Register to continue reading for free

France Retail: still a blurred picture for footwear retail

French footwear retailers seem to be at a crossroads trying to figure out what will happen next. Prices are flat, sales are slow, consumer confidence is in general volatile, and stocks are building up (leading to a fall in imports). There was, however, a small improvement in consumer confidence in August, in line with the downward trend in inflation, suggesting that a much-needed relief may be reaching French households. Still, this may not be enough to boost retail sales this year as political uncertainty continues to cloud the horizon

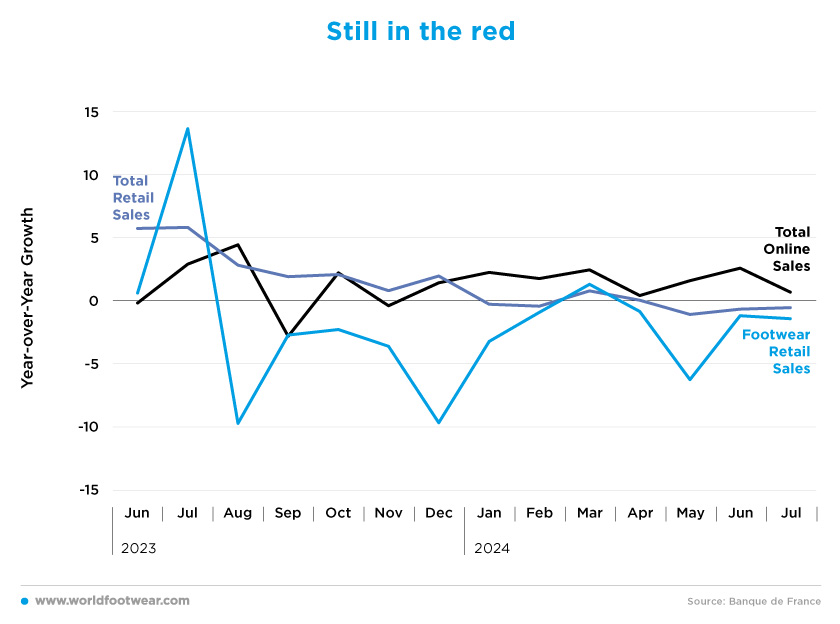

Still in the red

In July, French footwear retail sales (seasonally and working-day adjusted) fell by 2.7% month-on-month and by 1.5% year-on-year, maintaining the negative growth figures since March, according to data from the Bank of France.But footwear is not alone. In July 2024, clothing and textile sales recorded a slight drop of 1.5% in value terms compared to the same month last year and by 3.5% compared to the same month of 2019. “Furthermore, although tourists came in large numbers for the Olympics, they undoubtedly did not prioritise shopping”, said the IFM panel (fashionunited.fr). Overall, retail sales are lower than last year, with only online sales showing small increases (0.6% growth in July 2024 compared to July 2023).

The traditional sales period (from the 26th of June to the 23rd of July) opened against a backdrop of political uncertainty and at the end of a gloomy June, which saw 20% more rain than normal in France. The statistics for August are not yet available, but so far 2024 does not seem to be treating the French retail sector well: the scenario is stable, but that stability is still in the red.

Looking at it from other indicators. There's no doubt that the streets of Paris were packed this summer, not only because of the seasonal European summer tourism, but also thanks to the Olympics (held between the 26th of July and the 11th of August). TC Group, a commercial intelligence company based in Spain and established in France, noted a 5% increase in pedestrian traffic in the capital compared to 2023. However, this increase has not translated into more shoppers in the stores, which has fallen by 7% compared to 2023. This also contrasts with the figures for 2022, which show a 3% increase in store visits and a 2% increase in pedestrian traffic (fashionunited.fr).

The French economy as a whole appears to have slowed in line with its European peers, with GDP growth of just 0.3% in the second quarter of 2024, largely driven by exports as consumer spending in the country remains fairly flat.

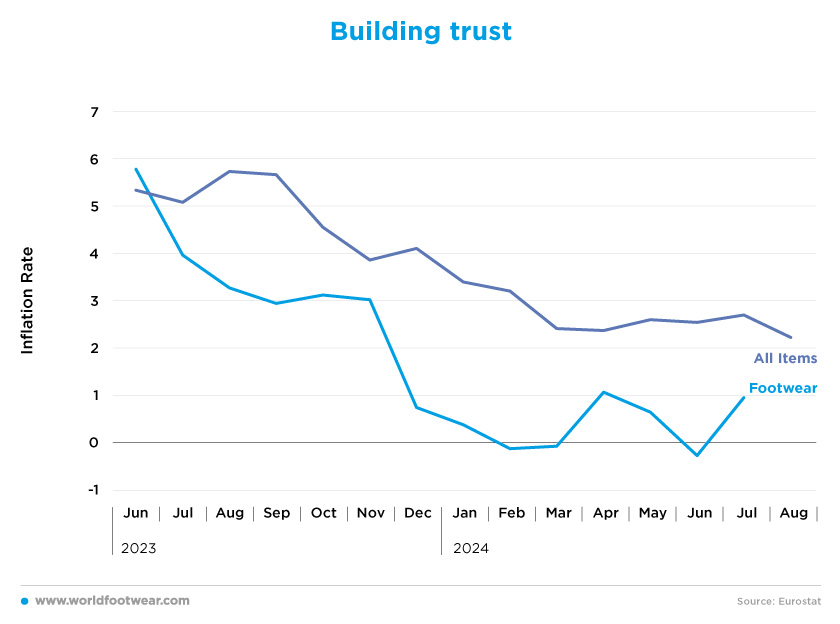

Building Trust

All items consumer prices in France reached 2.2% in August, down from 2.7% in July. Since July 2023, the French economy has been on a consistent downward trend in terms of inflation, reaching its lowest level in the last two years.Footwear also followed the trend, but with consistently lower values, even recording a negative inflation rate in June – meaning that footwear prices were on average lower than last year at the same period. Since the beginning of the year, footwear inflation has fluctuated between minus 0.1% and 1%, which shows stability, but most importantly helps to build consumer confidence, as they see they can start predicting future expenses with greater certainty.

“The fall in inflation should reassure some consumers and gradually remove the stress caused by high inflation in 2022/2023. Spending restraint continues to weigh heavily on household budgets and there are trade-offs, often to the detriment of our non-food products. Investment projects (home furnishings, kitchens, etc.) are being postponed. We have to face the situation, be agile, and adapt, hoping for a rapid return of confidence and calm to build the future of retail”, said the retail trade association Procos in a statement (procos.org).

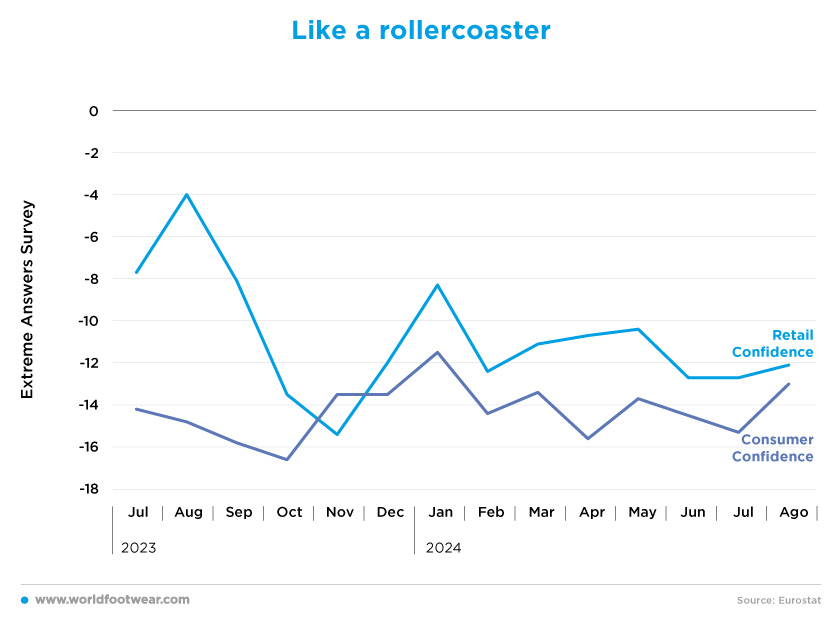

Like a Rollercoaster

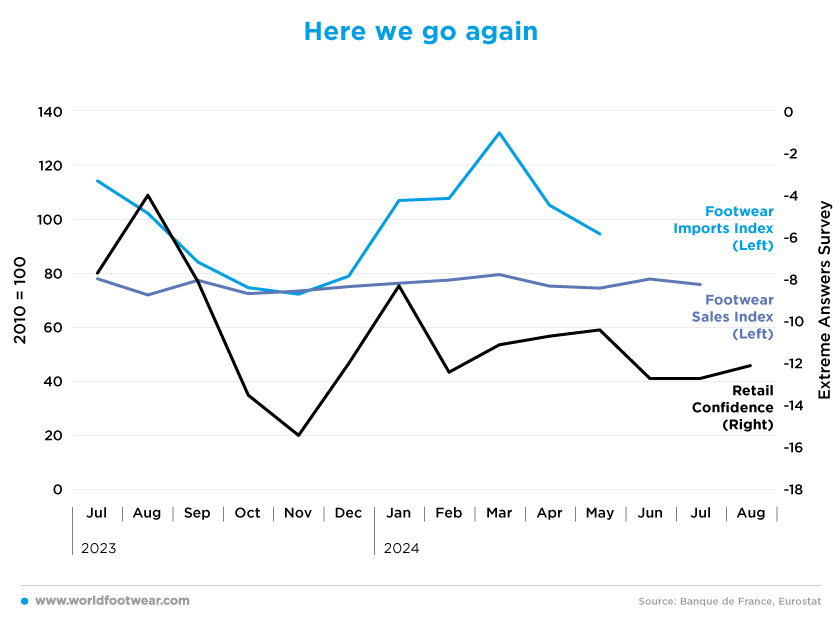

Since October 2023, confidence indicators have been on a rollercoaster ride, with retailers showing less negativity than consumers.

So far, the year-to-date retailer confidence has decreased by 46%, reaching its lowest level of the year in June and July (both minus 12.7), but is now starting to rise. As for consumers, although their confidence decreased by 13% in the same period, August recorded an increase of 15% from the previous month (from minus 15.3 to minus 13). “French consumer confidence improved in August to the highest level since the start of the war in Ukraine, survey results published by the statistical office INSEE showed on Wednesday” (rttnews.com).

In another development, France’s central bank governor has warned of a political uncertainty “shock” and said that business leaders are slowing investment and hiring as they hedge against possible tax hikes. “Business leaders are telling us they are worried about the wait-and-see approach of their customers, who are choosing to save rather than spend, about to delay investment and freeze hiring”, François Villeroy de Galhau told France Info radio (ft.com).

France’s business elite is worried about volatile politicians, inexperienced policymakers, street protests, and a possible wave of bankruptcies in the coming months.

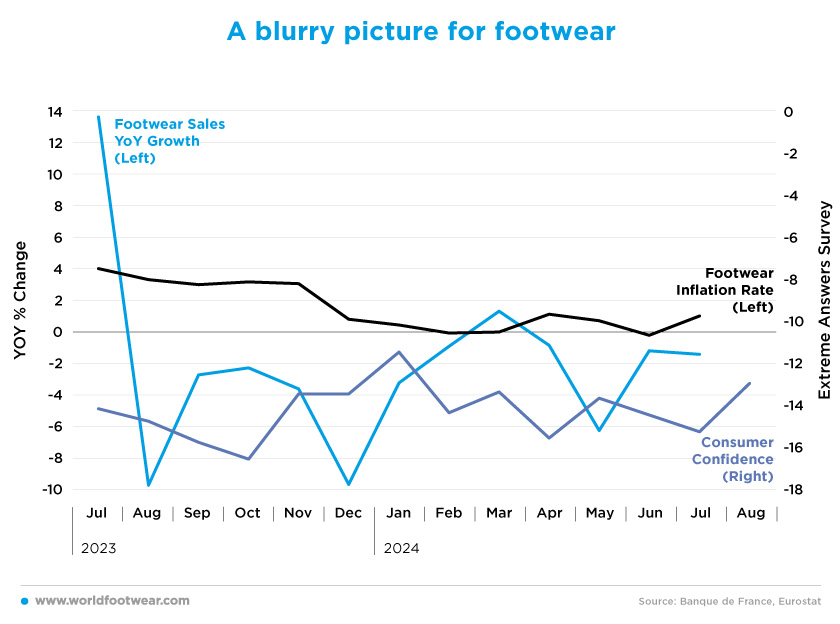

A blurry picture for footwear

At this point, it’s clear that 2024 has been a terrible year for the footwear sector, with March being the only month with year-on-year sales growth. Prices are flat, sales are slow, consumer confidence is volatile, and stocks are building up. It’s certainly a blurry picture, as retailers try to figure out what’s next.After the tough final quarter of 2023, it looks like history is set to repeat itself this year. “In the second quarter of 2024, more than 16 thousand protective, administration, and compulsory liquidation procedures were opened in France. … In the ready-to-wear clothing sector, 250 procedures were recorded during this period”.

However, “this represents a fall of 7.7%, which raises hopes of an improvement in the coming years”. While three-quarters of the bankruptcies concerned micro-enterprises with fewer than three employees, the strongest trend was observed among SMEs with between 50 and 99 employees, where the number of bankruptcies rose twice as fast as the average. This slowdown is also more pronounced in the B2C sector” (fashionunited.fr).

Here we go again

Given the results in sales, it’s easy to predict what will happen to footwear imports. The last two quarters of 2023 saw a downward trend in imports (from 43 million pairs in June to 28.7 in December), which was then reversed with continuous monthly increases in the first quarter of the year, reaching the peak of 48 million pairs of shoes imported in March, worth 745 million euros.

Since then, imports have started to fall and although official Eurostat data only covers the first five months of the year, it's easy to see that retailers still have stock to sell after the lack of consumer demand at the end of last year. This means that footwear imports aren't likely to rise much, if at all.

Additionally, in a survey carried out between the 8th and the 12th of July on behalf of the CCI and the Ile-de-France Regional Observatory of Commerce, Industry and Services (CROCIS), a fifth of retailers said they feared logistical difficulties as a result of the Games. This could be another factor in the decline in imports.

French companies reported the biggest drop in new orders since the start of the year, according to the S&P Global. They blame political uncertainty over snap elections for a drop in orders that contributed to a sharp slowdown in Eurozone economic activity, a closely watched business survey showed (ft.com).

Rents are also a concern. “In our sectors, high stock levels are putting a strain on cash flow, and if we combine this situation with the uncertainties of business activity over the next few months, it is clear that businesses urgently need to implement the agreement signed between representatives of retailers and landlords on the monthly payment of rents”, urged André Tordjman of Procos at the association’s half-year conference (procos.org).

Looking ahead, the main unknowns remain the unstable political situation over the next few weeks and the official economic impact of the Olympic Games on the economy.