Puma with record sales

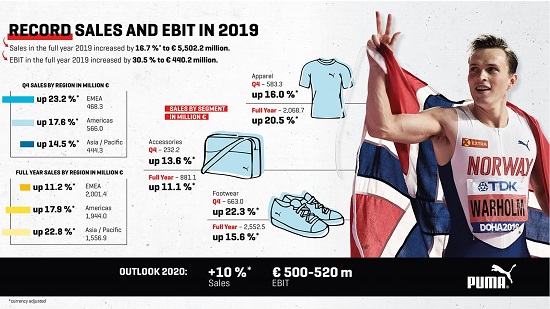

All regions and all product divisions were up by double digit rates, resulting in a 20.6% increase in total revuene. This made 2019 the best year in Puma's history

“2019 ended with a very strong fourth quarter for us with revenue being up by 20.6% reported (18.3% currency adjusted) and EBIT up 47%. All regions and all product divisions were up by double digits. This made 2019 the best year in Puma‘s history with a revenue of 5.5 billion euros (+18.4%) and an EBIT of 440 million euros (+30%). I am very proud of what the team has achieved and think this performance shows the global potential of the PUMA brand. After a good start into 2020, February has of course been negatively affected by the outbreak of COVID-19. The business in China is currently heavily impacted due to the restrictions and safety measures implemented by the authorities. Business in other markets, especially in Asia, is suffering from lower numbers of Chinese tourists. Given the current uncertainty around the virus it is of course impossible to forecast its impact on the business. We will do everything we can in the short term to minimize the damage and remain very positive in the long term both for our industry and for PUMA”, commented Bjørn Gulden, Chief Executive Officer of PUMA SE.

Fourth Quarter 2019

PUMA's strong sales growth continued in the fourth quarter of 2019. Sales increased by 20.6% reported to 1 478.6 million EUROS (+18.3% currency adjusted). All regions and all product divisions contributed with double-digit increases. Sportstyle, Running and Training as well as Motorsport were the categories with the highest growth rates.

Full Year 2019

Puma's sales increased by 18.4% reported in the financial year 2019 (+16.7% currency adjusted). All regions and product divisions contributed with double-digit growth.In the EMEA region, sales rose by 11.2% reported to 2 001.4 million euros (+11.2% currency adjusted). As a result, the EMEA region exceeded the two-billion-euros sales mark for the first time. The main growth drivers were Germany, Spain, Russia, and Turkey. In the Americas region, sales increased by 20.6% reported to 1 944.0 million euros. Currency adjusted sales increased by 17.9%. Both North America and Latin America contributed with double-digit growth rates. Currency exchange effects for North America were positive, while especially the weakness of the Argentinian Peso led to a negative currency effect on sales for Latin America. The Asia/Pacific region delivered the strongest sales growth of 26.0% reported to 1 556.9 million euros. This corresponds to a currency adjusted increase of 22.8%. Growth in the region was mainly driven by China and India.

In the footwear division, sales increased by 16.8% reported to 2 552.5 million euros. Currency adjusted sales increased by 15.6%. The strongest growth was achieved in the Sportstyle, Running and Training, and Motorsport categories. In the apparel division, sales increased by 22.6% reported to 2 068.7 million euros (+20.5% currency adjusted) and was also driven especially by strong growth in Sportstyle, Running and Training as well as Motorsport categories. As a result, sales in the apparel division exceeded the two billion euro sales mark for the first time. The accessories division showed a sales increase of 13.5% reported to 881.1 million euros. This corresponds to a currency adjusted sales growth of 11.1%. Higher sales of legwear, bodywear and Cobra golf clubs contributed to the increase.

Wholesale continued to drive growth with an increase of 15.0% currency adjusted, supported by a strong performance of our key accounts. Puma's direct-to-consumer sales (owned and operated retail stores and eCommerce) increased by 22.0% currency adjusted to 1 395.3 million euros. This was driven by like-for-like sales growth in our own stores, the expansion of our retail store network and a continued strong growth of our eCommerce business. Direct-to-consumer sales represented a share of 25.4% of total sales in 2019 compared to 24.3% in 2018.

Source: Puma