Register to continue reading for free

Germany Retail: cautious optimist prevails as the year begins

There are no fireworks in the German retail sector. Overall sales are stable, with e-commerce standing out, inflation is on target, and consumer confidence, which remains negative, has risen slightly. However, retailers have experienced a rollercoaster of emotions throughout 2024, and the only certainty at the start of the year is cautious optimism. Political turmoil, economic difficulties and geopolitical conflicts could just as easily lead to a turbulent year for retail

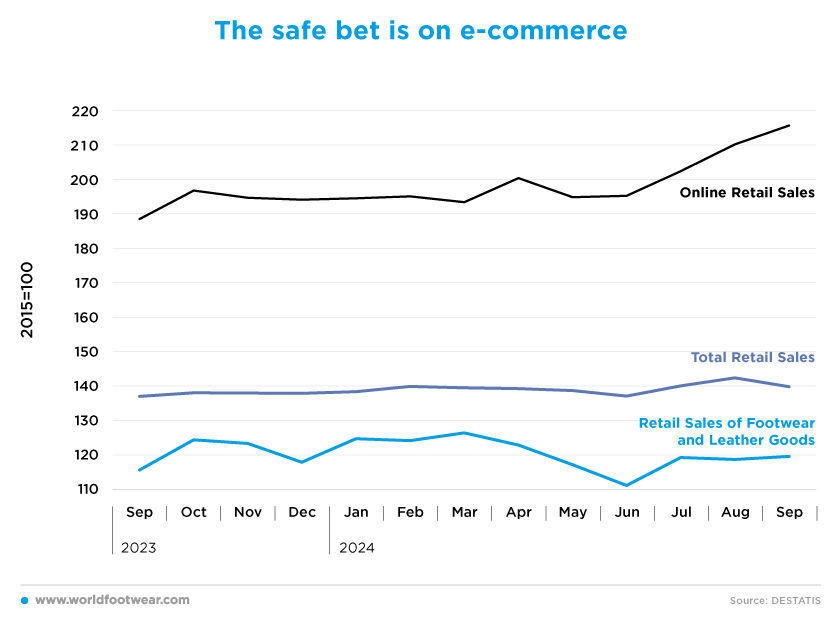

The safe bet is on e-commerce

Online sales are clearly the hotspot when it comes to retail sales. Not only is e-commerce in a league of its own, but it's also growing faster than physical retail. The CEO of the German Retail Association (HDE), Stefan Genth, pointed out that, “the significant increases in online trade are at least partly due to the restructuring of a very large mail order company” (fashionunited.de).For the first six months of the year, all retail channels seemed to stabilise, but footwear sales declined in the second quarter. Since June, the German consumer seems to be shopping again. Footwear recovered slightly from the decline in June, growing by only 7.5% between June and September. Total retail sales also grew by only 2% in the same period, but the online story was quite different.

E-commerce had already shown more resilience during the year, with no major fluctuations, and since June its growth has been increasing, with online sales up by 10% through September. And it looks like it’s going to keep rising, with last year’s Christmas bonanza likely to bypass some high street retailers. According to a survey by management and technology consultancy BearingPoint, consumers planned to spend almost 83% of their budget on online shopping - a higher proportion than ever before.

Looking to the last quarter of 2024, Christmas is not only the most wonderful time of the year for many Germans, it is also the most important for retailers. In some sectors, November and December are traditionally the best months for sales, so sales increases are expected – the German Retail Association (HDE) expects sales on Black Friday and Cyber Monday to reach 5.9 billion euros this year, which would put sales at the same level as last year (eizelhandel.de).

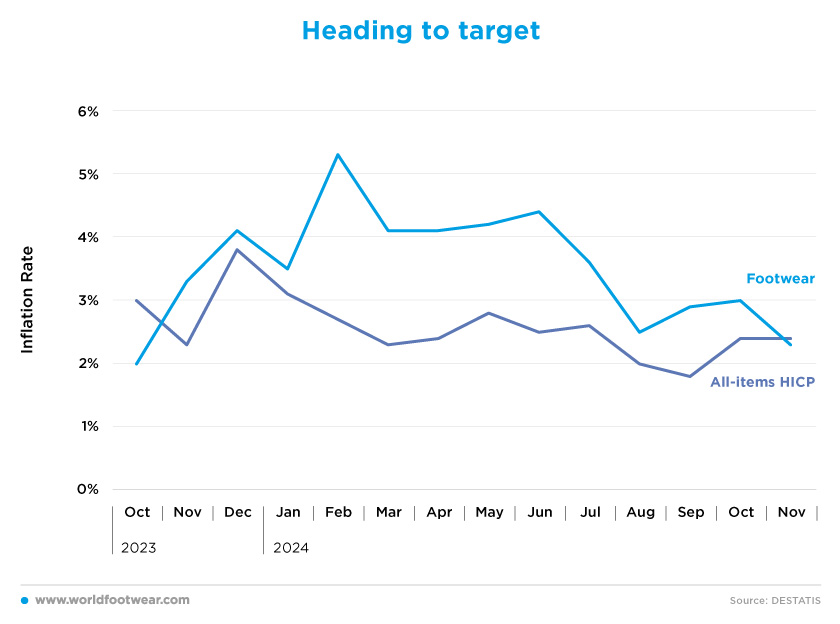

Heading to target

Inflation for German consumers was much more moderate in 2024 than in the previous three years. Having missed its inflation target since September, Europe’s largest economy is now trying to get back on track. Following a slowdown in economic activity, and as inflation has fallen over the year, Germany now has an inflation rate of 2.4%.As far as footwear is concerned, the story is slightly different, but has the same ending. Since October 2023, footwear inflation has been above the 2% target, reaching its highest level in February (5.3%) and then declining to 2.3% last September, 0.1 percentage points below the inflation rate for all items. The months with higher inflation correspond to the best-selling months, which means that these increases are the result of more demand as prices tend to rise, but this isn’t always great. Inflation can also cause consumers to cut back on purchases and create uncertainty about prices.

Economists expect the inflation rate to remain above 2% for the time being. The increase in the CO2 price for petrol, heating oil and gas, as well as the rise in the price of a ticket to Germany, are likely to push up inflation. The German Council of Economic Experts is forecasting an average inflation rate of 2.1% and the Ifo Institute expects an average inflation rate of 2.3% in 2025 (fashion united.de).

All in all, the latest readings suggest that there's a chance that the 2% target will soon be reached, which could be a good way of boosting confidence.

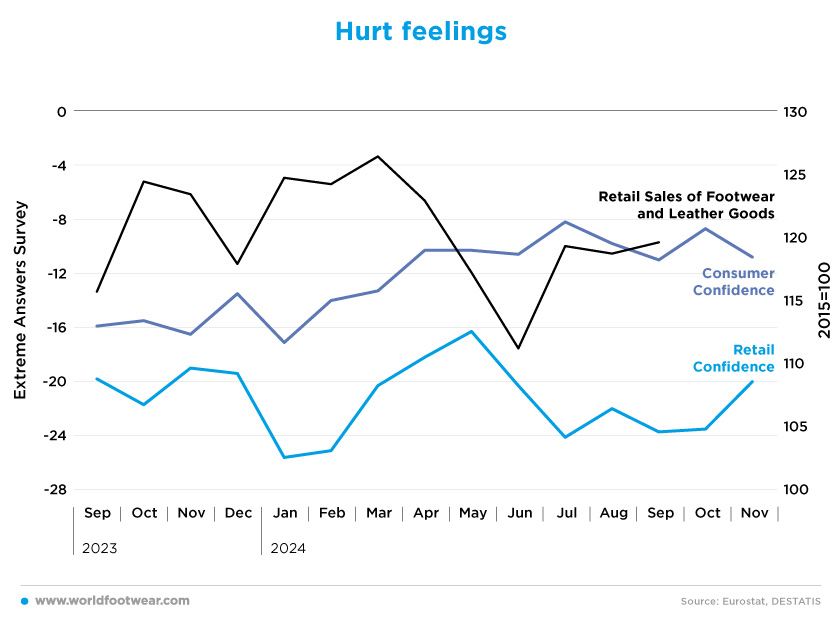

Hurt feelings

Both consumer and retail sentiment remain well below zero, but retailers are feeling the pain of lower levels of sales – there is a correlation between retail sales and retail sentiment, with a slight lag due to forecasts for the next period.Consumer confidence shows a slight recovery trend throughout the year, going from minus 17.1 in January to minus 10.8 in November. Retailers, on the other hand, seem to be riding a rollercoaster of emotions, never knowing what to expect as 2024 has brought both better and worse periods compared to last year.

But what has been happening to retailers outside of sales? The German Retail Association (HDE) is angry about federal politics and the turmoil in Berlin, “people have had to learn that politics cannot solve their problems”, says the President of the association (fashionunited.de). More recently, however, retail confidence has risen by 15% from October to November as retailers look forward to the results of the Back Friday and Christmas shopping season.

Looking ahead, small and medium-sized businesses (SMEs) fear a rapid economic downturn next year, according to a survey. Eight out of ten SMEs (80%) expect the German economy to shrink faster than in 2025, according to a survey by the German Association of Small and Medium-Sized Businesses (BVMW). And the main shortages are expected to be in skills and labour (fashionunited.de).

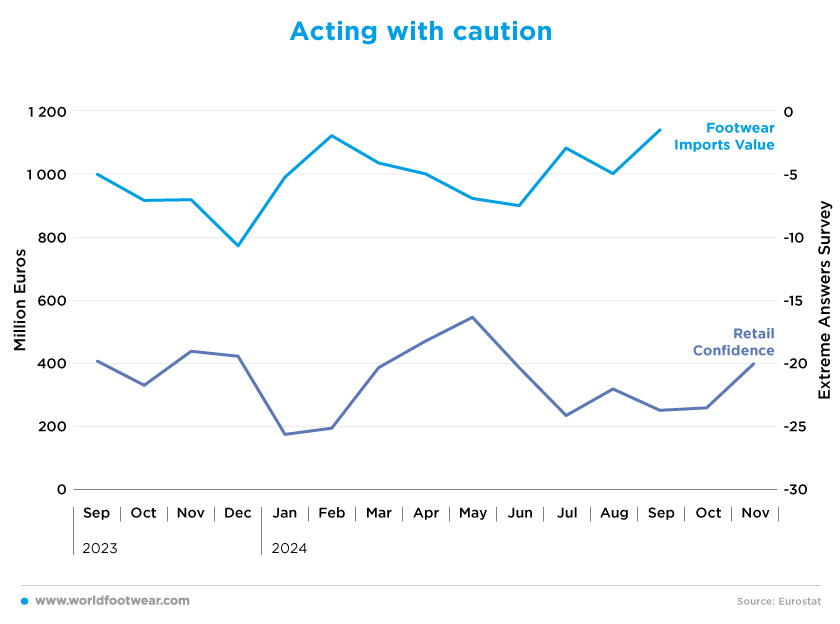

Acting with caution

Imports are mainly driven by expectations of future sales, so it’s clear that retailers are being cautious about placing orders. There is a time lag between ordering and arriving in the country, so retailers seem to be getting more confident and buying more products to stock, which takes a couple of months to arrive.“Retailers are cautiously optimistic. From what we hear, they continue to plan on the basis that consumers will increase their spending slightly. However, the mood is not euphoric - it will not go much beyond moderate expectations. The last few weekends have already shown this. ‘Cautious optimism’ is therefore the keyword. Uncertainties caused by international conflicts or economic developments are dampening consumer sentiment and thus stronger growth” (fashionunited.de).

The value of footwear imports reached its highest level of the year in September, with more than 1.1 billion euros imported in that month alone, an increase of 14% compared to the same months last year. Between January and September 2024, more than 513 million pairs of shoes have been imported, with an average price of 17.95 euros.

Overall, rising incomes could provide a positive stimulus, but economic uncertainty is putting pressure on retailers and consumers. Indeed, February’s snap election brings further uncertainty at a time when Europe’s largest economy faces the prospect of a second consecutive year of economic contraction in 2024, with growth rates lagging behind other eurozone countries (chinadaily.com).