Register to continue reading for free

France Retail: watch out for the snowball effect

Both the footwear and the retail sector as a whole have failed to start the year on a strong footing, according to sales data. Consumers, who seemed to start the year in a more positive mood, took a step back in March and remain pessimistic about the French economy. Import data also suggest that retail confidence is in free fall. All in all, the risk of a snowball effect in the French retail sector cannot be dismissed.

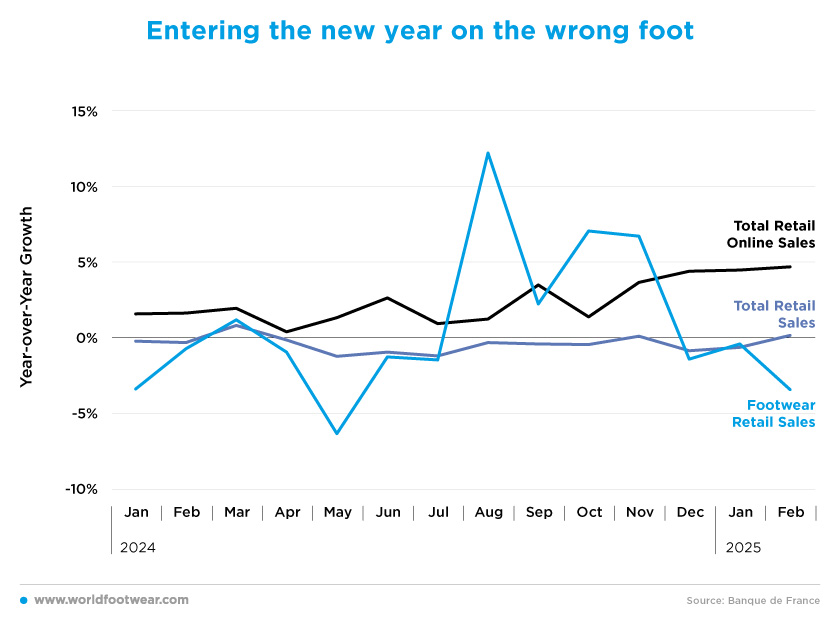

Entering the new year on the wrong foot

After the rollercoaster ride of footwear sales in 2024 due to the boost from the Paris 2024 Olympics, 2025 started with two months in the red. In January and February 2024, footwear sales were already down compared to the same months in 2023, and now 2025 is following the same trend with minus 0.4% and minus 3.4% growth in the respective months.The overall retail sector is also not so good. After 3 months, it is now finally positive, with a 0.2% growth in February, but if the trend of last year continues, we will see this behaviour of consecutive small increases and decreases throughout the year.

In a different league, online retail sales continue their strong momentum, reaching a record 175.3 billion euros in 2024, an increase of 9.6% compared to the previous year. This growth is mainly driven by a strong increase in transaction volumes and the first effects of slowing inflation (ecommerce-europe.eu).

After a 1.6% growth in online sales in February 2024, February 2025 brought the highest figure of the last two years with a 4.7% year-on-year increase. This rise in online consumption has led companies to change their approach to the market, with giant French fashion retailer Spartoo, for example, liquidating TooStores R1, its subsidiary set up in 2015 to manage physical stores.

“… our omnichannel approach remains firmly at the heart of our priorities, through an asset-light strategy focused on our network of affiliates and the creation of corners. In this way, we are preserving the strong synergies that exist between the online sales model and physical points of sale…”, said Boris Saragaglia, the co-founder and CEO of Spartoo (shoeintelligence.com).

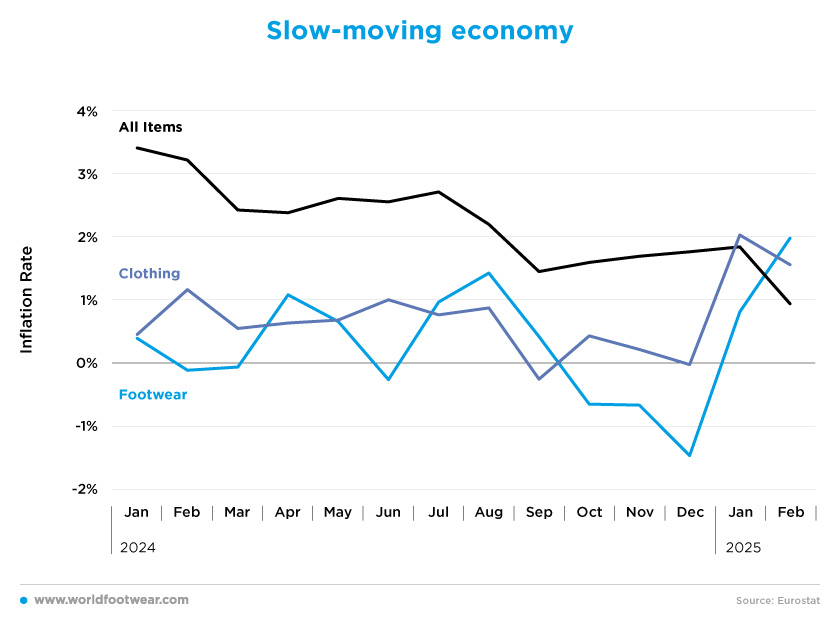

Slow-moving economy

After falling below the 2% inflation target in September 2024, the French economy has shown signs of slowing down, with headline inflation below 2% since then.Driven by a fall in electricity prices, the consumer price index fell to 0.8% in February, after rising by 1.7% in January, according to a flash estimate from the French statistics office Insee. On a monthly basis, prices in France didn’t change.

The very low inflation in February 2025, the lowest since February 2021, is, therefore, explained “by the fall in electricity prices”, said Sylvain Bersinger, chief economist at Paris-based economic consultancy Asterès (euronews.com).

The main fashion products (footwear and clothing) have had an even tougher time, with prices barely changing and even showing negative inflation in some months. But since December 2024, the prices of these types of goods have risen slightly compared to the previous year. The latest results, from February 2025, show that both goods have finally reached the 2% inflation target, possibly indicating an increased commitment to economic activity in this sector.

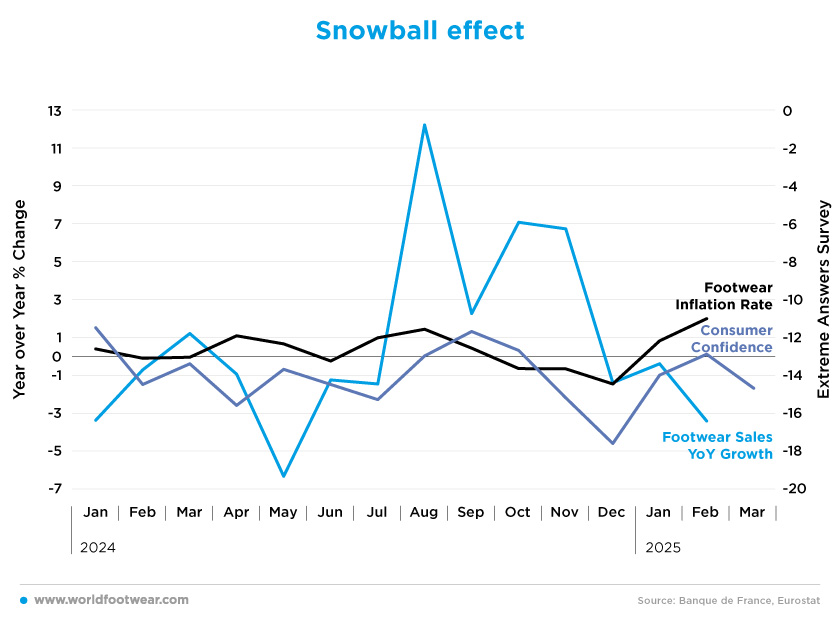

Snowball effect

Consumers remain pessimistic about the future of the French economy, and this is reflected in the economic results.The French Consumer Confidence indicator is still well below zero, and in 2024 the result is even more negative at the end of the year than at the beginning. So far, 2025 has brought an upward trend, but in the latest reading in March, the French took a step back and reconsidered their position.

This decline is due to many factors, but mainly the rise in inflation and slow wage growth. Although low, inflation has had a significant impact on household budgets, which have been squeezed in recent years by the energy cost crises in central Europe, and wages haven't followed the same trend.

Therefore, retailers may have to start looking at these types of economic indicators to predict sales. There is a fairly strong correlation between increases in consumer confidence and sales growth. Logically, when consumers are more confident, they tend to be more willing to spend on non-essential items such as footwear, like a snowball effect.

But perhaps there’s a silver lining, as some remain optimistic about the future. The Societe Generale economist Fabien Bossy said in a research note: “While growth has been driven by public spending and external demand over the past three years, private domestic demand is finally showing signs of life” (reuters.com).

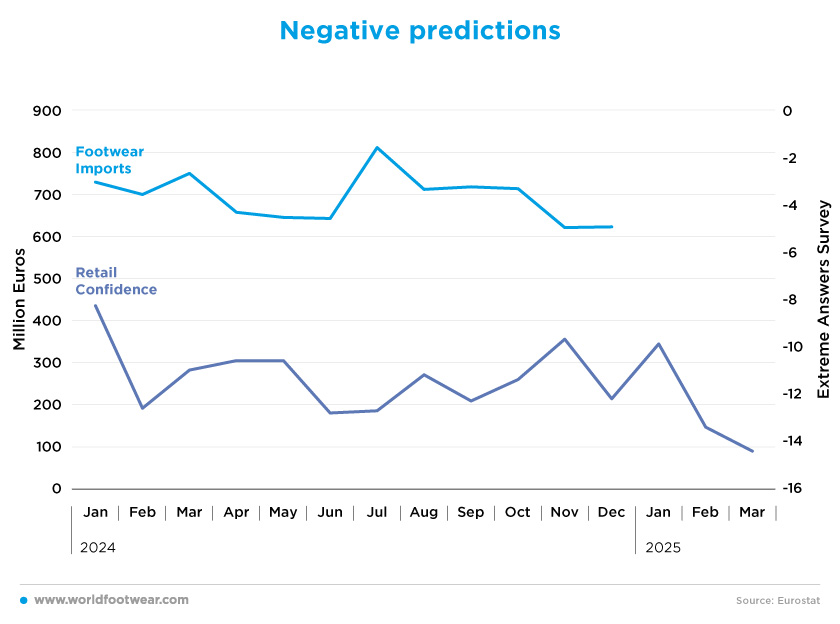

Negative predictions

In 2024, 8.2 billion euros worth of footwear was imported into France, corresponding to a total of 446.5 million pairs (average value of 18.74 euros per pair), which represents a fall of 2.3% in value but an increase of 2.2% in volume. This contrasting behaviour between value and volume is the combination of falling inflation and consumers’ search for better value for money, opting for cheaper products or channels.The decline can be explained to some extent by retailers’ negative view of the economic future, which they believe is getting gloomier, and the problem is that this feeling is getting stronger. “Beyond the mechanical end of the Olympic Games’ positive effect, the year-end slowdown underlines the need to adopt a budget to put an end to uncertainties and restore household and business confidence”, said Finance Minister Eric Lombard (reuters.com).

Although import data is not yet available, 2025 will likely see a monthly decline in footwear imports, as has been the case over the past year. Since January, retail confidence has fallen by 40%, suggesting that retailers are bracing themselves for an even tougher year, which may lead to a further fall in imports.