Register to continue reading for free

Germany Retail: The shoes must go on! But COVID-19 is still not off the stage

One of the key footwear players took a massive hit with the dissemination of the pandemic inside its borders. During the first COVID-19 wave, footwear retail almost collapsed in Germany, but the recovery was faster than what was initially expected, and September was marked by optimism. However, a partial lockdown in the Autumn and not very good perspectives for Christmas are anticipating bad news for Germanic retailers, once again, and even before a full recovery has been achieved

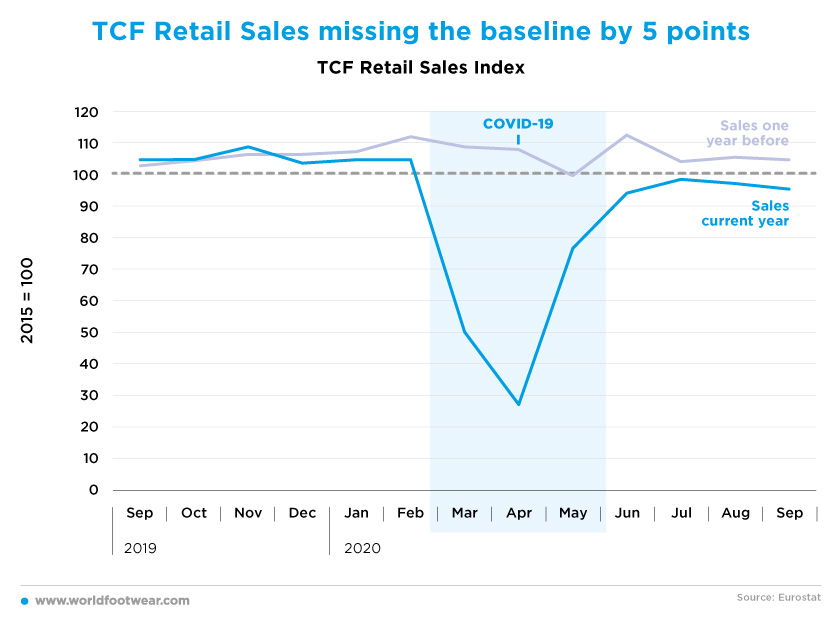

TCF Retail Sales missing the baseline by 5 points

After the sharp “descent into hell” in April and May (75 points under the baseline), Textile, Clothing and Footwear (TCF) retail sales in specialized stores were quick to resurface and by July they were once again touching the baseline. Shortly thereafter figures began dragging their feet, and September’s indicator closed at 95 1/2 points, marking the second consecutive month going down.

This image can be perhaps too dependent on a retail mode which has been hurt the most by COVID-19. On the 3rd quarter broader, data from the Federal Statistical Office puts retail already on the upside - yet in a downward slope.

The plot in Germany’s retail post COVID-19 was not very distinct from other countries, as the sanitary emergency demanded restrictive measures to the movement of people, impacting businesses. “The worldwide closing of the stationary sale outlets of specialized retail trade caused sales of the industry to collapse in the first half of 2020”, said Manfred Junkert, Managing Director of the Federal Association of the German Footwear and Leather Goods Industry.

If some recovery was seen after the slowdown of the first wave, the partial lockdown and the restrictions imposed on the 2nd of November are likely to hurt TCF retail more. Germany’s restaurants, bars, entertainment venues and gyms have been closed over November, while schools, factories and stores remain open with social distancing conditions.

If some recovery was seen after the slowdown of the first wave, the partial lockdown and the restrictions imposed on the 2nd of November are likely to hurt TCF retail more. Germany’s restaurants, bars, entertainment venues and gyms have been closed over November, while schools, factories and stores remain open with social distancing conditions.

Ara Shoes is just one of the companies already announcing measures to deal with the impacts of the pandemic crisis, as they announced they will accelerate the restructuring process started earlier in the year, which will include a workforce reduction at the Langenfeld site in “order to compensate for the loss of sales and the negative forecast for the next two years”.

Recently released data from the labour market indicates that employment in the country fell (further) in November, which added to a gloomy consumer sentiment, as assessed by survey released by the GfK institute, will impact the household spending. Not very good news for footwear retailers just a few weeks ahead of Christmas, as high street retailers of non-essential goods will be more impacted, and the shift consumer habits are expected to continue.

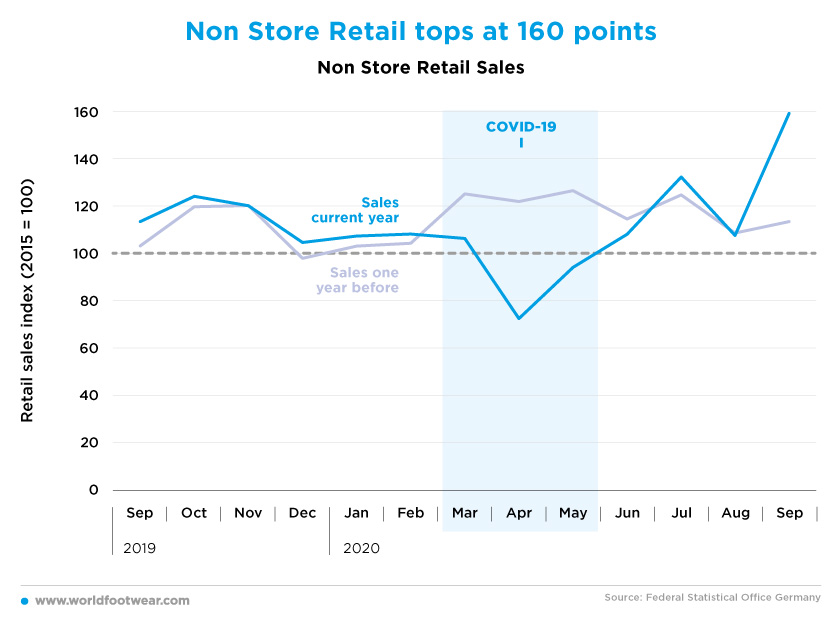

Non Store Retail tops at 160 points

In fact, non store retail (as a proxy of online retail where TCF is a big player) bet records in July and again in September (60 points above the line).

E-commerce has been a bubble of fresh air for many, especially for those who were already working the online channel. Gabor, for example, was quick to respond and in September the brand had “500 000 pairs in stock for autumn/winter season to enable retailers to reorder at short notice”. Orders were possible to be made continuously through the B2B online shop and over the phone.

E-commerce has been a bubble of fresh air for many, especially for those who were already working the online channel. Gabor, for example, was quick to respond and in September the brand had “500 000 pairs in stock for autumn/winter season to enable retailers to reorder at short notice”. Orders were possible to be made continuously through the B2B online shop and over the phone.

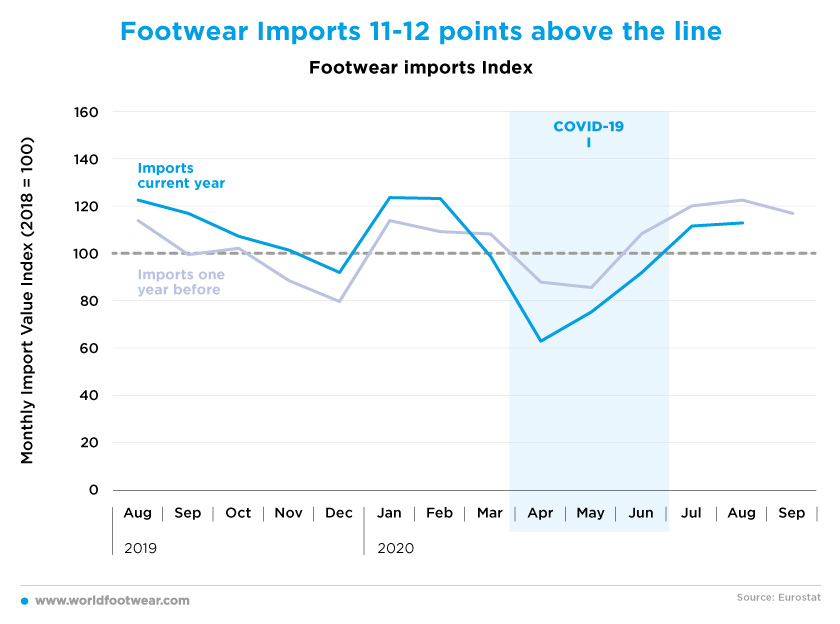

Footwear Imports 11-12 points above the line

After a collapse in the 2nd quarter, footwear import numbers in July and August also confirmed a clear positive mood (11-12 points on the upside), while not so bright as one year before.

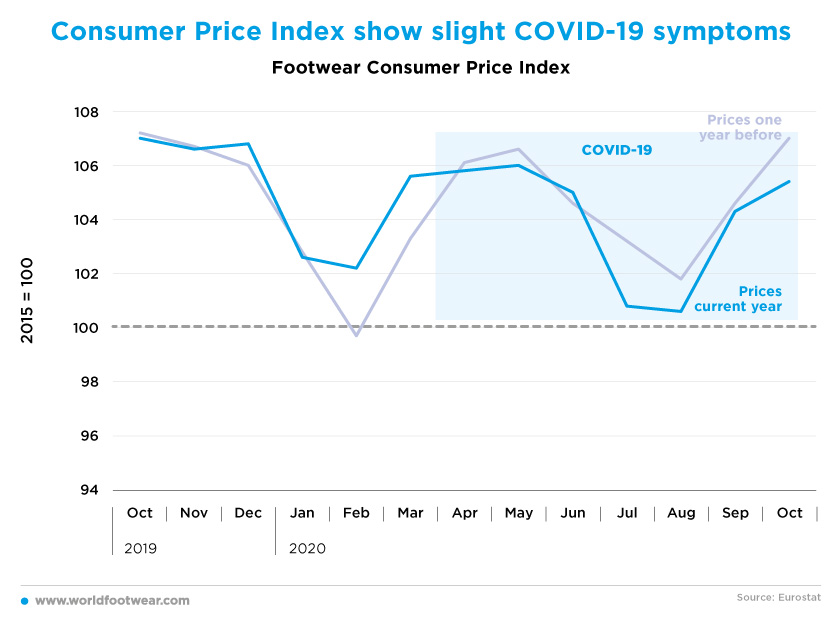

Consumer Price Index show slight COVID-19 symptoms

The Footwear Consumer Price Index is a poor predictor of the fate of footwear retail as it substantially continues to follow its annual cyclical pattern. Anyway, the negative COVID-19 impact on demand slightly reinforced price cuts in July and August, and smoothed upward price pressures subsequently. It will be no surprise if the next price downcycle is more pronounced in the turn of the year.

Saying this, the ANWR Group, which is estimating orders for the next spring/summer season to be around 30% below the average volume, has recommended its members to prepare better than ever: “At best, every retailer should take a close look at each shoe in the store and consider whether it can still be sold in the coming spring or summer”, advised Tobias Eichmeier, Managing Director of ANWR. The shoe retailing cooperative believes this can avoid massive end-of-season clearance discounts.

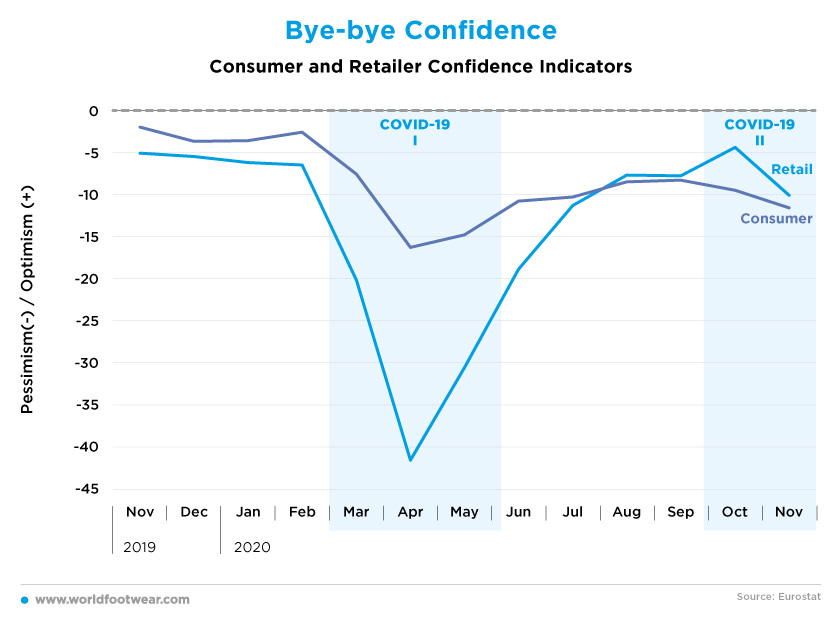

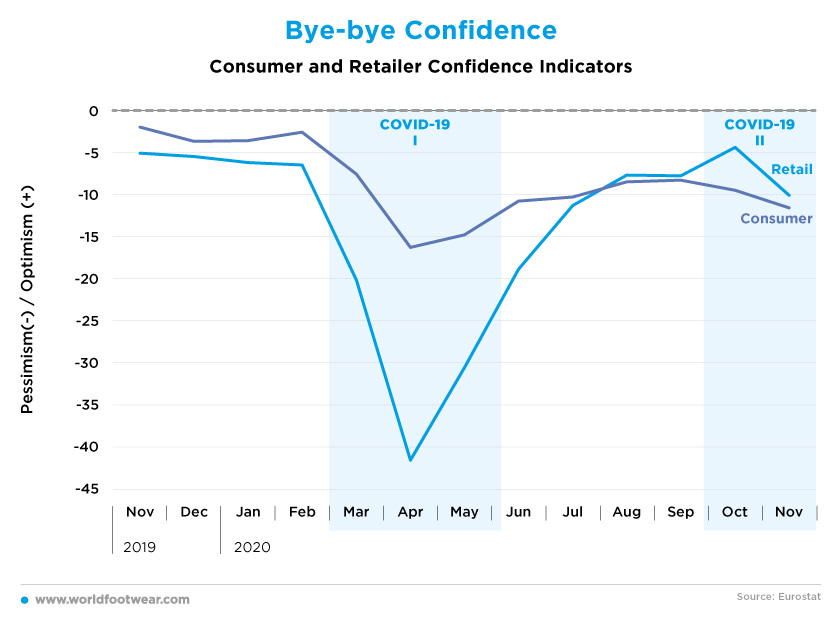

Bye-bye Confidence

One fact can be taken for granted: the German consumer confidence indicator stopped improving in October and aggravated even more in November. And those are not good news for retailers, which immediately refrained their illusions from the previous month. So, perhaps it will be difficult for the footwear “violins” to play it again.

In fact, according to a survey of 550 companies led by the German Retail Association (HDE), around 52% of companies expects significant losses in sales and customers after the extension of the country’s partial lockdown into December. The same survey found that 62% of retailers surveyed are pessimistic about the further course of Christmas business. “The prospects for Christmas business in this coronavirus year are worryingly poor, especially for many inner-city retailers and especially the fashion houses. November and December are normally the strongest months of the year in terms of sales for many retailers. If these sales are now lost, many businesses will be in trouble”, stated HDE Managing Director Stefan Genth. The survey also found that 38% of the retail companies overall and 45% of inner-city retailers see their existence threatened.

In fact, according to a survey of 550 companies led by the German Retail Association (HDE), around 52% of companies expects significant losses in sales and customers after the extension of the country’s partial lockdown into December. The same survey found that 62% of retailers surveyed are pessimistic about the further course of Christmas business. “The prospects for Christmas business in this coronavirus year are worryingly poor, especially for many inner-city retailers and especially the fashion houses. November and December are normally the strongest months of the year in terms of sales for many retailers. If these sales are now lost, many businesses will be in trouble”, stated HDE Managing Director Stefan Genth. The survey also found that 38% of the retail companies overall and 45% of inner-city retailers see their existence threatened.