Register to continue reading for free

Japan Retail: retail prospects are again at stake

Hope for a return to normality in March, following the lift of the quasi-emergency restrictions imposed to control the Omicron-variant outbreak at the end of 2021, appears to be off the picture. The impact of Russia’s invasion of Ukraine on households and companies, which is prompting a hike in commodities and food prices, can no longer be discarded. Most likely, the footwear retail growth momentum of the final months of last year will not be accompanied by an increase in prices to avoid scaring away consumers, whose confidence suffered yet another blow in front of the international conjuncture

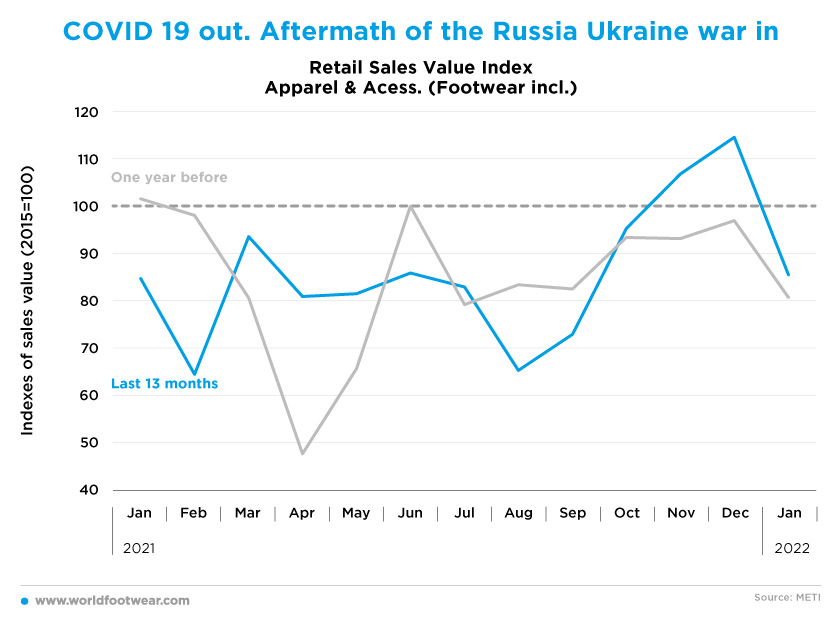

COVID-19 out. Aftermath of the Russia-Ukraine war in

According to the METI of Japan statistics, apparel and accessories (including footwear) retail sales closed the last two months of the last year 7 to 14 percentage points up the 2015 baseline, finally leaving the pandemic behind. It was, however, a short-lived relief.

Observing the full-year picture give us a different view. Considering department stores: “Department store sales in Japan rose moderately in 2021 from the previous year to some ¥4.4 trillion but stayed below (21%) the level seen before the outbreak of COVID-19, sources said Saturday. And customer levels have started falling again, amid the spread of the omicron coronavirus variant, casting a pall over sales in 2022” (japantimes.co.jp, January 2022).

In truth, sales plunged in January about 15 percentage points below the baseline, with the outbreak of the Omicron variant pushing daily cases to record levels in early February. And while Prime Minister Fumio Kishida announced in a news conference (reuters.com, March 2022) that “quasi-emergency restrictions would be lifted as of March 2021 and the country would slowly start returning to normal, since new infections had dropped substantially”, he also acknowledged the gravity of the impact of the Russia-Ukraine crisis on households and companies, saying that the COVID-19 pandemic fallout and the crisis serve as a 'double whammy' (mainichi.jp, March 2022).

Uniqlo sales in February seem to showcase the stated. According to fastretailing.com (March 2022), “same-store sales including online sales decreased by 14.0% year-on-year while total sales, including online sales, decreased by 11.4%. Same-store sales declined year-on-year in February as sales of newly launched Spring ranges struggled in the face of persistently cold weather throughout the month”.

Altogether, we venture to forecast that retail prospects are seriously at stake in Japan, again, for the near future.

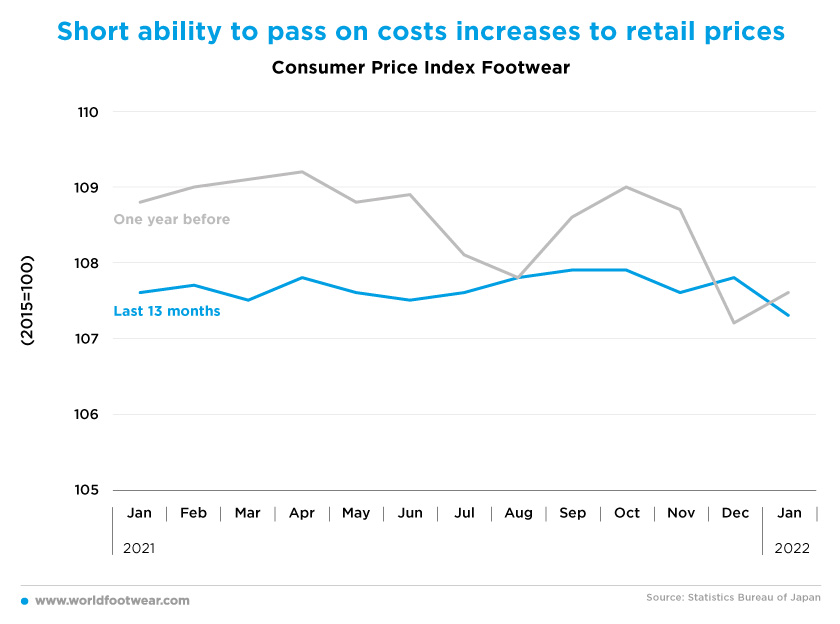

Short ability to pass-on costs increases to retail prices

Should footwear retail maintain the growth momentum of the final months of 2021, higher footwear prices would be expected shortly to reflect the increasing production and import costs brought in by the pandemic. But, as the economics professor at Tokyo’s University Tsutomu Watanabe recalled, “many companies will baulk at outright price increases, just as they did in 2008 during another commodities surge and in 2013-2014 when the yen weakened sharply, leaving shrinkflation as one of the few ways to protect margins” (japantimes.co.jp, January 2022).

In addition to the restrictions imposed to circumvent the highly infectious Omicron wave, retail might suffer from additional inflationary effects due to sharp rises in energy costs (and food prices) triggered by the Russian-Ukrainian crisis. According to Junko Nakagawa, board member of the Bank of Japan (BOJ), “such moves could weigh on Japan's economy if they hurt corporate profits and household income” (reuters.com, March 2022).

Hideo Kumano, an executive chief economist at the Dai-ichi Life Research Institute, explained that if the WTI (West Texas Intermediate crude oil price) averages 120 US dollars a barrel this year, a Japanese household with two or more people would have to pay 68 000 yen (590 US dollars) more a year for fuel, electricity, and gas, while the high wheat price would translate into a 2 000 yen increase a year in spending (mainichi.jp, March 2022).

Given the likely erosion of consumers’ disposable income from now onwards, following weak retail prospects, the footwear consumer price index, which in January was already 0,3 percentage points below the level of last year, is now expected to go further on the same path.

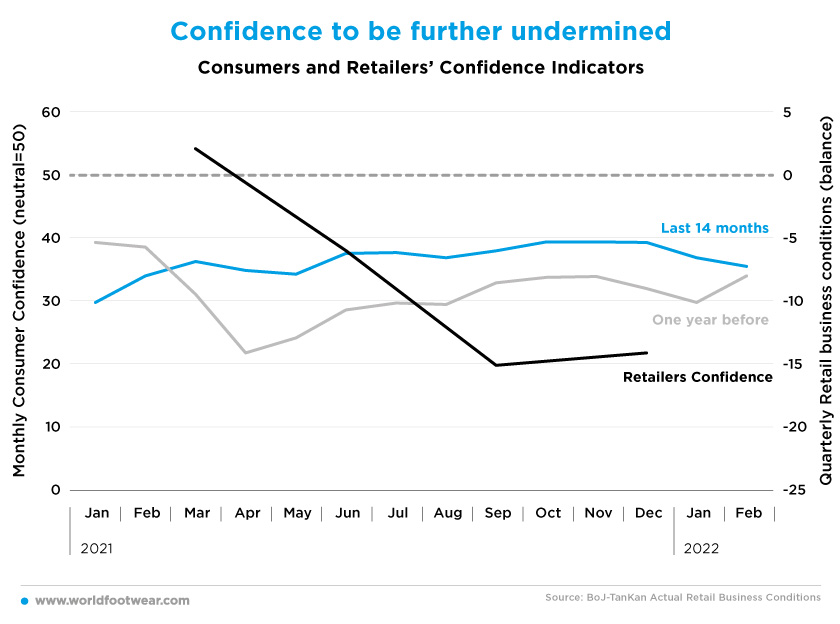

Confidence to be further undermined

In the first two months of the year, even before the breakout of the Ukrainian crisis, weak retail prospects seemed to be already well embedded in consumers’ confidence (Cabinet Office, Japan). On a comparable basis to the Top December level (the same as before the pandemic), consumers lost more than 5 confidence percentage points, closing February 16 percentage points down to the neutral mood.Now, “the greater impact of the Ukraine crisis will be felt in the months ahead given crude oil and commodity prices have been surging and more price hikes for food items are expected this year”, stated Toru Suehiro, a senior economist at Daiwa Securities Co. “Commodity inflation would cool sentiment among consumers, who would have to cut back on spending. The key is fiscal support", he defended (mainichi.jp, March 2022).

Equal pessimism is shown by the TanKan (overall) retail Business Conditions survey (BoJ) with net unfavourable quarterly scores since June 2021. After a standstill in the fourth quarter, improving prospects for the first quarter this year will be frustrated.

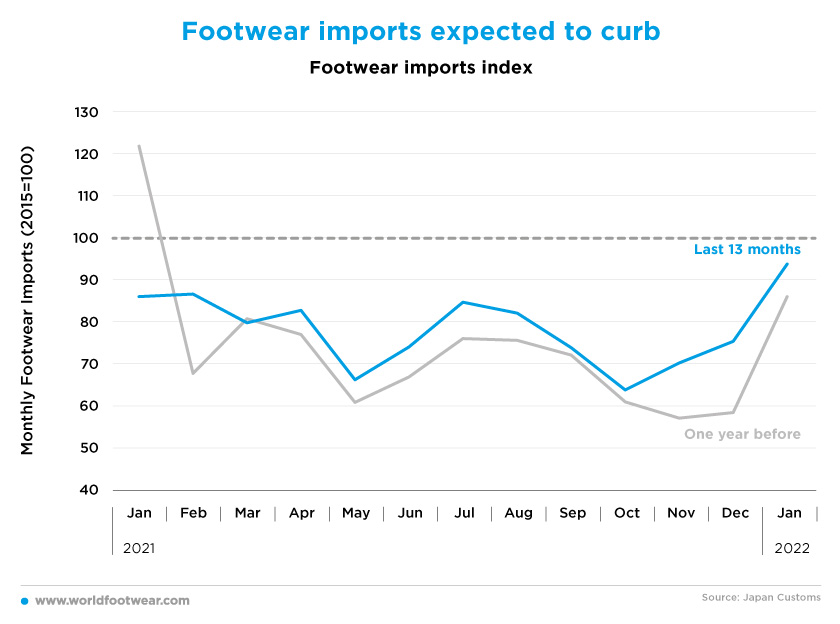

Footwear imports expected to curb

Following the usual seasonal upwards pattern, footwear imports have accelerated from October through January this year, but are still distant from two years ago (22 percentage points below).Nevertheless, with much slacker retail on the horizon, footwear imports will undoubtedly be curbed even as the Omicron shadow fades away.