Register to continue reading for free

France Retail: with no crystal ball and eyes wide shut

Despite the slowdown in inflation in recent months and the slight improvement in consumer confidence, footwear retail remains on a downward trend. There is some hope for an upturn in the retail environment in the first half of 2024, but the available data on imports at the moment does not allow us to look ahead with sufficient clarity. Meanwhile, the online second-hand market shows signs of becoming increasingly relevant in France

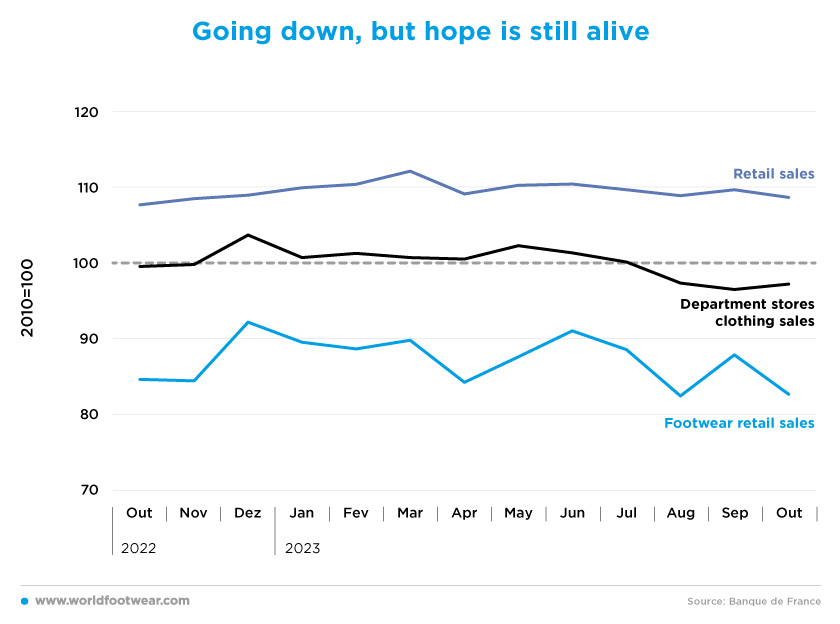

Going down, but hope is still alive

After the first quarter, the Retail Sales Index (seasonally adjusted, by BdF) is moving away from its previous positive trend and is only slightly above last year’s level in October. In particular, footwear retail sales are now clearly in decline, having fallen by 2 percentage points year-over-year at the end of October; other discretionary items such as clothing have followed a similar weak pattern since at least July.

After the first two weeks, when activity was as sluggish as in September, more autumnal weather at the end of [October] helped to turn things around somewhat in sectors such as clothing and footwear. However, at the end of the month, these sectors recorded a significant decline, as compared to October 2022 (down by 5.7% for clothing and by 5% for footwear). In addition, the number of visitors to points of sale continued to fall sharply this month (down by 11.1%), barely better than in September (down by 12.5%) (procos.org).

Commenting on household spending in the third quarter, French Finance Minister Bruno Le Maire said that “the upturn in household growth is good news. It drove growth in the third quarter, proving that for the first time in many months, household income is rising faster than inflation”. This renewed (the) hope that France will meet its 2024 economic growth target if inflation continues to ease (locate2u.com).

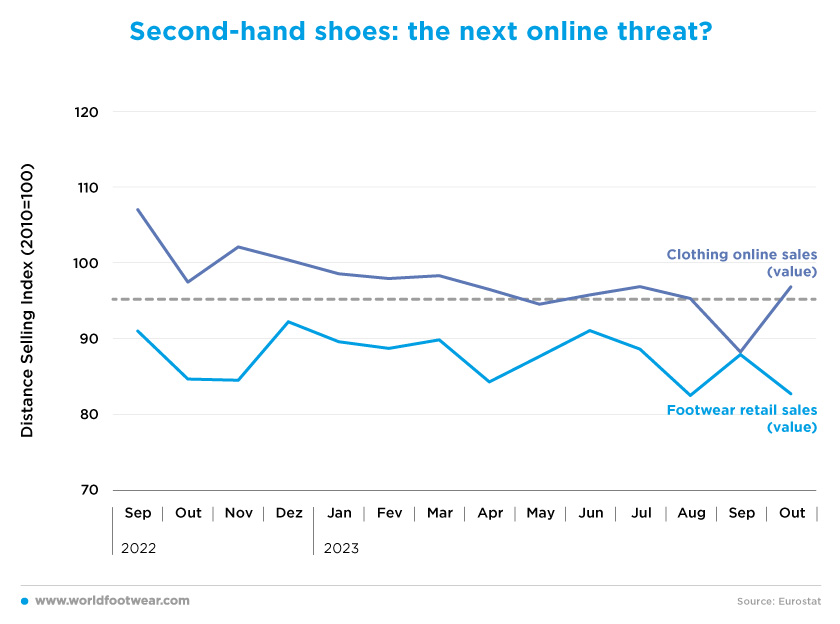

Second-hand shoes: the next Online threat?

Both the Clothing distance selling index (by BdF, seasonally adjusted), where online is the main driver, and the Footwear (shop) retail index show a downward trend. However, the year-over-year drop in digital commerce seems to be more pronounced, as seen at the end of September (almost by 19 percentage points vs. only 3 percentage points).

According to the Retail Federation Procos, online sales since the beginning of the year are identical to those of 2022 (up by 0.2%), i.e., significantly less dynamic than those of shops (up by 2.5% in value over 10 months). The decline in the volume of products sold online (between minus 2% and 3% since the start of 2023) is confirmed (procos.org).

In the first half of 2023, Spartoo saw its gross merchandise value decrease by 2.6% (…), the number of active customers fell by 7%, customer discounts over the period were 3 percentage points up and the gross margin lost 1.7 percentage points year-over-year (shoeintelligence.com).

The days of investors throwing money at online operators seem to be over. Spartoo is (…) struggling to attract investors (…) to finance the opening of branches (…). “Such expansion is no longer on the agenda, given the lack of financing capacity”, notes its President, Boris Saragaglia, (who is) hardly enthusiastic about the coming months. But if inflation continues, household income doesn’t follow and the loss of purchasing power strengthens the second-hand shoe market on the internet, which is (already) undermining the clothing market, things may change for the better for the online channel. Vinted platform is already one of the top ten shoe retailers in France, according to Kantar Worldpanel (lemonde.fr).

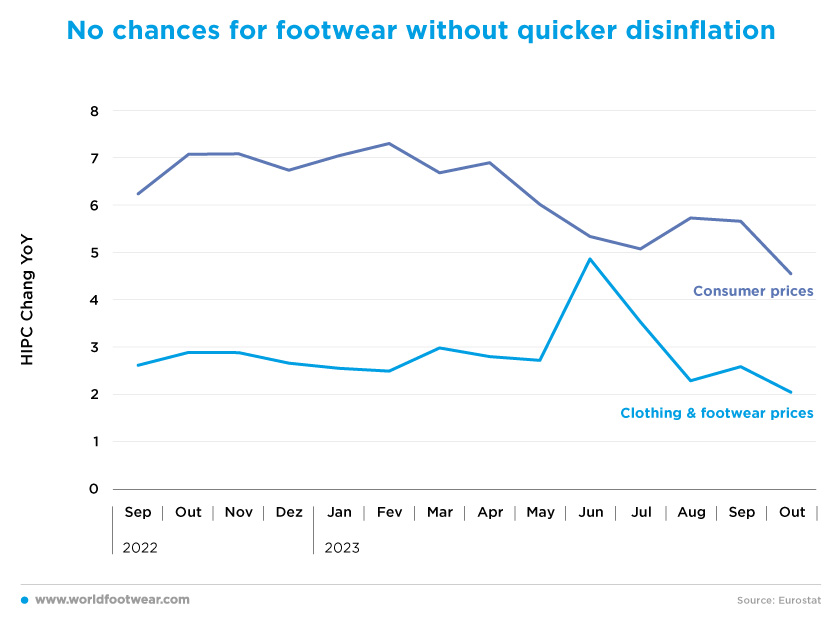

No chances for footwear without quicker disinflation

During significant inflationary processes, such as the one Europe has experienced, higher price increases for essential items such as food tend to cut discretionary demand for clothing and footwear and push down relative prices in the category. In contrast, with less pressure on essentials on the disposable income of consumers, more opportunities can be expected for retail in the clothing and footwear category and/or for less urgency to contain prices.

In October, the All Items Consumer Price Index (HICP by Eurostat) in France fell more quickly year-over-year (from 6.2 to 4.5%) than that of Clothing and Footwear (from 2.6 to 2%).

But despite the slowdown in inflation in recent months, there has not been enough of an improvement in the category’s retail performance. According to Pierre Talamon, President of the FNH (The National Clothing Federation), “74% of independent retailers saw their sales fall in September 2023, (…) with 42% of them recording a drop in turnover of more than 20% over the year” (fashionunited.fr).

At best, in the absence of major external events, the expected improvement in inflation and a reduction in food price increases should breathe new life into the specialised retail sector in the first half of 2024. Still, “landlords’ decisions on whether or not to fully index the rents of their retail tenants for 2024 could have serious consequences for shops that have already been weakened by a difficult year in 2023”, points out Emmanuel LE ROCH, General Delegate of Procos (procos.org).

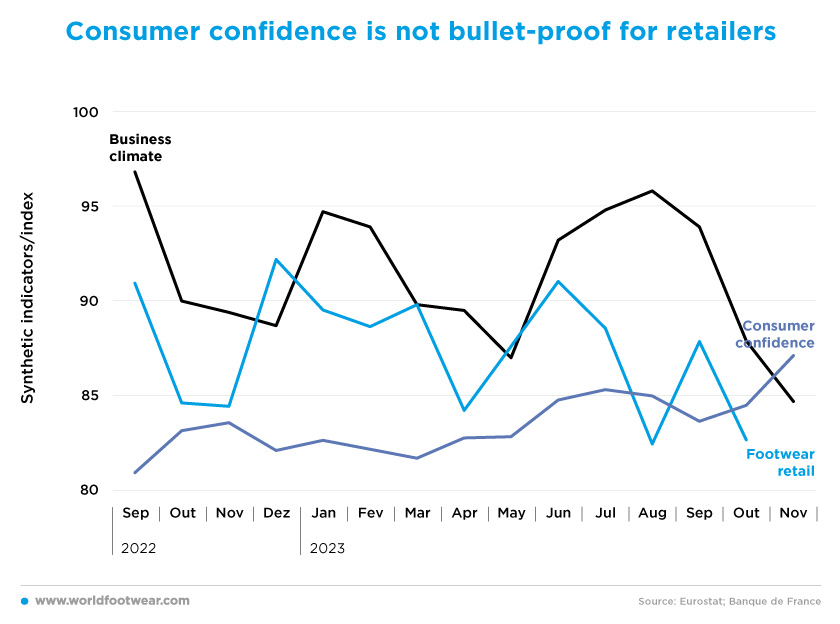

Consumer confidence is not bullet-proof for retailers

In our last WF Retail Fash (ending in August), we pointed out the fact that small improvements in consumer confidence do not immediately translate into retail gains, especially when it comes to small ticket items such as clothing and footwear.Looking three months ahead, the Synthetic Consumer Confidence indicator (by INSEE) has consolidated its trend upwards (3 percentage points up to 87 in November year-over-year), reaching its highest level since April 2022. However, as previously shown, the Retail Sales Index (by BdF) barely changed, while the Footwear Retail index (same source) continued its downward trend. The Retail Federation Procos wondered whether (consumer) “confidence would be sufficient to boost consumption of non-food products” (despite) “inflation is contracting, (…) and purchasing power is holding up rather well” (procos.org). It should be noted that although consumer confidence has improved, it is still far from its long-term average (100).

Instead, the Retail Synthetic Business Climate indicator (also by INSEE) reflects the downward trend in the footwear trade fairly well, albeit with some delay. Footwear has been losing steam since at least June, while retailers’ mood has been falling since August, losing 11 percentage points in the three months to November. Footwear retail data for November is not yet available, but it would not be surprising to see a further decline pop up.

With no crystal ball and eyes wide shut

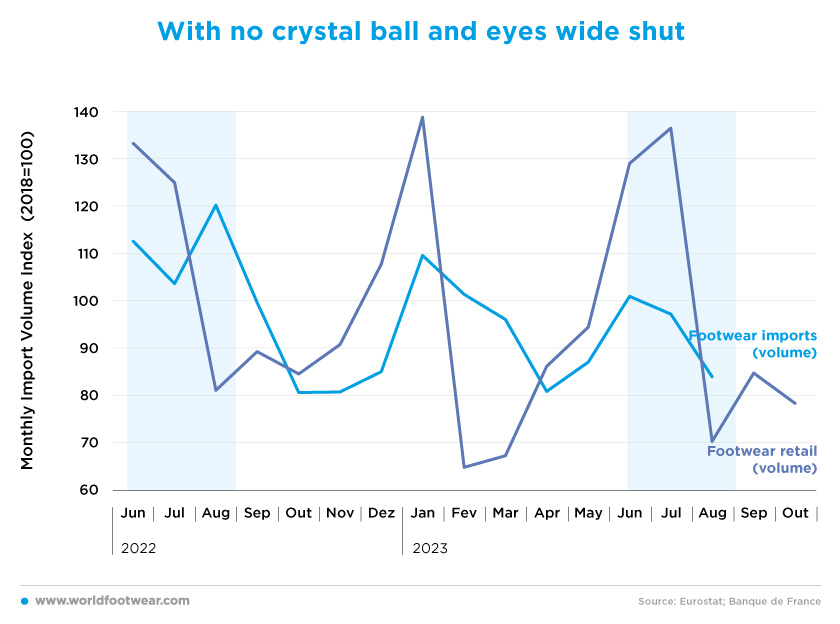

As consumer confidence is a poor crystal ball for footwear retailers, who in France are mainly fed by imports (data from Eurostats), supply decisions are a tricky problem and even more so for overseas imports.

So far, both volume trends (not seasonally adjusted) are quite synchronised in a still sluggish market. But “what-if”, as some wishful thinkers seem to believe, the market rekindles in the first half of 2024? Is there room in the retail balance sheet to support the risk of over-ordering again?

In our WF Retail Flash edition closing in March, with the help of professional sources, we have made a tour of the list of fashion casualties of the recent past, including dress shoe specialists such as San Marina, André and La Halle. Now, according to Hélène Janicaud, Director of Fashion Research at Kantar Worldpanel, “the (French) sneaker market is contracting, after growing by 30% over five years”. And Boris Saragaglia, President of Spartoo, solemnly declared that “there will soon be no shoemakers left in city centres and shopping malls” (lemonde.fr).

All in all, there’s no telling how things will develop in the coming months.