Register to continue reading for free

Germany Retail: dark clouds are hanging again over the footwear sector

The positive signs on the horizon for the footwear retail sector reported in the previous Flash were short-lived. Sales in the first half of the year were not what retailers had hoped for, and the continued stabilisation of shoe prices shows no signs of turning the situation around. Against a negative macroeconomic backdrop, consumer confidence has been downward, and retailers face many challenges, including business closures and labour market instability. Footwear imports have started to fall, pointing to a possible crisis in the sector

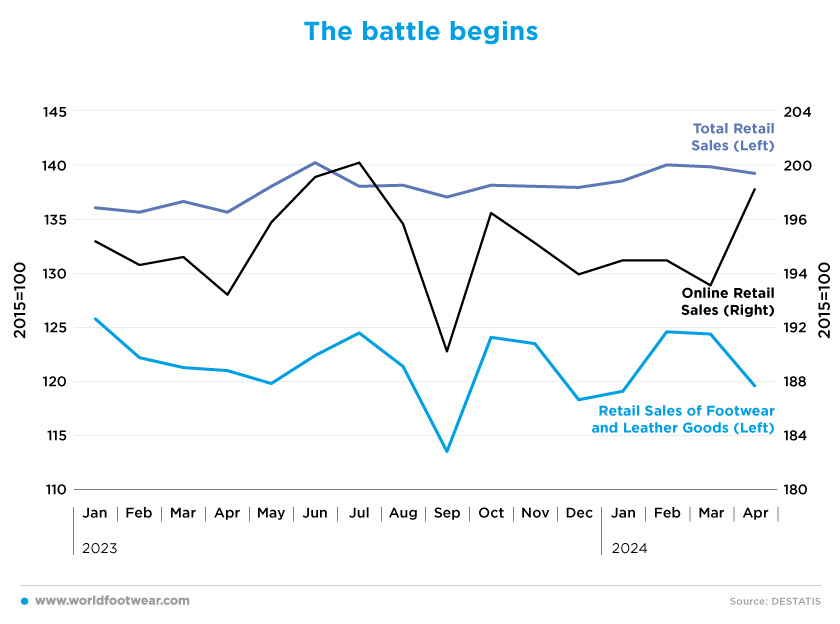

The battle begins

Germany’s leading economic institutes have downgraded their forecast for 2024 and now see Europe’s largest economy shrinking by 0.1%, according to their joint autumn economic forecast. However, in general, retail sales in the German economy are slightly better than in 2023 (up by 3.6% year-on-year in April) and online sales are recovering from the deep slump in September 2023 and are well above what we saw in April last year, with an increase of 3% month-on-month. But an analysis of online sales of fashion goods in particular may help us to start figuring out the situation. These sales point to an increase in direct imports by end consumers from fast-expanding suppliers such as Shein and Temu, according to the BTE (German Association of Footwear and Leather Goods). As a result, BTE estimates that the actual quantity of fashion and footwear offered or purchased in Germany has barely decreased over the past year due to the sharp rise in uncontrolled imports from the Far East.

Overall, the latest figures for German footwear retail sales show that the first four months of 2024 were even worse than the previous year. According to BTE, the footwear trade is expected to close in the first half of 2024 with an average decline in sales of around 2% compared to 2023, mainly due to the continued weak consumer sentiment and the rainy and very changeable weather in May and June.

Gabriele Accatino from Violafonti and Accatino told La Conceria that “in Germany, the situation remains very complicated. Traders are currently struggling with unsold summer products, while winter sales have not yet started because of the hot weather”. This points to a possible crisis in the German footwear market. In addition to the general reluctance to spend, footwear retailers currently see the lack of attractiveness of city centres as a major problem.

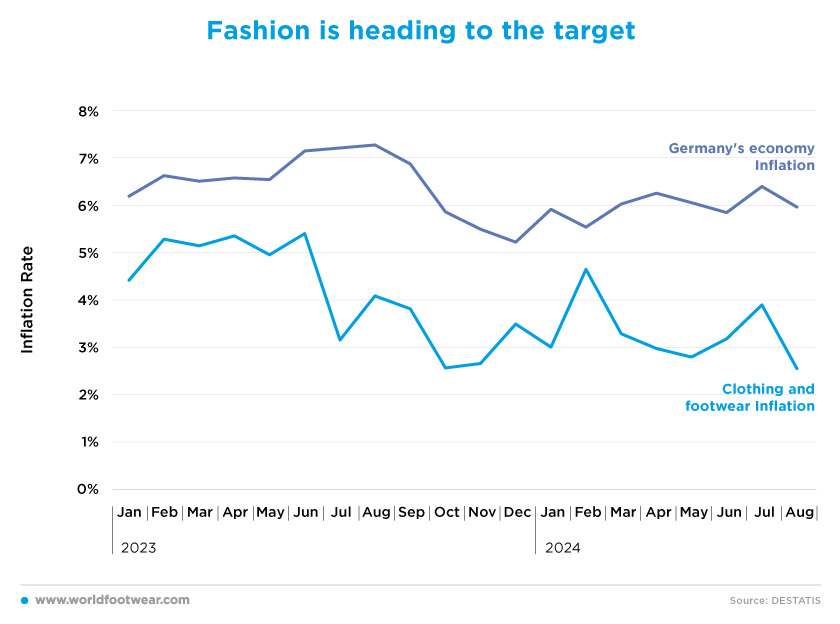

Fashion is heading to the target

Even if sales aren’t what retailers had hoped for, prices are stabilising and this could encourage consumers to spend once again. More broadly, price pressure on consumers is easing as inflation in the German economy as a whole is falling. After a slight uptrend in inflation in the first seven months of 2024, it now seems to be finally falling, mainly due to the decrease in energy prices compared to last year. The goal for the German economy set by the European Central Bank is for it to achieve the 2% target in the next two years.For footwear, the inflation rate has fallen sharply since August 2024, with a rate of 2.6% (the lowest in the last two years), suggesting that footwear prices in Germany are close to the 2% stable inflation target.

However, despite rising wages, many people are still holding on to their money due to the impact of inflation. According to the Federal Statistical Office, private consumption fell by 0.2% quarter-on-quarter in the second quarter. Over the past two years, the average household income rose by 5.1% between 2022 and 2023 - but the inflation rate was 5.9% (fashionunited.de).

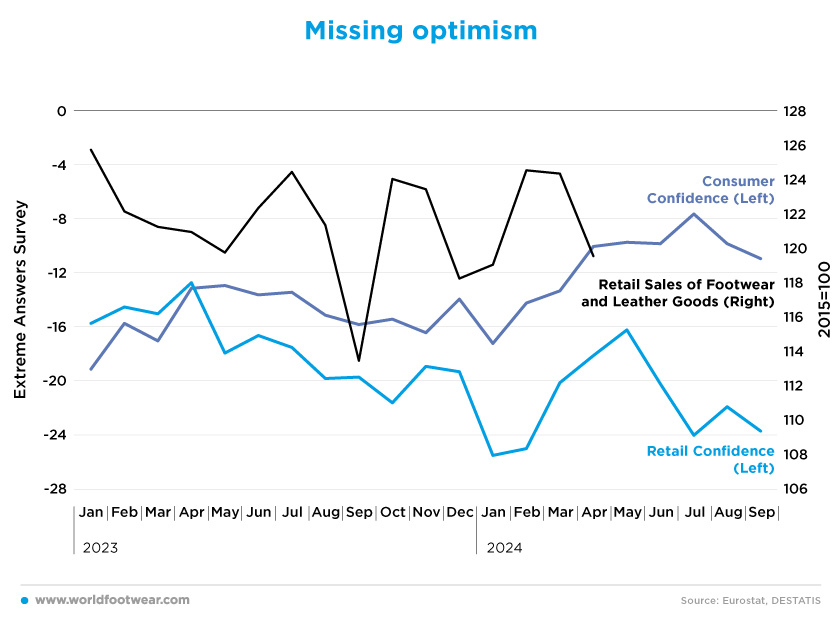

Missing optimism

The truth is that retailers are becoming more bearish about the future, and for a good reason. After the downhill trend in 2023 due to scepticism about sales this year, retailers became more optimistic about the future, but the picture changed completely after May, with the retail confidence indicator rising from -16.3 to -23.8 in September. And they are not to blame. According to BTE estimates, around 100 shoe retailers closed their doors for good in the first half of 2024, some due to insolvency, some voluntarily, e.g. due to a lack of successors. BTE estimates that the number of shops has fallen by around 800, as compared to the same period of last year, leaving a total of around 8,750 open shoe stores.A survey from the association also shows that 41% of footwear retailers rate their current business situation as poor due to current challenges and pressures, including the skills shortage and the demands of digitalisation. Only 16% of footwear retailers say their current business situation is good. More than one in two footwear retailers fear a slight to significant decline in sales compared to 2023 (bte.de).

As for consumers, after seven months of recovery since January, the picture started to blur again in August, with consumer sentiment starting a downward trend. From July to September, consumer confidence decreased by 43%, a severe step back as private households in Germany currently see their financial situation over the next 12 months less positive.

“Apparently, the euphoria of German consumers triggered by the European Football Championship was only a brief flare-up and faded after the end of the tournament. In addition, negative news about job security is making consumers more pessimistic and a fast recovery in consumer sentiment seems unlikely”, explains Rolf Buerkl, consumer expert at NIM. “Slightly rising unemployment rates, an increase in corporate insolvencies and staff reduction plans at various companies in Germany are causing employees to worry about their jobs. Therefore, hopes for a stable and sustainable economic recovery must be further postponed” (gfk.com).

The reality is that consumers’ buying power is increasing, but there is a general instability in the labour market. According to the Federal Employment Agency, the number of people registered as unemployed is currently around 200,000 higher than a year ago. In the first quarter of 2024, the savings rate was higher than in the same quarter of the previous year. So, it can be guarded that the mixed economic situation and rising unemployment could further strengthen the trend towards precautionary saving. As a result, private consumption is unlikely to pick up in the coming weeks. (einzelhandel.de).

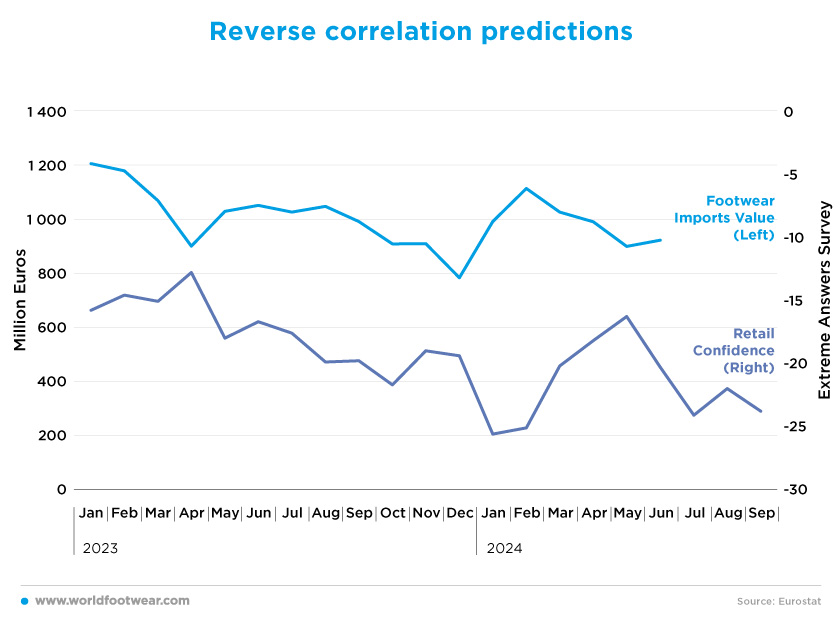

Reverse correlation predictions

Last year was marked by a continuous downward trend in imports, from 1.204 million euros in January to 783 million in December. As for 2024, we saw a positive start to the year with a peak in February of 1.113 million euros, but it rapidly fell to 921 million euros in June, which was less than 130 million than the same month last year.There’s a common pattern in all retail markets, and the German market is no exception: a clear correlation between imports and retail confidence. When retail confidence rises, we know that imports will likely rise in the following months, as this confidence is translated into future sales and increased demand. But the opposite is also true, and unfortunately, since May, retail confidence has fallen sharply, indicating the direction of imports.

Against the backdrop of recent footwear sales, it is unsurprising that footwear retailers are cautious about ordering for Spring/Summer 2025. According to the BTE survey, around 40% of footwear retailers plan to reduce their order volumes by up to 5%. In contrast, only 12% of footwear retailers intend to increase their purchasing volumes by up to 5%. The majority (46%) will continue to order at the same level as last year (bte.de).

Another battle front is opening against local retailers. As mentioned above, there is a supply gap, mainly due to direct imports by end users from fast-expanding suppliers such as Shein and Temu, which are not included in foreign trade statistics. It is estimated that these two companies alone send around 400,000 parcels to Germany daily. Moreover, most of these imports often do not comply with EU regulations and are sometimes even harmful to consumers’ health. Together with the German Retail Association (HDE), the BTE is calling for effective controls on imports from third countries to protect customers and ensure fair competition for all players (bte.de).

All said and done, there are once again dark clouds hanging over the footwear sector.

All said and done, there are once again dark clouds hanging over the footwear sector.