Quicksilver, Inc. reports disappointing results

Giant outdoor sports and lifestyle company reported net loss of 220 million US dollars or 1.29 US dollars per share and revenue of 396 million US dollars, down by 19%

“We continued to execute against the key initiatives laid out in our profit improvement plan and to drive growth in our direct to consumer channels and emerging markets”, commented Andy Mooney, President and Chief Executive Officer of Quiksilver, Inc., adding: “As we expected, revenues for the third quarter declined in our wholesale channels in North America and Europe. In addition, late product deliveries, largely the result of our transition to global demand planning, negatively impacted our sales performance and gross margin."

“We are resolving the product delivery issues and already see improved fulfillment in the Holiday season. We continued to right-size staffing, redeployed our marketing to invest more in media and point of sale, improved the quality of distribution in North America and completed a number of licensing transactions for peripheral product categories. We are encouraged by the positive feedback we have received on our Spring 2015 product lines, both for apparel and footwear.”

Net revenues for the third quarter were 396 million US dollars compared with 488 million US dollars, down by 19%.

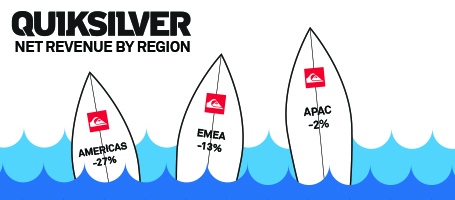

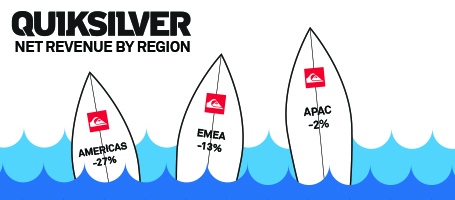

Two digits decline was registered for net revenue in the Americas and EMEA (Europe, Middle East, Africa) region, respectively down by 27% (to 191 million US dollars from 261 million US dollars) and 13% (to 143 million US dollars from 164 million US dollars). APAC (Asia Pacific) net revenue decreased 2% to 62 million US dollars.

Net revenue decreased across the three core brands: at constant currency Quiksilver decreased 30 million US dollars, or 17%; Roxy was down by 12 million US dollars or 9%; DC decreased 57 million US dollars, or 34%.

By distribution channel, wholesale revenue decreased 30% to 235 million US dollars and retail revenue increased 1% to 123 million US dollars (same-store sales in company-owned retail stores improved 1%). Ecommerce revenue grew 10% to 35 million US dollars.

Emerging markets generated net revenue growth of 10% in constant currency.

Gross margin decreased to 47.8% from 49.1%. The 130 basis point decline in gross margin reflects increased discounting in the wholesale channels of certain regions, partially offset by sales growth in our higher-margin direct to consumer channels.

Net loss from continuing operations attributable to Quiksilver, Inc. was 220 million US dollars, or 1.29 US dollars per share, versus income from continuing operations of 0.2 million US dollars, or 0.00 US dollars per diluted share in previous period last year.

Asset impairments in the period totaled 182.6 million US dollars compared with 2.2 million US dollars in the previous year, reflecting a non-cash charge of 182 million US dollars in the third quarter of fiscal 2014 to write-off the carrying value of goodwill attributable to the Company’s EMEA reporting segment.

Pro-forma loss from continuing operations attributable to Quiksilver, Inc., which excludes the after-tax impact of restructuring and other special charges, non-cash asset impairments and non-cash interest charges, was 35 million US dollars, or 0.20 US dollars per share, versus pro-forma income from continuing operations of 13 million US dollars, or 0.07 US dollars per diluted share.

Results for the 9 months period ended on the 31st July were less aggravated but still negative, with net revenue down by -11.2% to 1 215 million US dollars, and net income was highly impacted by the referred asset impairments, going from -61.5 million US dollars to -257.8 million US dollars.

Quicksilver, Inc. shares were last traded at 1.07 US dollars on the 10th of September at the New York Stock Exchange.

“We are resolving the product delivery issues and already see improved fulfillment in the Holiday season. We continued to right-size staffing, redeployed our marketing to invest more in media and point of sale, improved the quality of distribution in North America and completed a number of licensing transactions for peripheral product categories. We are encouraged by the positive feedback we have received on our Spring 2015 product lines, both for apparel and footwear.”

Net revenues for the third quarter were 396 million US dollars compared with 488 million US dollars, down by 19%.

Two digits decline was registered for net revenue in the Americas and EMEA (Europe, Middle East, Africa) region, respectively down by 27% (to 191 million US dollars from 261 million US dollars) and 13% (to 143 million US dollars from 164 million US dollars). APAC (Asia Pacific) net revenue decreased 2% to 62 million US dollars.

Net revenue decreased across the three core brands: at constant currency Quiksilver decreased 30 million US dollars, or 17%; Roxy was down by 12 million US dollars or 9%; DC decreased 57 million US dollars, or 34%.

By distribution channel, wholesale revenue decreased 30% to 235 million US dollars and retail revenue increased 1% to 123 million US dollars (same-store sales in company-owned retail stores improved 1%). Ecommerce revenue grew 10% to 35 million US dollars.

Emerging markets generated net revenue growth of 10% in constant currency.

Gross margin decreased to 47.8% from 49.1%. The 130 basis point decline in gross margin reflects increased discounting in the wholesale channels of certain regions, partially offset by sales growth in our higher-margin direct to consumer channels.

Net loss from continuing operations attributable to Quiksilver, Inc. was 220 million US dollars, or 1.29 US dollars per share, versus income from continuing operations of 0.2 million US dollars, or 0.00 US dollars per diluted share in previous period last year.

Asset impairments in the period totaled 182.6 million US dollars compared with 2.2 million US dollars in the previous year, reflecting a non-cash charge of 182 million US dollars in the third quarter of fiscal 2014 to write-off the carrying value of goodwill attributable to the Company’s EMEA reporting segment.

Pro-forma loss from continuing operations attributable to Quiksilver, Inc., which excludes the after-tax impact of restructuring and other special charges, non-cash asset impairments and non-cash interest charges, was 35 million US dollars, or 0.20 US dollars per share, versus pro-forma income from continuing operations of 13 million US dollars, or 0.07 US dollars per diluted share.

Results for the 9 months period ended on the 31st July were less aggravated but still negative, with net revenue down by -11.2% to 1 215 million US dollars, and net income was highly impacted by the referred asset impairments, going from -61.5 million US dollars to -257.8 million US dollars.

Quicksilver, Inc. shares were last traded at 1.07 US dollars on the 10th of September at the New York Stock Exchange.