Register to continue reading for free

Netherlands Retail: good expectations for the footwear holiday season

After record growth between July and September, footwear sales fell abruptly in October, accompanied by a hiccup in consumer confidence. But that’s no cause for despair: lower footwear inflation has kept footwear prices relatively stable and there has been a recent upturn in retailer confidence. This could bode well for the future of footwear imports, especially with the festive season just around the corner. In this context, the online channel will continue to be favoured by Dutch consumers to shop

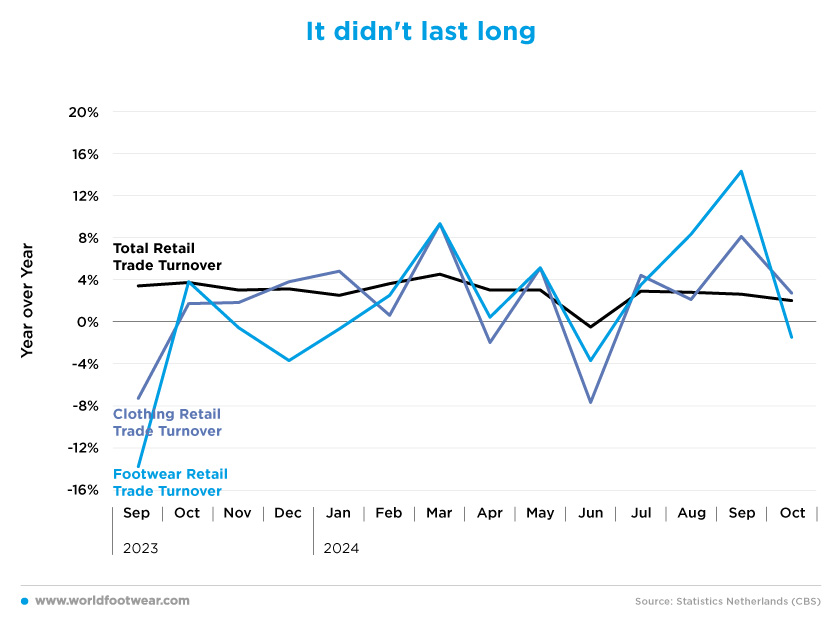

It didn’t last long

The end of last year was gruelling for footwear retailers, who saw their sales fall sharply, even more so than other retail sectors. However, so far in 2024, footwear retail sales have shown positive year-over-year growth compared to the same months in 2023, except for January and June. Still, while the total turnover of retail sales in the Netherlands’ economy has been stable, with only one month out of the last twelve showing negative year-over-year growth (June with minus 1%), footwear and clothing have been much more volatile.

Specifically, footwear retail turnover showed an incredibly above-average performance from July to September, with September showing a record-breaking 14.3% growth, according to Statistics Netherlands (CBS) figures. But it didn’t last long, as the latest figures for October show a decrease of 1.5% in turnover, as compared to the previous year, taking the crown away from footwear once again.

According to data from the INretail Fashionpanel, “the picture was less optimistic for retailers in the Dutch footwear sector, where sales fell by 4% in October. The number of pairs of shoes sold fell by 6%, while the number of transactions also fell by 4 %” (fashionunited.uk).

According to data from the INretail Fashionpanel, “the picture was less optimistic for retailers in the Dutch footwear sector, where sales fell by 4% in October. The number of pairs of shoes sold fell by 6%, while the number of transactions also fell by 4 %” (fashionunited.uk).

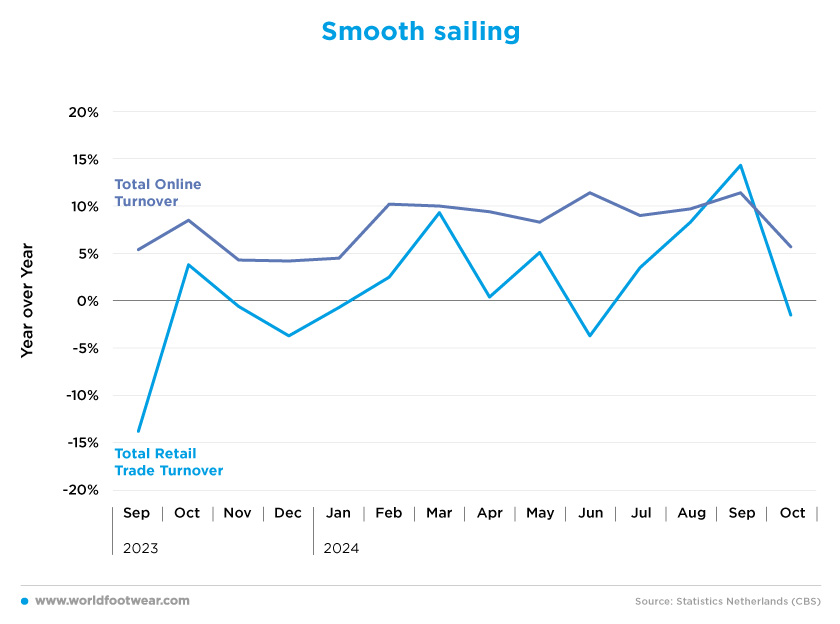

Smooth sailing

On the other hand, online retail turnover has been growing steadily for over a year. Although the online has been on the rise worldwide since the COVID pandemic, it’s worth noting that it continues to grow in the Netherlands, with double-digit growth in February, June and September.According to the latest quarterly figures from the Central Bureau of Statistics, 99 990 companies are registered in the category 'retail via Internet'. The number of web stores is, therefore, higher, with many companies that consider it as their main activity (ecommercenews.nl).

It is curious that in June online sales showed the opposite trend to total retail sales. As previously analysed, June was the worst month in terms of year-over-year growth in total retail sales (minus 3.7%), but in the same period, online sales grew by 11.4%, showing that the fall in consumption was mainly in physical sales.

As far as the latest reading is concerned, in October, total retail sales returned to a negative figure (minus 1.5%) and online sales showed slower growth, but still a positive increase of 5.7%.

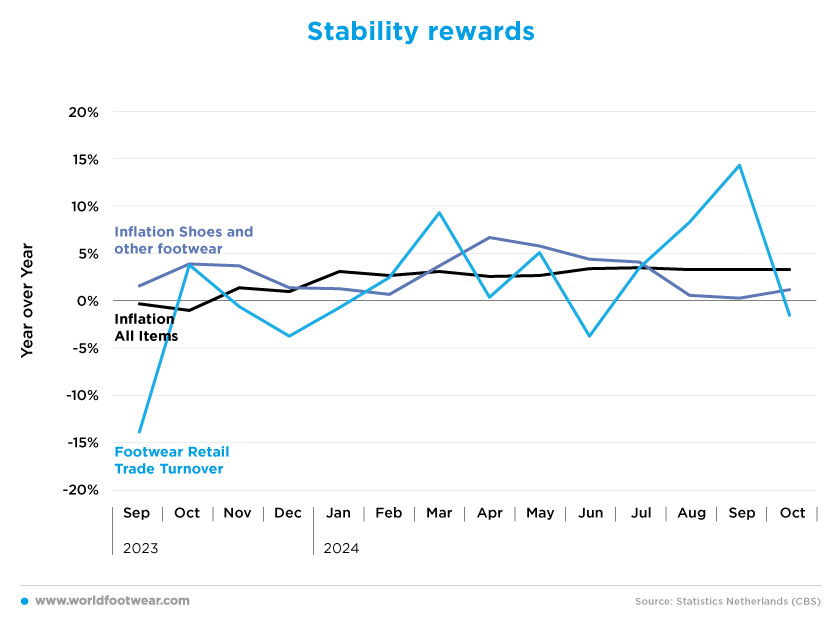

Stability rewards

Inflation has been a big issue across European markets, but the Netherlands has been a little better at dealing with it.The inflation rate for all items has been above the 2% target since January, when it jumped from 1% in December 2023 to 3.1% in January 2024. After the big drop in 2023 from 8.4% to 1% over 12 months, 2024 has shown better economic momentum with inflation ranging from 2.6% to 3.5% (latest reading for August, September and October all with an inflation rate of 3.3%). The above 2% target numbers are “mainly due to the price developments of services and tobacco products that inflation in the Netherlands is higher than in the eurozone”, reads the report of CBS (euronews.com).

As for footwear, inflation has been slowing down since April, almost reaching 0% at the end of the summer (0.6% in August and 0.3% in September). Lower inflation brought some stability to footwear prices, which probably contributed to the increase in retail sales in the same months (8.3% and 14.3%, respectively). In the latest reading for October, footwear inflation rose to 1.2% and sales fell by 1.5% year-over-year.

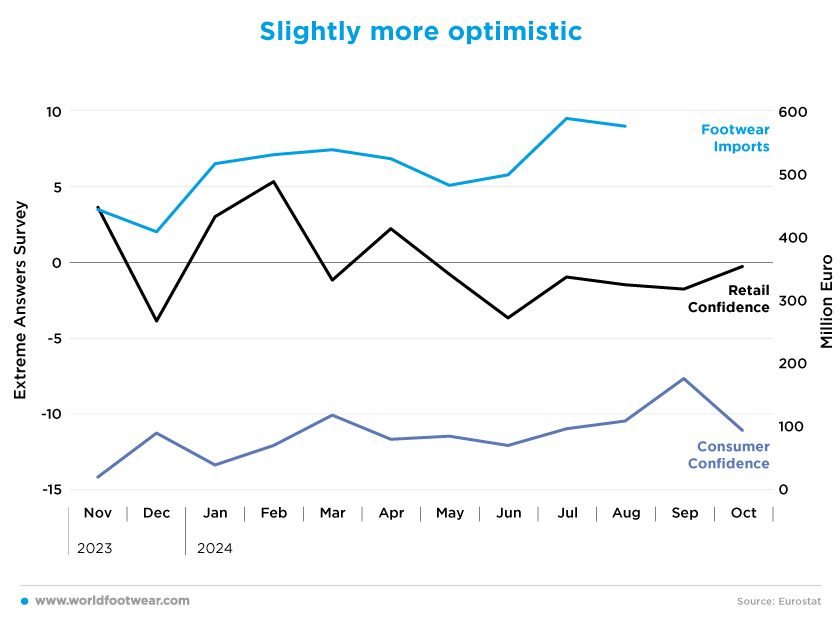

Slightly more optimistic

Although negative for most of the year, retail confidence was several points higher than consumer confidence, showing that retailers are more optimistic about the future than consumers. Still, after the positive values in the first two months of the year, retailers lost some hope (from 3 in January to minus 0.3 in October), while consumers fared slightly better, showing an increase of 17% in confidence indicators (from minus 13.4 in January to minus 11.1 in October).However, the latest reading for October shows that consumer confidence has fallen again, mainly due to a deterioration in consumers’ propensity to buy (cbs.nl). At the same time, it also showed a renewed improvement in retailer confidence, which could bode well for the future of footwear imports. From January to August, monthly footwear imports ranged between 481 and 587 million euros, with the record month of July (587 million euros imported) preceding the increases in footwear sales in August and September.

“The Netherlands is an important country for the production of international brands and is home to the European or regional headquarters of household names such as PVH, Chanel, Nike and Just Brands”, notes a report by Fashion United. This, combined with the upward trend in confidence indicators and the expected increase in sales during the Christmas season, will surely boost footwear consumption once again.