Register to continue reading for free

Japan Retail: the picture is unclear for both consumers and retailers

Contrary to what was suggested in our previous flash, fashion retail sales have fallen sharply since April, by a total of 22.8%, while total retail sales have remained somewhat stable. In this context, the low footwear inflation in Japan, now close to 0%, tends to indicate a lack of demand. Perhaps the growth in consumer spending and tourism will help to turn the situation around, especially given the falling yen in September. However, for now, the future remains unclear for all

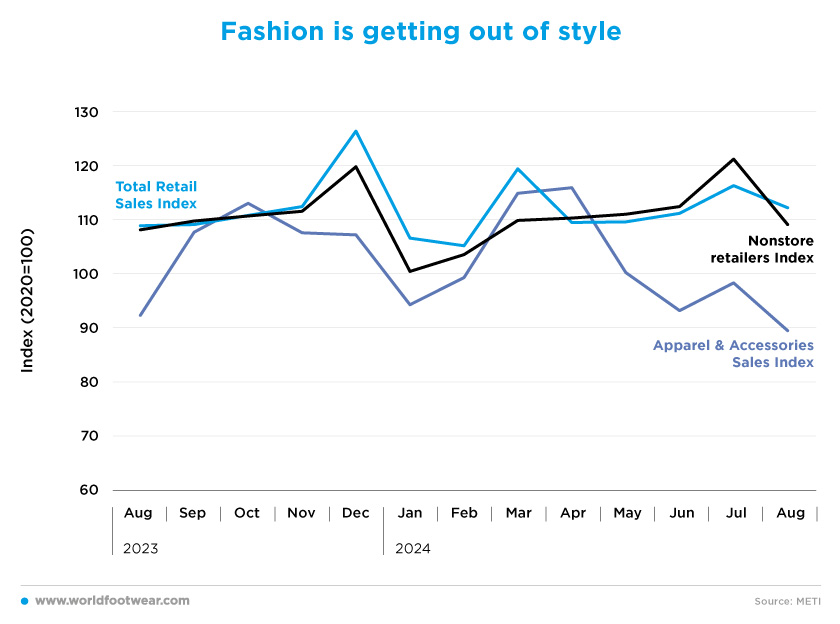

Fashion is getting out of style

The Japanese retail sector has remained stable in 2024, except for low retail sales in January and February. So far, retail sales in Japan are 2.8% higher than the same period last year, and online retail is following the same trend. In fact, “the Japanese online retail market is expected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% from 2023 to 2028. Increased adoption of mobile commerce and the growth in online grocery is driving the growth of online retail. Online retail is forecast to account for 21.9% of total retail sales in Japan by 2028” (globenewswire.com).However, looking at the fashion sector, it’s clear that it has been lagging behind. The year 2024 has shown some recovery, with retail sales up by 4.1% as compared to the first 8 months of last year, but the truth is that retail sales of clothing and accessories have plummeted since April, falling a total of 22.8%.

“Japan saw the highest number of bankruptcies since 2013 in the six months through September, as companies were increasingly hit by rising costs”, reports The Japan Times, partially reflecting the impact of higher prices. “Construction, manufacturing and retail were among the sectors that had the highest number of cost-driven bankruptcies, according to the report. (...) Looking ahead, another potential risk for companies is higher debt-servicing costs following the Bank of Japan’s interest rate hikes in March and July” (japantimes.co.jp).

Still, there are some positive signs on the horizon. Consumer spending is finally growing (up by 0.9% in the second quarter of 2024), after four straight quarters of contracting, according to the government data, and there are big expectations for tourism growth, with the “possibility that visitors to Japan will reach 35 million this year, exceeding levels before the Covid-19 pandemic, Bloomberg Intelligence analysts Angela HanLee and Rebecca Wang wrote in a report” (bloomberg.com).

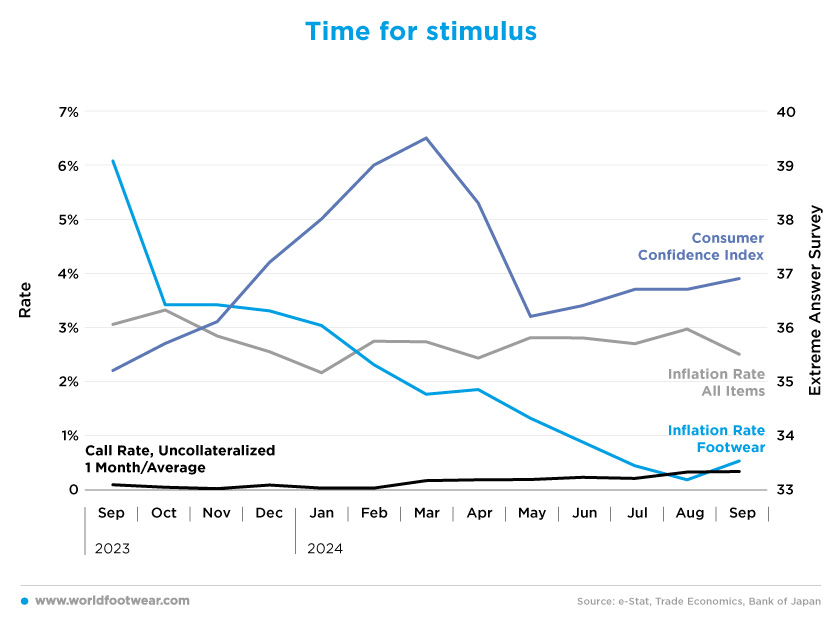

Time for stimulus

The Japanese economy has been known for its stability over the past few decades. However, Bank of Japan's (BOJ) decision to end negative interest rates in March changed the picture – in September, the central bank even raised interest rates for the 11th consecutive time to 0.328%. Therefore, after a huge slump in consumer confidence, the train has started moving again and consumer confidence is back on a growth track (up by 2% in the last 4 months).Both of those two economic indicators have their say on the outcome of inflation and it’s very clear that the BOJ’s decisions and the consumer sentiment are controlling it. The overall inflation rate of the Japanese economy has been quite stable between 2% and 3% for the last 11 months and recently showed a decline to 2.5% in September, as the Bank of Japan hopes to reach the 2% target next year.

“The pace of increase in consumer inflation likely eased due to lower prices of electricity and city gas, while those of some foods such as rice were higher”, pointed out Takeshi Minami, chief economist at Norinchukin Research Institute (reuters.com).

However, it is interesting to note that when we analyse inflation by product, footwear is one of the items that is pushing it down. Footwear inflation in Japan is now close to 0% and reached its lowest level in August (0.2%). This kind of price stability is good for consumers, but it tends to suggest a lack of demand, meaning that the reason for such small yearly increases in footwear prices may be related to the low levels of sales that retailers are recording.

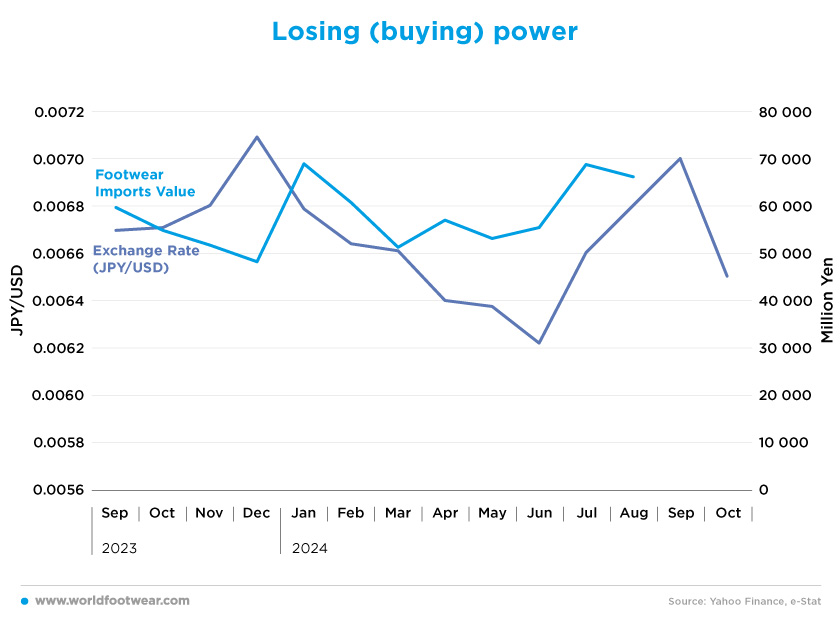

Losing (buying) power

The return of inflation to Japan, combined with a tumbling yen, which hit a 38-year low against the dollar in June after falling by 12% since December 2023, has pushed up the cost of imports and caused domestic consumption to stagnate.So, it is unsurprising that footwear imports have fallen by a total of 8 million pairs since the start of the year, albeit a 2.5% increase in value (up by 11.8 billion Yen), as compared to the same period in 2023. So far, in 2024, a total of 414 pairs of shoes have been imported into Japan, worth 480 billion yen, at an average price of 1161.58 yen/pair (7.55 USD).

Footwear importers are struggling to buy from outsiders as their currency continues to depreciate. The question is how long can they bear to sustain imports at this price with sales plummeting? With the yen falling again last month, we believe imports will have to absorb these costs and rise in value, which is when retailers have profits to buy new stock.

Japan’s political upheaval has only added to the yen’s woes by increasing the uncertainty about the country’s fiscal and monetary policy outlook. For example, the “business confidence at big Japanese manufacturers sank to a seven-month low in September”, a Reuters monthly poll showed. “The Reuters Tankan, which closely tracks the BOJ quarterly business survey, showed the sentiment index for manufacturers was at plus 4 in September, down sharply from August’s plus 10 and the lowest since February's minus 1” (reuters.com).

The picture is therefore unclear, so both consumers and businesses are expected to remain cautious in the upcoming months.