Register to continue reading for free

Germany Retail: positive signs on the horizon, but it’s not yet time to pop the champagne

Good news keep coming, but no one is out of the woods yet. Footwear retail sales outperformed overall retail sales in January and February, although they remain lower than the same period last year. Consumer sentiment remains negative but is improving, driven by lower inflation rates and wage growth, and retailer sentiment, although more negative, is following the trend. With recent news of a better economic outlook for the year and a rise in the value of imports at the start of the year, there is a chance that consumers will pull retailers up. Let’s see how the coming months unfold

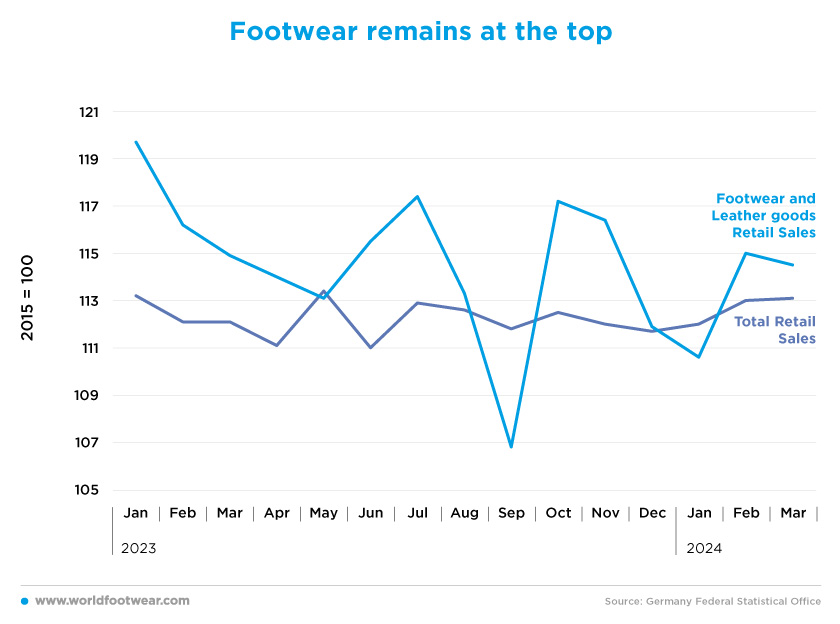

Footwear remains at the top

After starting the year slightly behind total retail sales, the footwear and leather retail sales index (by the German Federal Statistical Office) is back on top for the second month in a row. Some companies have reported good readings from the first quarter of 2024. For example, the “Munich-based retailer Ludwig Beck increased its sales in the first quarter of the current fiscal year and improved its operating result (…). According to the companies’ report, gross sales in the period from January to March totalled 18.7 million euros, almost 6% up on the same quarter last year” (fashionunited.de).Deichmann, the family-owned footwear retailer based in Essen, is also experiencing significant growth in its home market. “Gross revenue in Germany increased by around 9% to just under 2.8 billion euros (2.3 billion euros net/ 2022: 2.5 billion euros gross) in 2023. Like-for-like growth was almost 9%. Since the company is increasingly focusing on strong top brands to complement its popular own brands, these positive results reflect the higher-priced models in the range, on the one hand, and growth in the number of pairs of shoes sold, on the other. The group sold over 70 million pairs of shoes in around 1,400 stores across Germany as well as online, which represents an increase of almost 3% compared to the previous year” (corpsite.deichmann.com)

The reality is that footwear retail sales in the first quarter of 2024 were below what the sector saw last year, with February being the best month of the quarter. “The market experts at IFH Cologne and BBE Handelsberatung are expecting steady, slow growth for the footwear market until 2028 (…). Despite the growth in the market volume of shoe retail, private consumer spending is declining (…). According to projections from April 2024, the pre-crisis level of 9.9 billion euros in 2019 will not be reached again until 2025.”

Is the online era finally doomed?

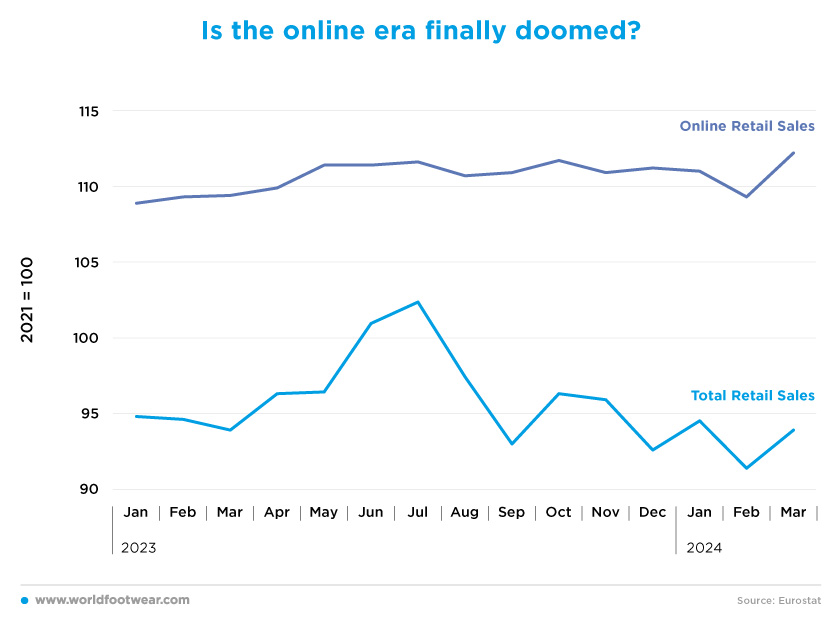

Online sales in Germany fell throughout 2023, following a decline in 2022, with footwear among the segments that took the brunt of the downturn. A survey by the Federal Association of E-commerce and Mail Order Trade (BEVH) shows that although total online sales fell moderately in the first quarter of the year, dropping by 2.6% to 18.883 billion euros from 19.383 billion euros in the first quarter of 2023, online clothing sales dropped by 1.2% to 3.286 billion euros in the first quarter of 2024 from 3.327 billion euros in the same period last year and online footwear retail revenue increased by 1.1% to 860 million euros from 851 million euros.

Looking at the 2021 baseline, online sales are below the levels seen at that point, but retail sales are ridding another wave. The latest reading on both indexes (by Eurostat) shows that in March 2021 retail sales were 12% above the baseline, while online was 6% below, a trend we have seen since the middle of 2023. The question now is how long retailers can continue to ride this wave.

On the German e-commerce scene, marketplaces such as Temu and Shein accounted for more than half of total online sales. Marketplaces are gaining more market share as consumers rely more on their smartphones to make purchases, according to a survey by the German Trade Association HDE. Online sales in the fashion and accessories sector accounted for 41.8% of total sales in 2023, down from 42.9% in 2022 (shoeintelligence.com).

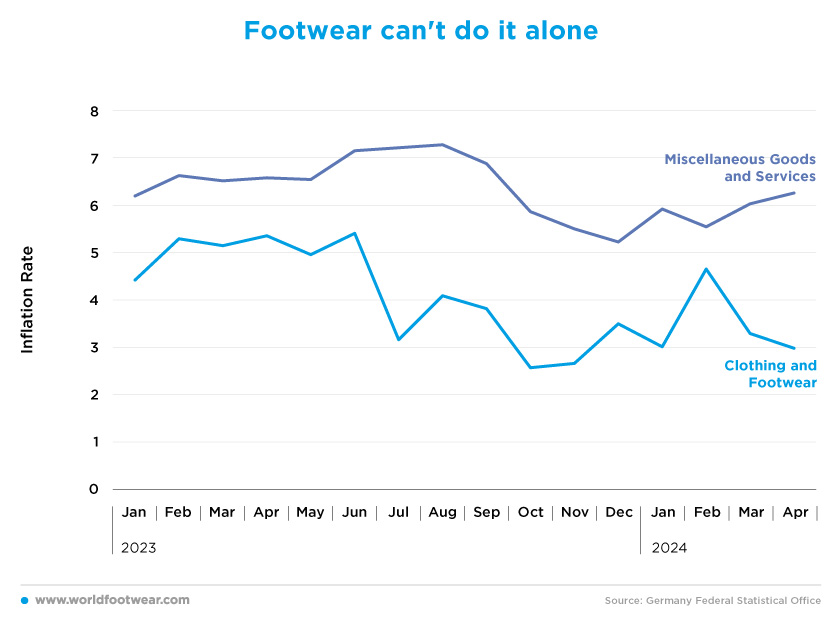

Footwear can’t do it alone

The lower rate in the Clothing and Footwear inflation rate (calculated using Eurostat’s HICP) than in the German economy as a whole has been a staple of the last two years. While both have been on a downward trend – after a little convergence in February 2024, when the C&F was at 4.7% and Germany’s economy was at 5.5% ¬–, things have changed with the Clothing and Footwear sector below 3%, less than half the rate of the other sectors, which is back on the rise to 6.3% in April 2024. The trend suggests that the 2% target for clothing and footwear may be close.

The German Council of Economic Experts predicts that “inflation in Germany is likely to be at 2.4% this year, falling to 2.1% in 2025. Inflation was at 5.9% last year, hitting private consumption. Core inflation is expected to be 3.0% in 2024, falling to 2.4% in 2025.” (reuters.com). Although clothing and footwear items are a big part of consumer spending, the reality is that the sector can’t bring back inflation alone. It’s time for other sectors to lend a hand.

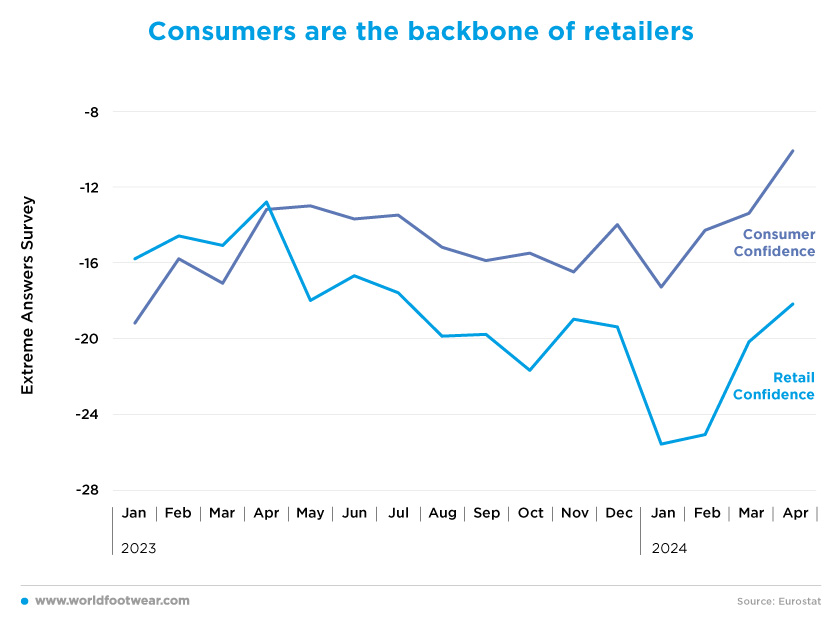

Consumers are the backbone of retailers

German consumer sentiment improved for the fourth month in a row as the outlook for Europe’s largest economy brightened somewhat and income expectations rose.In the first quarter of 2024, the consumer sentiment index rose by 7.2 points, from minus 17.3 to minus 10.1 points between January and April, exceeding the expectations of most analysts. The truth is that even though consumers are beginning to see a brighter future for Europe’s biggest economy and income expectations are rising, making them more confident, there are still more pessimists than optimists, as the indicator remains below zero.

“Falling inflation rates combined with respectable wage and salary increases are boosting consumers’ purchasing power”, said Rolf Buerkl, consumption expert at the Nuremberg Institute for Market Decisions (NIM). “Nevertheless, there still seems to be uncertainty among German consumers”, he added, commenting that they still lack the clear economic prospects needed to invest in larger purchases (reuters.com).

After crossing paths in April 2023, Retail confidence has been below consumer confidence with a more pronounced difference at the beginning of this year, in January, when consumer confidence was at minus 17.3 and retail confidence was at minus 25.6. After that critical point, both sentiments are back on an upward trend, rising side by side.

Taking this into account and looking ahead, the economy should gain further momentum, as strong wage growth fuels a cautious recovery in private consumption and even the inventory cycle should gradually start to turn positive, argued Carsten Brzeski, global head of macro at ING.

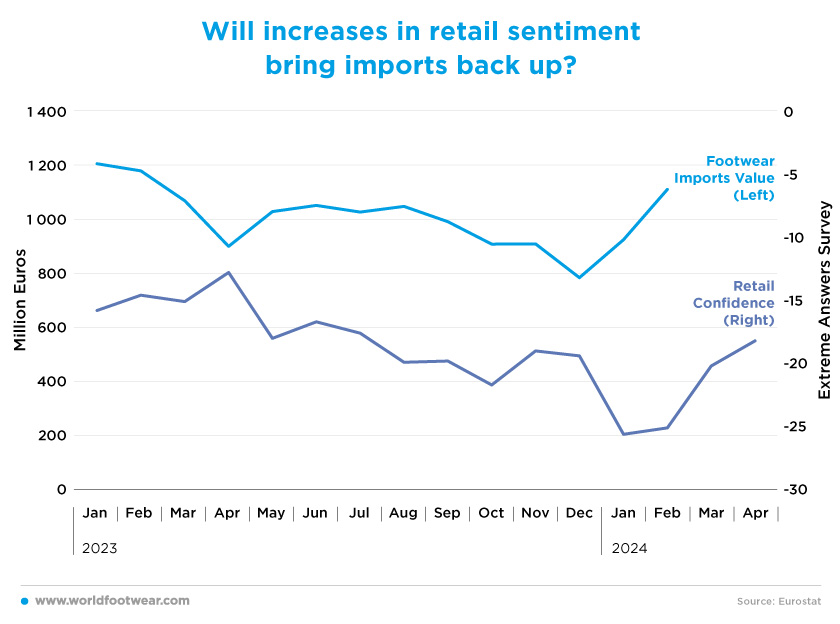

Will increases in retail sentiment bring imports back up?

After the decreasing trend in both the value of footwear imports and Retail Confidence (data by Eurostat) in 2023, with imports reaching their lowest value of the last 14 months in December 2023 (783 million euro) and retail confidence doing the same in January 2024 (-25.6), the way retailers view their near future finally seems to be improving and driving imports back up.In January and February 2024, the value of footwear imports rose by 18% and 20%, respectively, a logical consequence of the improvement in retail confidence. Although the March and April export data is not yet available, the correlation with consumer sentiment suggests that the first quarter of 2024 will show a good rebound from last year.

In May, the German Council of Economic Experts released its forecasts for economic growth this year. Having started the year with the prospect of stagnation, the Council now expects GDP to grow by 0.2% this year. For 2025, the same report predicts growth of 0.9%. The German economy is expected to gain some momentum over the year, with inflation expected to fall and nominal wages forecast to rise.

Thanks to that, “politicians, companies and consumers are all positive about developments in the coming months”. Nevertheless, “consumers remain somewhat sceptical”, as “they continue to rely on financial security through savings, which means that consumer sentiment is rising only slowly”. However, it can still boost consumption somewhat, so, “it remains to be seen what kind of impetus this will give to overall economic growth” (einzelhandel.de).