Register to continue reading for free

Japan Retail: slow but steady future for retail

After unexpectedly slipping into recession at the end of 2023, the Japanese economy appears to be back on track to grow 3.2% in 2024 (FMI forecast). Against this backdrop, fashion retail sales are outperforming the overall retail performance and, interestingly, footwear inflation is now below the 2% target for any economy. However, the picture is not so clear-cut. The weak yen could dampen any growth in imports and the country is still adjusting to a major change in monetary policy. Nevertheless, as predicted in our last Flash, it’s safe to say that a modest recovery has taken place in the sector

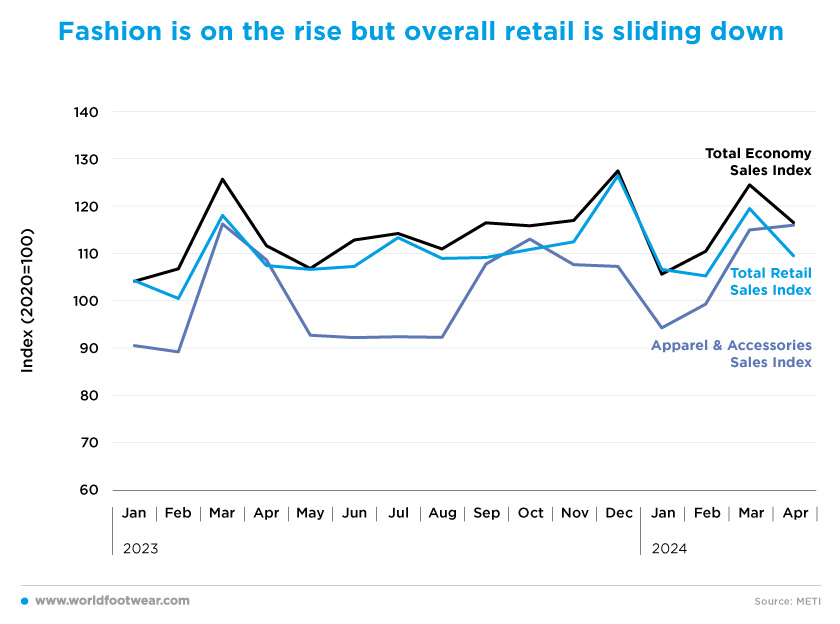

Fashion is on the rise but overall retail is sliding down

Since January, fashion sales (clothing, footwear and accessories) have been increasing month on month, reaching their highest level in the last 13 months in April (23% growth from January to April 2024). Several fashion giants seem to be backing this up with their earnings forecasts for 2024. For instance, Asics Corp raised its full-year operating profit forecast by 64% on rising demand for its practical running shoes in Japan and abroad” (bloomberg.com) and Uniqlo “raised its forecast for what would be its third consecutive year of record profits, buoyed by strong sales at home and some overseas markets taking advantage of the yen's slide to a 38-year low” (reuters.com)

In fact, throughout the year 2023, fashion sales underperformed the Japanese economy as a whole, particularly in the summer months, when the Apparel and Accessories Index was more than 16% lower than the Total Economy Sales Index. Thankfully this year’s picture seems to be different: “Japan’s household spending rose 0.5% in real terms in April from a year earlier, the first increase in 14 months” and “outlays on clothing and footwear climbed 11.3% driven by purchases for summer clothing, with April recording higher temperatures than usual” reported the Japanese news agency Kyodo News (wam.ae).

However, if we look specifically at the retail sector, the story is somewhat different. The truth is that the overall health of the Japanese retail sector appears to be in line with the overall economic sales. But shouldn’t the Retail Sales Index be booming compared to the Total Economy Sales Index? Well, both have their base levels in the pandemic year of 2020, when retail sales were hit harder than overall sales, so even though the indices are tracking each other, retail lost some ground that it hasn’t been able to make up.

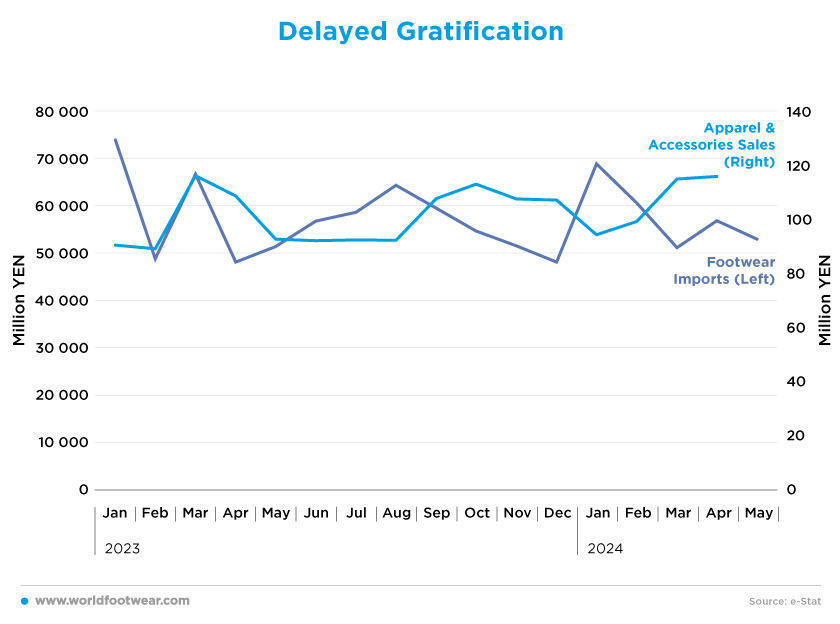

Delayed Gratification

Japan is seen as a fashion goods importer due to its trade balance of these types of goods, therefore, imports can be a good predictor of future footwear sales levels. This means that once imports start to rise, it is most likely just a case of delaying gratification for retailers, as sales are likely to rise in the months ahead. At least, that is the pattern observed over the last 12 months, where the covariance between one month’s imports and the next month’s sales was around 6%.In other analyses, however, the value of footwear imports since January 2024 fell from 69 billion Yen in January to 53 billion Yen in May 2024. The same thing happened last year, and total imports for both first quarters (2023 and 2024) were 237 billion Yen, but this time it has its own reason: the Yen has depreciated by more than 11% so far in 2024.

“A weaker yen is a plus for exporters”, said Ryotaro Tsuchiya, economist at Mizuho Securities. “On the other hand, given that import bills are also more inflated, it is difficult to find much of a positive, as Japan needs to pay more to foreign countries, which will increase costs for companies” (japantimes.co.jp). This factor alone is making things difficult for importers, who are seeing their purchasing power diminish from one day to the next.

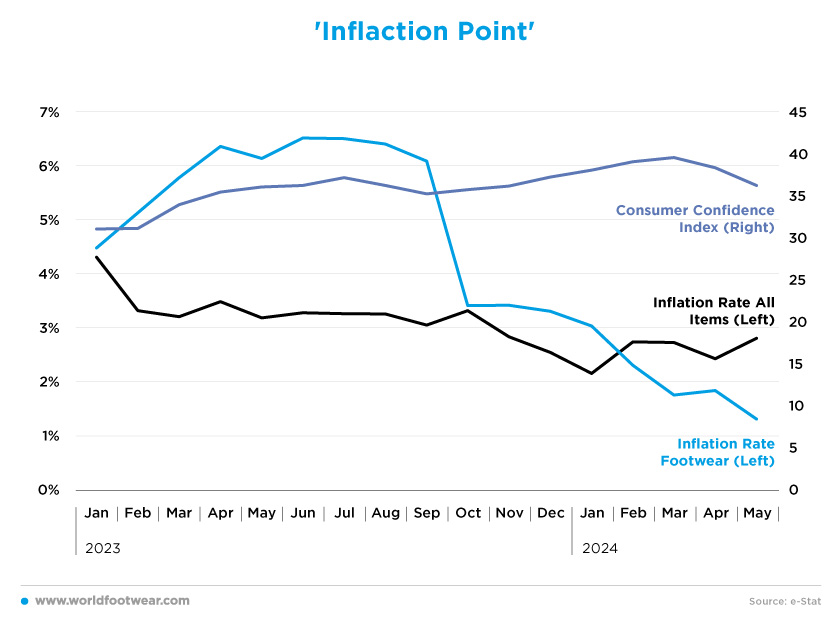

‘Inflaction Point’

As of February 2024, footwear inflation and All items inflation seem to have crossed paths and gone their separate ways. In the first nine months of 2023, footwear inflation was more than double as high as the Japanese economy’s overall inflation, reaching its all-time high in the summer months when it was around 6.5%. Since then, it has fallen drastically and as of February 2024 is officially lower than that of the economy.Even more impressive than the sharp disinflation in the footwear sector is the fact that it is now below the 2% target of any economy, helping consumers feel more confident about their footwear purchases by not seeing prices rise drastically.

Looking at the Japanese economy as a whole, inflation has proven to be a winner, as “core consumer prices in May rose by 2.5% from a year earlier, staying above the BOJ's target for more than two years” (japantimes.co.jp). The rising food prices are also weighing on consumer’s spending on other items.

“Rising prices, especially for daily necessities, have cooled consumer sentiment”, pointed out Hiroshi Miyazaki, a senior research fellow at Itochu Research Institute, with consumer confidence down by nearly 8% so far. “In terms of consumption trend going forward, I’m expecting rising wages and higher prices to push against each other”, he concluded (japantimes.co.jp).

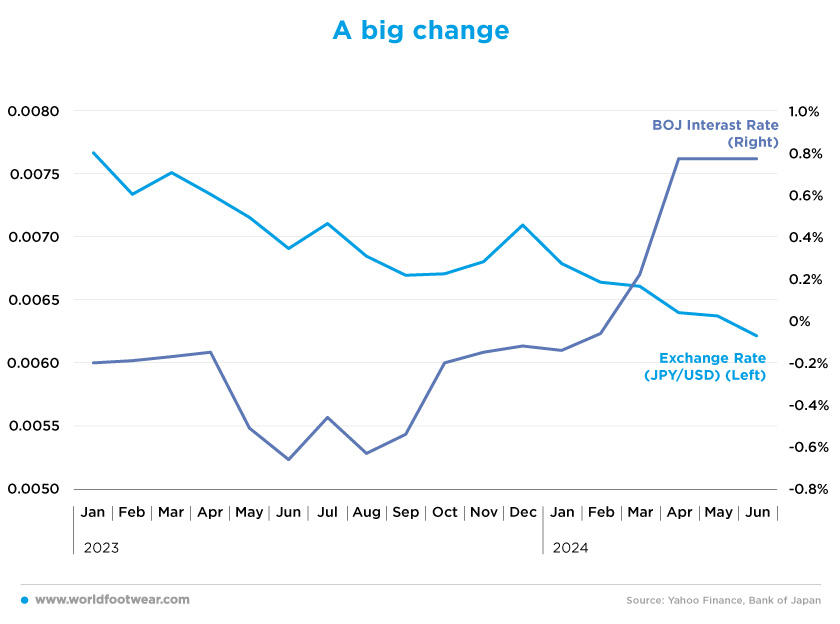

A big change

After more than 8 years (from January 2016 to March 2024), the Bank of Japan (BOJ) has officially introduced positive interest rates. Having failed to rid the Japanese economy of the so-called “sticky inflation”, the BOJ has been raising interest rates in an attempt to bring it down.The first interest rate above 0% came in March, when it was set at 0.22%, but the following month there was another big rise to 0.77%, where it remains today.

People were taken by surprise by this big move after such a long time with a completely different economic picture. The interest rate hikes and the recent downtrend in the value of the Yen (down by 10% in the last twelve months) have drastically affected the consumption of both families and companies, who now seem to be cutting back and re-evaluating their spending priorities as their purchasing power continues to erode.

What does all this mean for the footwear retail sector? At the moment, the picture is kind of blurry, with fashion sales rising, the cost of living also rising and the BOJ showing no signs of cutting interest rates, which means that consumers may eventually start to cut back more on their spending on non-essential items such as footwear. Meanwhile, the Japanese economy appears to be stabilising and on a path of modest growth. Imports and sales are indeed unlikely to soar anytime soon, but they are also unlikely to fall.

“Many economists expect the BOJ to move again later this year. They forecast an economic rebound in the quarter through June as auto output recovers and the wage hikes lift consumer sentiment. Many families will also receive one-off tax cuts starting in June” (japantimes.co.jp).

However, “if the yen continues to trade weakly, the bank will need to consider an early rate hike even as it decides on the pace of Japanese government bond purchase reductions,” said Yujiro Goto, head of foreign exchange strategy at Nomura Securities in Tokyo (japantimes.co.jp). But for now, the future looks slow but steady.