Register to continue reading for free

Japan Retail: no concrete forecasts as the country adjusts to a new economic paradigm

While the online channel continues to stand out in a retail market that has seen a slight increase in spending since September 2024, the fashion sector has struggled the most, most likely due to the warm weather that has affected seasonal shopping. For footwear in particular, after a year of low prices, there’s reason to wonder if the picture of near-zero interest rates could hurt consumer behaviour, as their confidence wanes. The overall stability of imports, despite currency fluctuations, doesn't allow for a concrete forecast

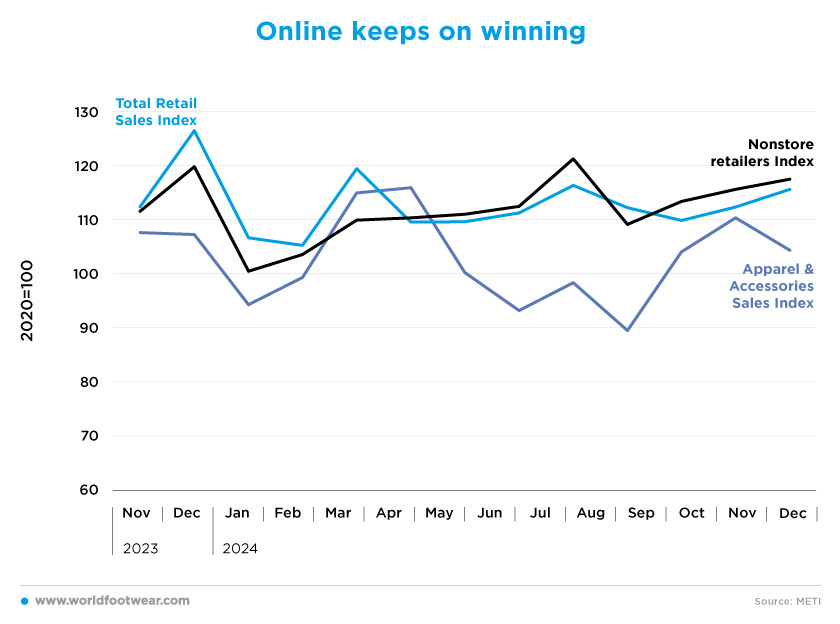

Online keeps on winning

Japanese consumers have shown their preference for online shopping over the past year. Since last year's April, online sales have outperformed retail sales (except in August, probably due to good weather that brought consumers out onto the streets). Still, compared to 2020, the year of massive e-commerce growth, both online and physical retail appear to be doing better. For most of the year, both types of sales were between 10% and 20% higher than in 2020.In particular, since September 2024, there seems to be an increase in spending every month. Japanese retail sales rose by 2.8% in November from a year earlier, government data showed on Friday. That was above the median market forecast for a 1.7% rise (reuters.com). Although December data is not yet available, it is reasonable to assume that the trend will continue with Christmas.

However, for footwear, clothing and accessories, 2024 was a rollercoaster. From April to August, fashion retailers saw a steady decline in sales (down by 23% in total over these 4 months). There was a slight upturn in September and October, but November saw another decline. Economists attributed the underlying weakness in consumption to rising prices and warm weather, discouraging consumers from buying seasonal clothing (reuters.com). In this context, Uniqlo Japan is a good example of a company that has tried to adapt its patterns to this weather volatility (fastretailing.com)

Therefore, even though online and total retail sales are doing better than last year, fashion seems to be the only sector struggling. Although official retail sales figures are not yet available, according to a Reuters poll of 16 economists, spending is likely to have risen by 0.2% year-on-year in December, following a 0.4% slump in November. That would be the first increase since last July, when it rose by 0.1% (reuters.com).

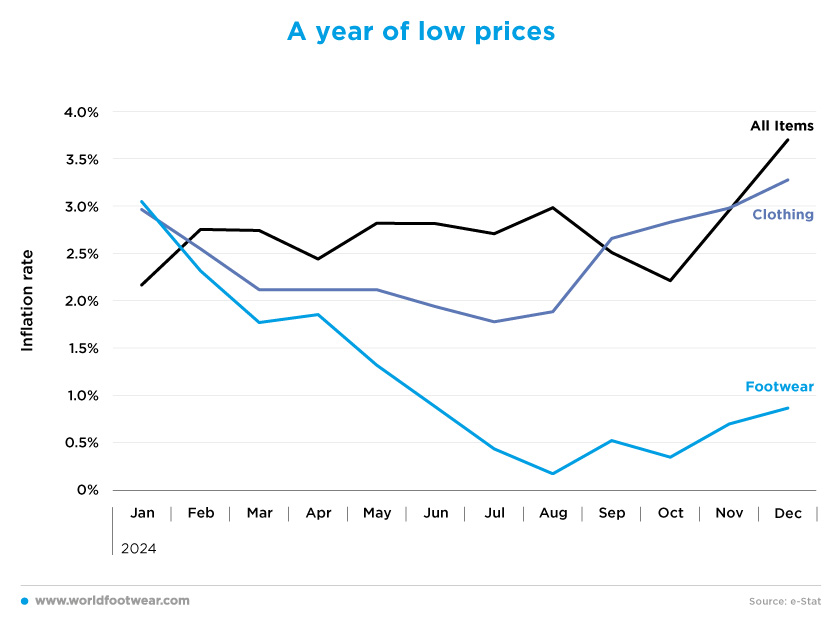

A year of low prices

Japan is experiencing a surge in inflation that it hasn’t seen for years. Throughout the year, the Japanese economy has shown inflation above the 2% target, and after a good fall to 2.2% in October, it seems to be on the rise again, reaching 3.7% in December, the highest inflation since January 2023. The clothing sector has followed a similar trend, but with better behaviour, going below target in the summer months (June, July, and August, over 1.9%), but is now rising again (3.3% inflation rate in December).On the other hand, prices for footwear have been very stagnant. In the first 8 months of the year, footwear inflation slowed from 3% to 0.2%. After this price stagnation, a new upward trend seems to have started, but a slow one. The footwear sector ended the year with an inflation rate of 0.9% in December; although small price changes can reassure consumers, the stagnation of these prices may indicate a lack of activity in sales. In 2023, footwear prices reached a value of 6.5% inflation, this comparison makes 2024 a year of low prices.

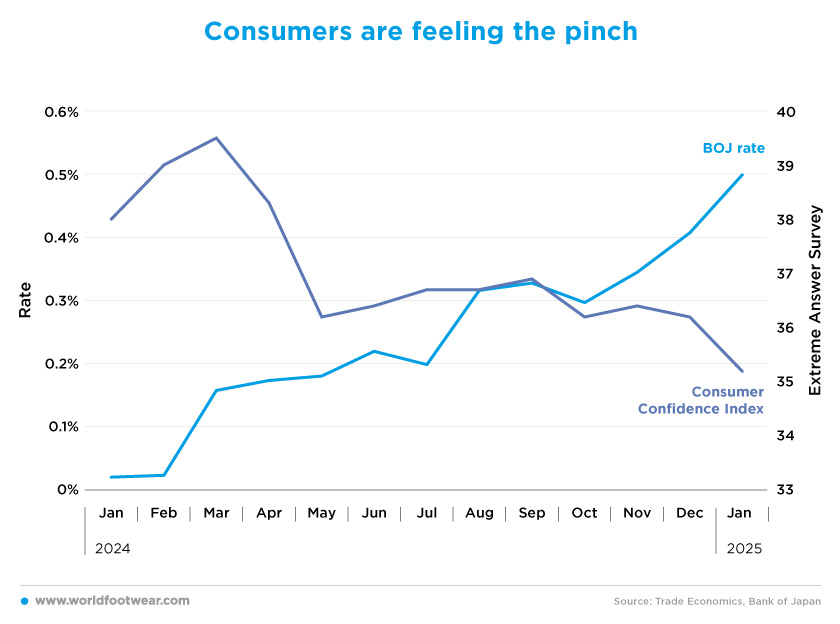

Consumers are feeling the pinch

In recent years, the Bank of Japan (BoJ) has been known for its near-zero interest rates, but this picture has completely vanished. If in January 2024, the BoJ rate was sitting at 0.02%, a year after and following consecutive increases is now at 0.5%, the highest in 17 years (since the 2008 financial crisis). This increase is mainly due to the fight against inflation, which has been on the rise in recent months.However, as a result, consumers are feeling uncomfortable and less confident about the future. Consumer confidence is estimated at 35.2, approximately 11% lower than in March 2024. This fall in consumer confidence can be attributed to the rise in the cost of borrowing, which makes it more difficult to spend and more expensive to borrow. With both lending rates and inflation on the rise, the propensity to spend will continue to fall, making life more difficult for consumers.

Still, according to Reuters, consumption and wage trends are key factors the BOJ is closely monitoring to gauge economic strength and determine the need for an additional rate hike.

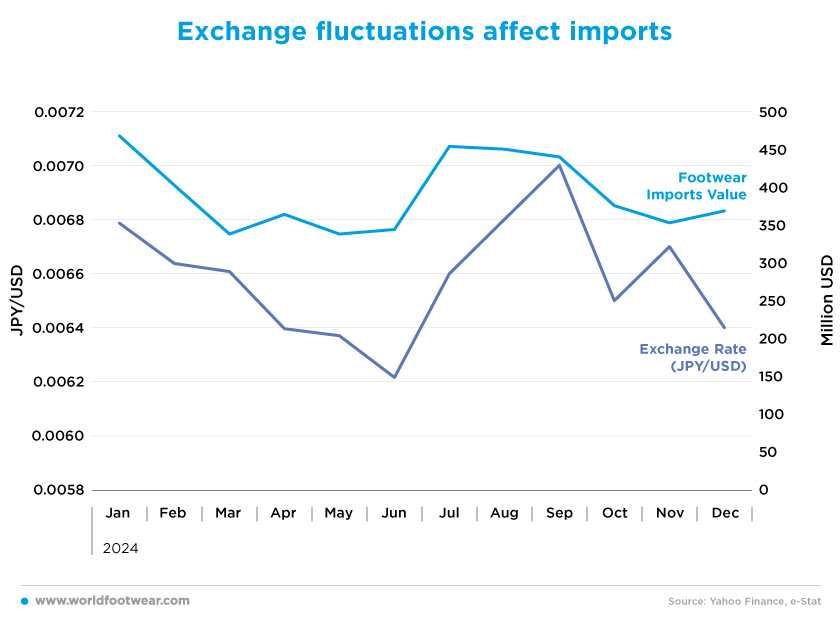

Exchange fluctuations affect imports

Footwear imports totalled 4.7 billion US dollars in 2024, a decrease of 3.8% as compared to the previous year. However, if we look at the number of pairs of shoes imported this year, we see an increase of 3.7% (in 2024, Japan imported 612 million pairs of shoes). The decrease in value is mainly due to the depreciation of the Japanese yen, which lost 8% of its value against the dollar in the first six months of 2024.While importers still manage to import a total of 391 million US dollars in footwear per month on average (compared to 407 million US dollars in 2023), even in the face of an average annual currency depreciation of 7.2%, the monthly changes in their purchasing power makes it difficult to maintain a good level. Perhaps BoJ’s interest rate increases will turn the situation around.