Register to continue reading for free

Japan Retail: trade did not improve at the end of 2023, but a recovery is not out of the picture

As anticipated in the previous edition of the WF Retail Japan, trade (physical and online) did not improve at the end of 2023. What’s more, the country unexpectedly slipped into recession amid sluggish consumption and pressure on retail costs due to the weak yen. However, it’s expected that the easing of consumer inflation and the recovery of wages due to labour shortages could occur in the first half of 2024 and both consumer and retailer sentiment is on an upward trend. So perhaps a modest recovery could take place soon

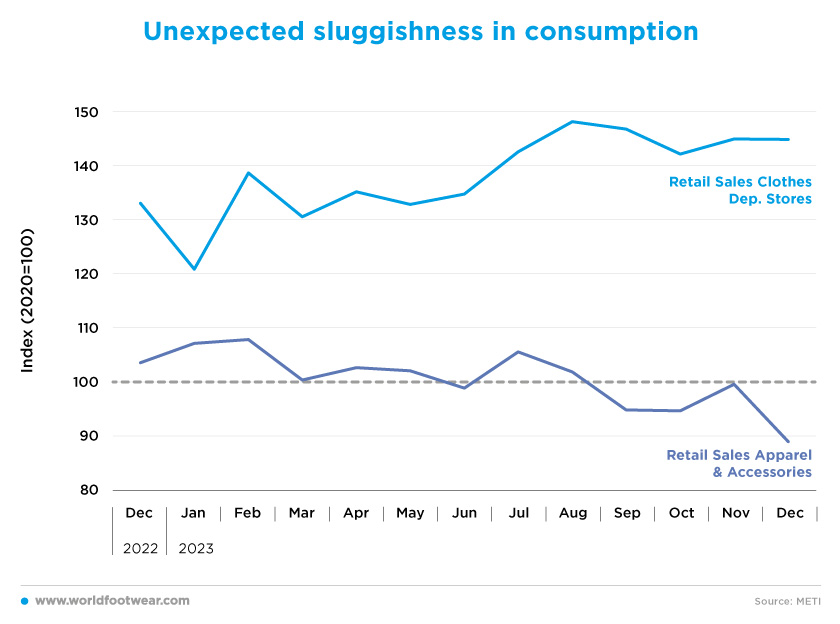

Unexpected sluggishness in consumption

The latest available data (seasonally adjusted, by the Japanese METI) on Clothes sales in department stores and Apparel & Accessories retail confirm the divergence between their trends in 2023. Clothing sales in department stores continue to grow, up by almost 12 percentage points year-on-year in November, driven by more affluent urban residents and the increasing number of foreign tourists ‘strong spending’ In contrast, the broader clothing category declined (down by 14 1/2 percentage points) over the same period.

“Demand from wealthy customers and inbound tourists grew in 2023, and is expected to keep growing in 2024”, said Tatsuya Yoshimoto, President of J. Front Retailing, the parent company of Daimaru Matsuzakaya department stores. The Department store operator Takashimaya expects its operating profit for the 12 months to the end of February to break records for the first time in 33 years, while Uniqlo’s parent company Fast Retailing saw its operating profit jump by 25% on the year for the September-November period. However, according to Nikkei analysts, price hikes by major Japanese retailers (including clothing) played a crucial role in such a nominal record (asia.nikkei.com).

On the contrary, the Apparel & Accessories retail index, which includes smaller retail channels, less affluent customers and less exposure to foreign consumers, reveals what has apparently gone unnoticed in Japan’s economic performance. After a 3.3% slump in the third quarter of the year, gross domestic product fell by an annualised 0.4% in the October-December period, meaning Japan slipped into a recession at the end of last year, (…) confounding market forecasts of a 1.4% increase. Such an unexpected performance prompted Yoshiki Shinke, a senior executive economist at Dai-ichi Life Research Institute to comment that the “sluggishness in consumption was particularly striking” (reuters.com).

Online sales seem not much better

Data for non-store retail trade (by METI), which is dominated by digital sales, followed an accelerating path, reaching a peak growth rate of almost 7% in October. After that, there was a marked slowdown and growth turned negative in December (minus 0.2%). This could be another sign of bad times ahead.

The fashion e-commerce market accounts for about 18% of the total e-commerce market in Japan, and it should be unique for the category not to share the general slowdown. And it is even less likely to do so given that growth in both clothing and department store retail was negative in three of the last four months of 2023, including December.

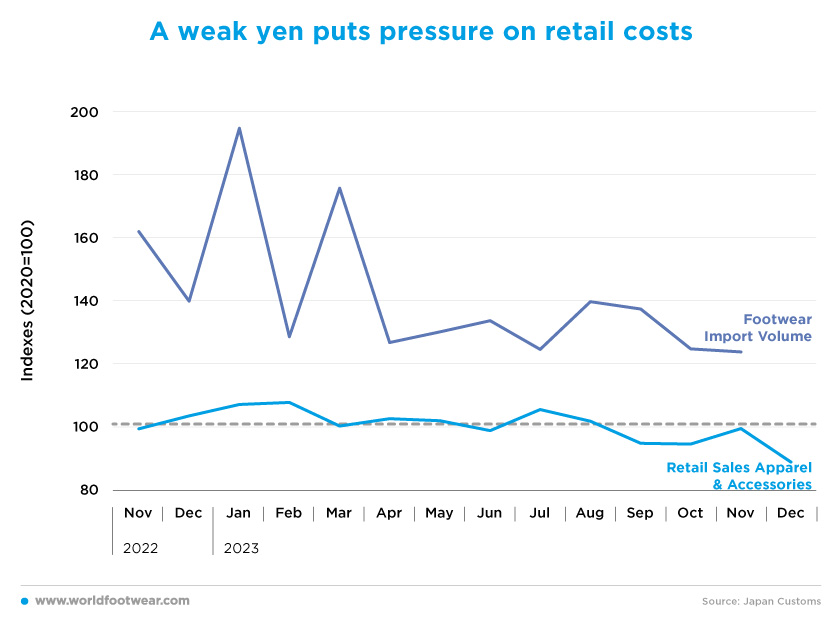

A weak yen puts pressure on retail costs

The value of sales of apparel (seasonally adjusted) was fairly flat from May to August and weakened from then until December. At the same time, the performance of the import volume data (especially for footwear) since April is also far from suggesting a stable recovery in retail trade, let alone anticipating its downward trend.

And it could hardly be the other way round, as a weaker yen against the major currencies due to the BOJ’s massive easing policy is “pushing up prices of imported goods and energy costs” (english.kyodonews.net), which (in December) rose at the fastest pace in three months (reuters.com).

Again, for a market that relies heavily on imports to feed its apparel and footwear retailers, turning a blind eye to input price inflation is far from wise.

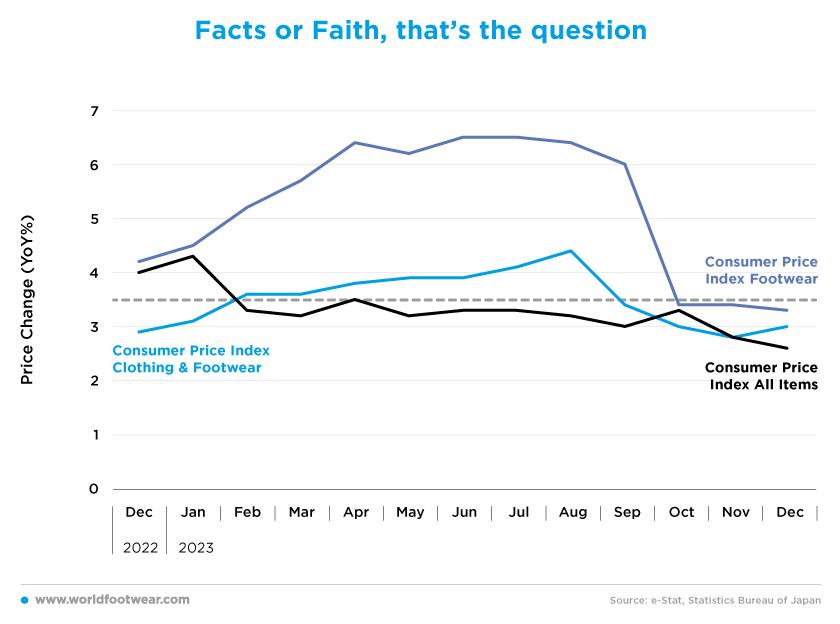

Facts or faith, that’s the question

However, instead of a rise in consumer prices for imported fashion categories, the Consumer Price indexes (by the Statistics Bureau of Japan) for August to December were forced down by a sharp correction of almost 1 ½ percentage points to 3% for clothing and footwear, and about 3 percentage points to 3.3% for footwear alone. But both figures are still above the general inflation rate of 2.6% in December, which may work against fashion retailers.

Although disinflation has slowed for almost 1 ½ percentage points year-on-year to 2.6% in December and despite the government’s efforts to encourage companies to raise wages, even with some progress on compensation price increases have continued to outstrip wage increases, putting pressure on household budgets; and “with pay significantly lagging inflation, the risk is consumers will baulk at paying up for goods and services — making companies more hesitant to raise prices,” said Bloomberg economist Taro Kimura (japantimes.co.jp).

That’s why Prime Minister Fumio Kishida has (once again) urged business leaders to raise wages above last year’s level in the spring labour negotiations to beat inflation. However, “the key is whether wage recovery will be sustained to support better consumer spending”, stated Takeshi Minami, chief economist at Norinchukin Research Institute.

Koya Miyamae, senior economist at SMBC Nikko Securities, believes that “there is a possibility that real wages will turn positive in the second half of the year”, as “consumer inflation will likely ease to around 2%” and “wage recovery is likely to accelerate on the back of factors such as the labour shortage” (reuters.com).

A Kyodo News survey conducted on major Japanese companies between late November and late December showed also that more than 70% of major Japanese companies expect the domestic economy to grow in 2024, believing that solid consumer and capital spending can overcome the impact of inflation (english.kyodonews.net).

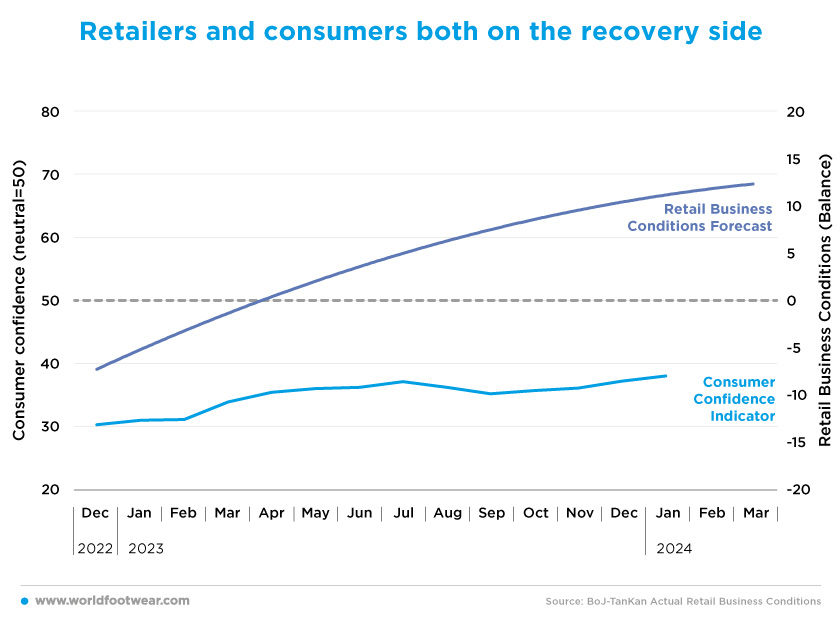

Retailers and consumers both on the recovery side

Negative economic growth in the last two quarters of 2023 means that Japan has technically entered a recession, with some analysts warning of another contraction in the first quarter of this year. This will make it harder for the Bank of Japan (BOJ) to start withdrawing its massive monetary stimulus soon, risking a return of the deflationary pressures that have plagued the economy for years (reuters.com).Nevertheless, consumer confidence (a survey by the Cabinet Office) has been on an upward trend, reaching 38 points in January, the highest score since December 2021, although still below the neutral cutting point (50 points). In addition, the quarterly TanKan Forecast Retail Business Conditions index (all enterprises, by BoJ) is also on a positive trajectory from June to March 2024.

The sustainable trajectory of the combined sentiment of both retailers and consumers seems to support the view that a modest recovery could take place in the first quarter of 2024, and fashion retail will follow.