwear and leather in Spain, these reached record levels in the third quarter of 2024. Online footwear sales continue to grow month-on-month, there are no signs that this clear trend will peak in the near future. However, it is true that in recent quarters, growth has been less pronounced and in single digits (revistadelcalzado.com).

As for the retail sector as a whole, the same trend as last year is expected. The Spanish economy performed quite well last year, and the retail sector wasn’t an exception, growing by an average of 0.3% per month. So far in 2025, the first two months have balanced each other out, with a fall of 0.8% in January followed by a rise of 0.8% in February.

According to the National Statistics Institute (INE), among the different types of retail trade, single outlets (2%), large chains (1.7%) and e-commerce (0.2%) recorded growth in turnover compared to the same month of the previous year, while large stores and small chains saw their turnover fall by 2.2% and 0.4% respectively (modaes.com).

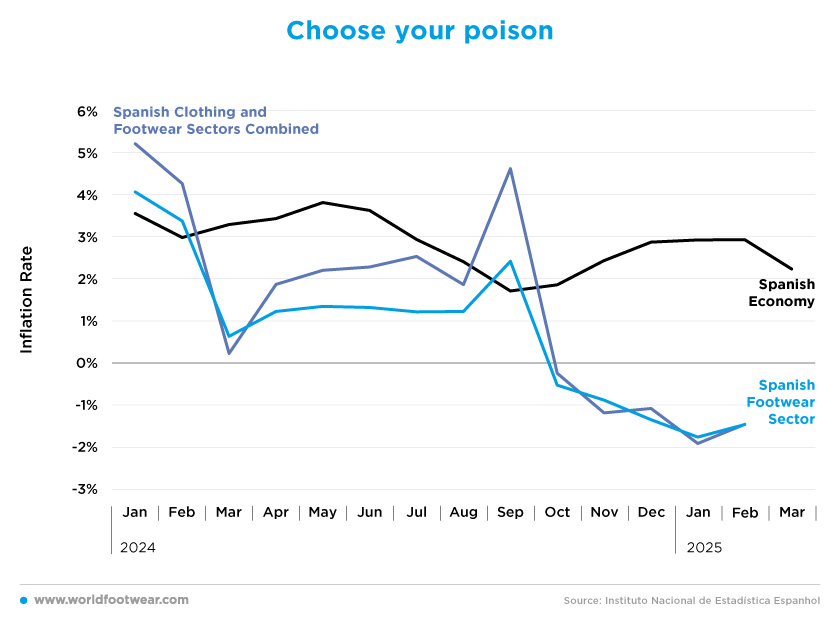

Choose your poison

The Spanish fashion sector has had to deal with periods of high inflation since the beginning of 2024, but also with disinflation since October. Inflation appears to be a cross-cutting issue for European economies recently, and Spain is doing its fair share to control it and stabilise the economy. However, the policies implemented may be affecting the sector in different ways.

While in the last quarter of 2024, the Spanish economy saw its inflation rate rise back above the 2% target (2.4% in November), in the footwear sector, it fell below zero to an average of minus 0.9% in the last three months of the year. So far, 2025 seems to be continuing this trend.

Meanwhile, the Spanish economy posted a monthly inflation rate of 2.2%, well below the forecast of the European Central Bank (ECB) of 2.6%. While a full-blown trade war with the US could upset price expectations, the ECB reiterated its view that the main impact would be on growth.

“The effect would be fundamentally on economic activity”, said the ECB Vice President Luis de Guindos. “For inflation, a trade war would have a negative effect, ultimately a tariff is a tax on imported goods, but over the medium term the reduction in economic activity would compensate this initial impact in some way”. (reuters.com).

In any case, clothing and footwear together saw their prices decrease by 1.5% in February 2025.

Economists are usually worried about high inflation, but they become even more concerned when the phenomenon of disinflation occurs. The apparel and footwear sectors are struggling to sell, and with demand low, prices tend to fall. The only hope for retailers is that the necessary discounting of sales doesn’t cut too much into their already slim margins.

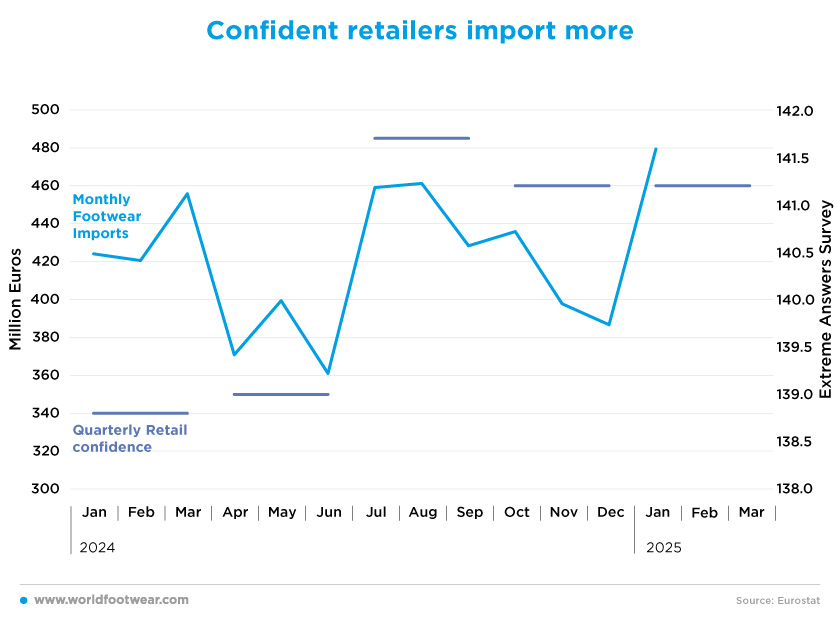

Confident retailers import more

Spain was one of the few European countries to see an increase in footwear imports in 2024 (up by 8.4% year-on-year), as its imports reached 5 billion euros - a total of 343.7 million pairs (corresponding to an average price of 14.55 euros). Along with the increase in footwear imports, Spanish retailers also became more confident throughout the year, with confidence levels increasing by 2% from January to December, peaking in the summer months.Spain purchased 34.4 million pairs of shoes from abroad in January this year, for a total of 478.8 million euros. According to Revista del Cazado, footwear imports increased by 31.2% in volume and 18.2% in value compared to the same month in 2004. The main suppliers, in order of value, were China (up by 25.3%), Vietnam (up by 13.7%), Italy (down by 6.6%), Indonesia (up by 14.2%) and Belgium (up by 77%). The average price per pair bought abroad in the first month of 2025 was 13.9 euros.

These data are also supported by the maintenance of high levels of confidence among retailers, who believe that the Spanish economy will maintain the growth rate of 2024, as the Bank of Spain announced at the beginning of March that it expects the country’s economy to grow by a still strong 2.7% in 2025, thanks to rising private consumption, which will hopefully also boost fashion sales (reuters.com).

The future looks bright for the Spanish retail sector. According to the Deloitte study, Inditex, Mercadona and El Corte Inglés are once again among the 100 largest companies in the sector.

Enrique Domínguez, partner in charge of Retail & Consumer Products at Deloitte, explained that even though “the inflationary context and geopolitical tensions have had an impact on consumer habits and, consequently, on the slowdown in the growth of the main retailers at a global level, in Spain we are seeing a strengthening of the sector, thanks to the strength of tourism, high investment in the export of services and consumer confidence above its European counterparts” (fashionnetwork.com).