Register to continue reading for free

France Retail: the ball is in the consumers’ court to boost retail

The first quarter of the year brought some contradictory signs in France, but perhaps all is not lost, especially for footwear retailers. Prices in the category have been rising at a slower pace than general items, becoming more stable every month, which perhaps helps explain the (albeit residual) increase in footwear sales in March. Confidence indicators for both retailers and consumers remain in the red, but the small year-on-year increase in imports at the start of 2024 points to higher demand later in the year. With the European elections in June and the Olympic and Paralympic Games in August, as well as real wage growth, the ball is in consumers’ court to boost retail

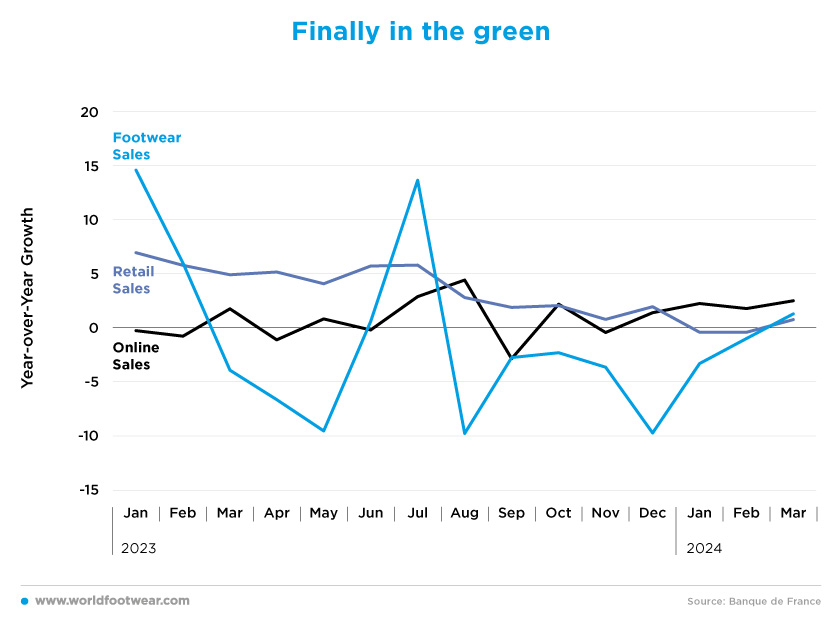

Finally in the green

The first quarter of 2024 started in the red, with January and February showing a lower volume of sales than the same months in the previous year, but in March the light changed to green and gave a little hope to footwear retailers, who in general recorded positive growth (but still less than 1%) due to a “positive calendar effect (five Saturdays in March 2024 compared to four in 2023) contributed to this result. Compared to the pre-Covid situation, the sales figures for March 2024 remain 10% lower than those for March 2019” (ifmparis.fr).Looking at the big picture, 2023 was a rough year for footwear shoe sales, with only 4 months showing better sales revenue than the same months in the previous year (2022); even during the Back Friday and Christmas months, footwear retailers didn’t see an increase in monthly sales revenue (data from Banque de France). Footwear retail sales closed the year with a 1.2% average decrease in month-over-month revenue in comparison with the previous year.

When compared to online and total retail sales footwear took a hit in 2023, and so far in 2024, things are not looking any better, with online sales showing growth above 2% every month of the first quarter of 2024, while total retail and even footwear showed lower numbers.

Although official data from the Banque de France is not available yet, estimates from the Retail Federation Procos suggest that “activity in specialised stores was poor in April, down by 3.8% compared to April 2023. After a buoyant March, which lifted the spirits of all concerned, April was a much slower month”, with several external factors, such as the shift of the holiday season between 2023 and 2024, as well as the early Easter, affecting the distribution and consequently weighing on the activity. On the other hand, internet sales in April (up by 8.6% on average for the specialized retail sector) were much more buoyant than in-store sales.

On a cumulative basis, the Retail Federation continued, “the activity of the specialised retail trade in the first four months of the year is identical to last year (0.1%)”, that is, lower than the inflation (estimated at 2.1%). The volume of sales in stores has therefore fallen slightly compared to the same months of last year, with some sectors recording significant decreases, including clothing (down by 3.1%) and, to a lesser extent, footwear (down by 1.2%).

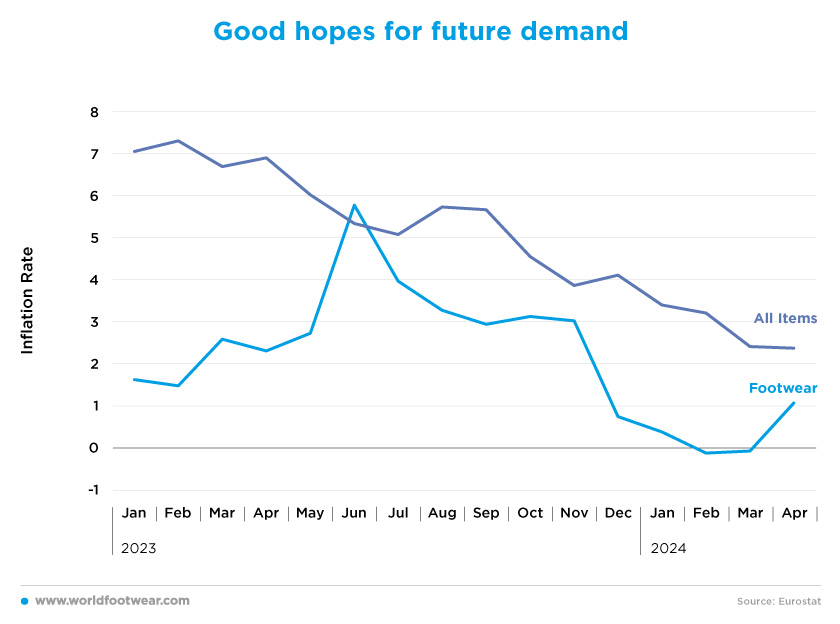

Good hopes for future demand

In the first quarter of 2024, footwear prices were stable as compared to the previous month (Eurostat’s CPI monthly variation), mainly due to lower demand. However, April already registered a positive inflation rate (1.1%), which, combined with the growth in sales from the previous month (analysed in the first graph), points to a higher demand.Comparing the footwear retail sector with the French economy as a whole, inflation in the former has been consistently lower than the second one for more than two years, except for June 2023, when the footwear inflation rate was 5.7%. Since that spike in June 2023, footwear prices have increased at a slower pace than general items, but both have shown a trend of slowing increases and are becoming more stable each month.

“Inflation in services is likely to remain particularly dynamic over the next few months and will stay close to 3%. (…) The prices of manufactured goods should continue to moderate and could post a negative inflation rate in the coming months against a backdrop of persistently weak global demand”, ING analysts forecast (think.ing.com).

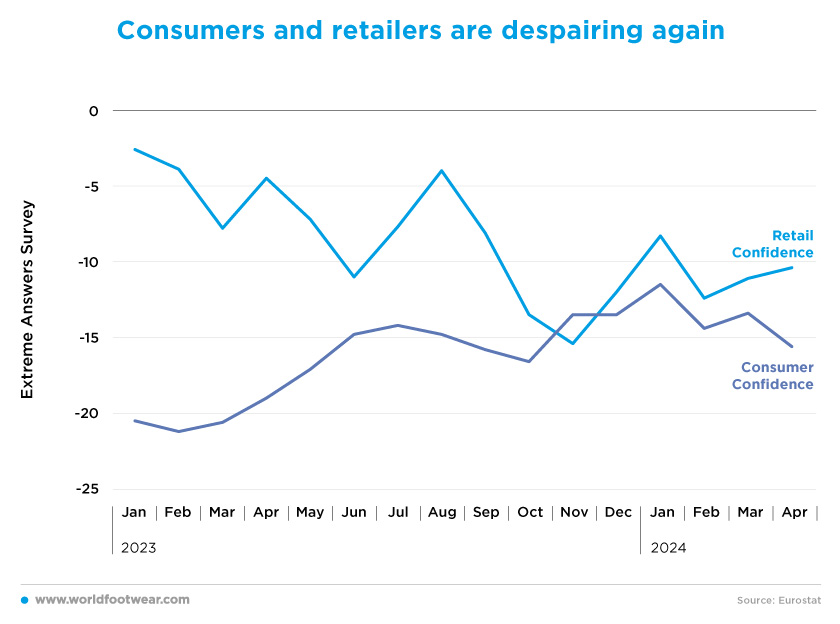

Consumers and retailers are despairing again

The consumer and retail confidence indicators (both by Eurostat) show a convergence pattern during the year 2023, with consumers becoming more optimistic about the future economy (consumer sentiment jumped from -20.5 in January to -13.5 in December 2023 and retail confidence declined from -2.6 to -12 in the same period). Since the beginning of 2024, the old patterns seem to be returning. More recently, in the first quarter of 2024, consumer confidence decreased by 16%, but retail confidence increased by 13%.Looking at the absolute value of the sentiment indicators, the reality is that both remain in the red. Consumer confidence hasn’t been positive since the pre-pandemic years, which tells us that consumers are still uncertain about what is, and this is currently affecting their buying decisions.

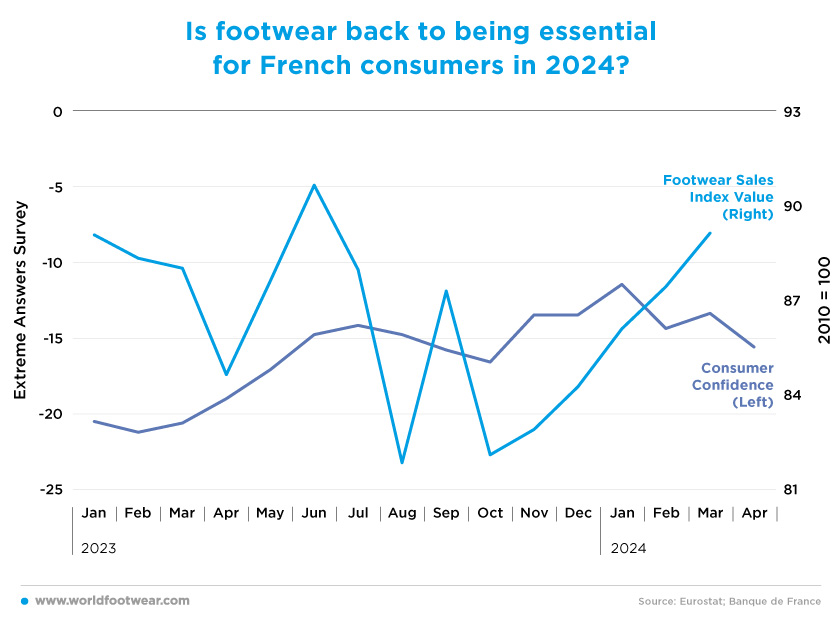

Is footwear back to being essential for French consumers in 2024?

Since the beginning of the year, consumer confidence has continued its downward trajectory, but the opposite is true for footwear sales in France. The footwear sales index (seasonally adjusted by Eurostat) has been slowly increasing, jumping by 8.5% between October 2023 and March 2024. One of the main reasons for this difference is that, as stated above, footwear is subject to little or no increases in inflation, meaning that its prices are more stable than those of other goods.This makes consumers feel more comfortable and gives them more confidence in the footwear market, as they feel they can predict future prices. So far, in the first three months of 2024, footwear sales increased by 5.7%, but the reality is that, as of March 2024, they are still 11% below the baseline (2010 average).

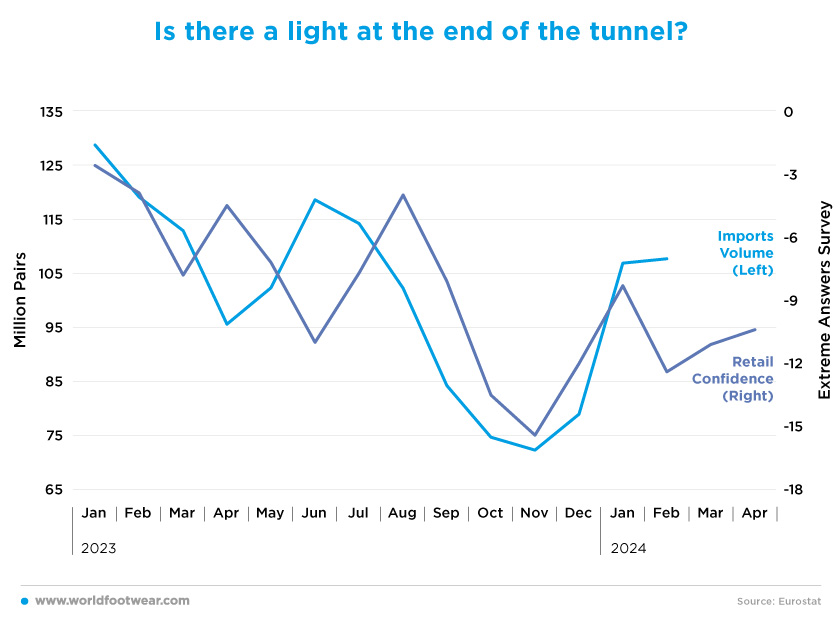

Is there a light at the end of the tunnel?

Footwear imports are mainly influenced by retailers’ expectations of future sales and the amount of stock they still hold. Looking at past data it’s possible to see the lagged trend between retailers’ confidence and the number of pairs of shoes that arrive in the country. In most cases, when retailer sentiment improves, the following months show an increase in imports. This is the result of better sales, which improve retailers’ hopes for the future and encourages them to import more stock, which arrives a few months later.After the last two months of 2023, the first quarter of 2024 shows a big increase in the volume of imports as well as in retailers’ confidence: in both January and February, more than 105 million pairs of shoes were imported into France, an increase of 41.8% when compared with the last two months of the previous year. In the grand scheme of things, however, both variables are well below the levels seen at the beginning of 2023. In fact, year-over-year imports were 9.5% below in February (119 million pairs imported in February 2023 compared to 108 in February 2024) and retail sentiment is even more in the red.

With the European elections in June and the Olympic and Paralympic Games in August, “it is difficult to predict business activity in the coming months”, according to the retail trade association Procos. However, the French footwear retail market seems to be regaining some strength.

After the rough past two years, French retailers are starting to see small but consistent improvements. Going forward, all indications suggest that it will still take time to get back to the pre-pandemic sales volumes, but with consumers on their side, there is light at the end of the tunnel. And “the latest forecasts from INSEE point to an increase in real wages, and, therefore, in purchasing power, giving hope for consumer trends until the end of 2024” (procos.org).