Register to continue reading for free

How consumers value different features of footwear

In the third edition of the Business Conditions Survey we have questioned our Panel Members on their views regarding how consumers would react to a number of potentially desirable features of footwear. Find out the answers

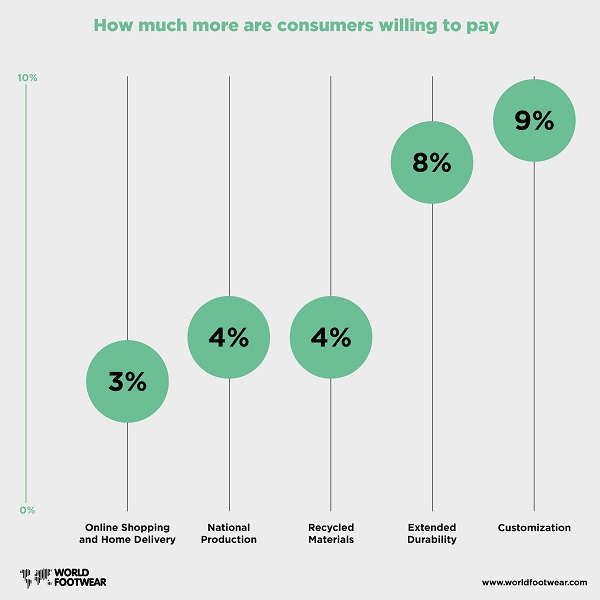

We have shortlisted a number of potentially desirable features of footwear: national production, customization, incorporation of recycled materials, extended durability, and online shopping and home delivery and have asked our Panel of Experts their views regarding the consumers reaction to each of them, and how much more they expected consumers to pay for each of them.

Our panel agrees that consumers view all of these as desirable. However, there are only two features – customization and extended durability – that the majority of the panel believes consumers are willing to pay for. Almost a third of the panel thinks consumers are willing to pay upwards of 10% more for footwear with each of these features.

The most common answer regarding the other features is that consumers care about them but are not willing to pay higher prices to have them.

On average, according to our panel, consumers are willing to pay 3% more for online shopping and home delivery, 4% more for shoes of national production or whose production includes recycled materials, 8% more for shoes with extended durability and up to 9% more for customized shoes.

About the Business Conditions Survey

In 2019 the World Footwear has created the World Footwear' experts panel and is now conducting a Business Conditions Survey every semester. The objective of the World Footwear Experts Panel Survey is to collect information regarding the current business conditions within the worldwide footwear markets and then to redistribute such information in a way it will provide an accurate overview of the situation of the global footwear industry.The third edition of this online survey was conducted during the month of October 2020. We have obtained 122 valid answers, 56% coming from Europe, 25% from Asia, 9% and 8% from South and North America, respectively, and the remainder from other continents. Almost one third (31%) of the respondents are involved in footwear manufacturing (manufacturers), 21% in footwear trade and distribution (traders) and 48% in other footwear-related activities such as trade associations, consultancy, journalism, etc. (others).

Cover Image credits: Matthew Lancaster on Unsplash