Register to continue reading for free

France Retail: retailers cautiously optimistic for the holidays

October brought good news for footwear sales and retailer confidence is also on the rise, despite negative footwear inflation and rising costs. However, the picture isn’t clear regarding consumer confidence, which fell to a five-month low in November as households worried about the economic outlook in light of France’s difficult political environment. Will this weigh on footwear sales in the last two months of the year, or will recent news that consumers are planning to spend more on the festive season prevail?

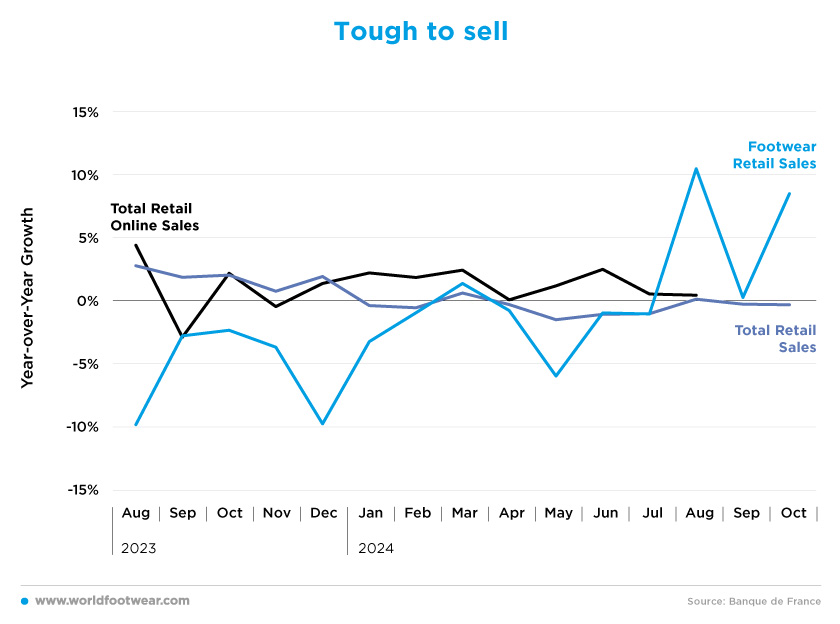

Tough to sell

Overall, retailers in France are having a hard time selling their stocks. So far in 2024, there have only been two months of sales growth (March and August with year-over-year increases of 1.4% and 0.1%, respectively). However, it should be noted that “the number of customers visiting shops increased slightly in October (up by 1.5%), in line with the trend in retail sales” (procos.org).Footwear retailers, in particular, had been experiencing an even more negative scenario until July, when things seemed to be picking up again. After several months in the red, August brought a 10.4% increase in sales compared to the same month of 2023. Although September quickly got things back down to earth with a 0.3% year-on-year increase, October surprised again with a new rise, this time of 8.5%.

But footwear is not alone. “The French clothing and textile sector continues to perform well. For October 2024, distributor sales recorded an increase in value of 4.1% in October, in one year”. However, these positive values for clothing and footwear sales, which are welcome as positive indicators for the future, must be read in comparison with the same months of 2023, which showed strong declines “as sales were penalised by a negative calendar effect and very mild weather”, according to a news report by France Fashion United.

Compared to physical retail, online is doing quite well. In 2024, there was only one month with negative year-over-year sales growth (April, minus 0.3%). All the other months showed a small, but continuous and steady increase in sales. “In the third quarter, the French spent 43.1 billion euros on the Internet (products and services), an amount 12.5% higher than in the same period of 2023” (fashionunited.fr).

Looking ahead, things could get even better as online sales are even more sensitive to events like Black Friday than in-store sales, meaning that November and December figures could bring positive news. And the retail association Procos has already pointed out that consumers were waiting for this event and its promotions to accelerate their spending.

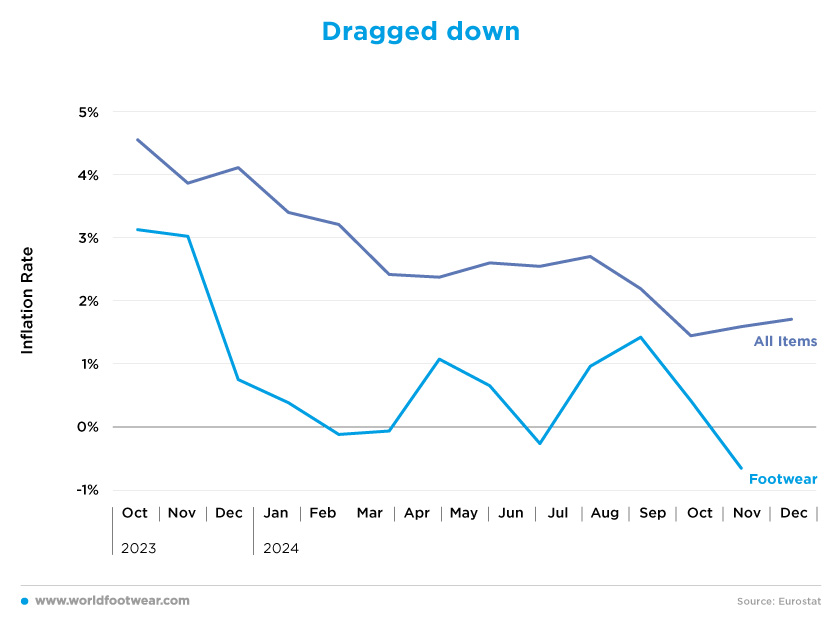

Dragged down

Across Europe, economies are once again at or close to the European Central Bank's inflation target, and France is no exception. All items’ inflation was somewhat stable until July (2.7%), but has since fallen, with the last three months already below the 2% target.“Consumer prices in France were up 1.7% year-on-year in November, statistics office INSEE said on Friday, in line with its preliminary reading published late last month”, reported Reuters.

Although footwear's inflation was high until November 2023, it quickly dropped to below target levels (0.7% inflation rate in December 2023). However, for the same reasons as the fall in all items’ inflation, it was pulled down so much that it was always below 2% throughout 2024, even reaching figures below 0% in 4 out of 10 available months.

The most recent reading was in October 2024, when footwear inflation was negative 0.7%, the lowest figure in recent years. This could mean that footwear sales are experiencing a slower period in terms of activity. With retailer costs rising and prices falling, the scenario could be getting bleaker for retailers.

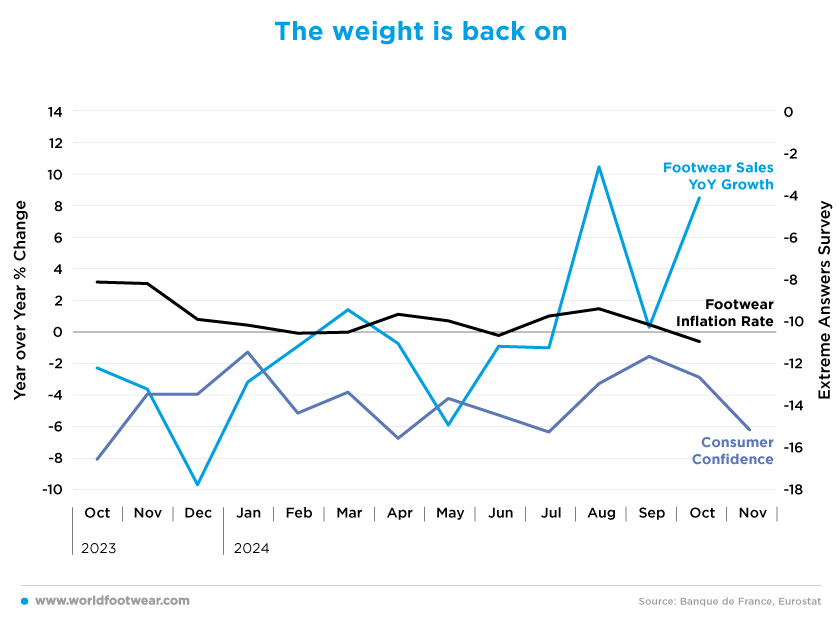

The weight is back on

Two of the main variables that can justify retail sales trends are usually inflation rates and consumer confidence indicators, so “consumers’ extremely strong attachment to price and concerns about purchasing power have made promotions even more important this year. This situation has led many players to engage even more quickly and heavily in promotions to ensure year-end sales, which are often vital given the heavy weight of December activity in business models” (procos.org).There is a clear correlation between negative inflation figures and a slight increase in footwear sales, as French consumers are informed and price-sensitive. However, the relationship between confidence indicators and footwear sales is difficult to understand. Consumer confidence has been up and down like retail sales, but it hasn’t had a positive month in more than two years.

Most recently, “confidence fell to a five-month low in November as households fretted over the outlook for the economy and the job market in the face of a looming political crisis” (reuters.com), when President Emmanuel Macron triggered a prolonged political uncertainty by dissolving parliament.

The only clear information that can be gleaned is that every time consumer confidence falls, footwear sales follow with a slight delay (one or two months later). So, the question remains whether, given that consumer confidence has fallen in the last two months (minus 12.7 and 15.2 in October and November, respectively), this weight will again push footwear retail sales down.

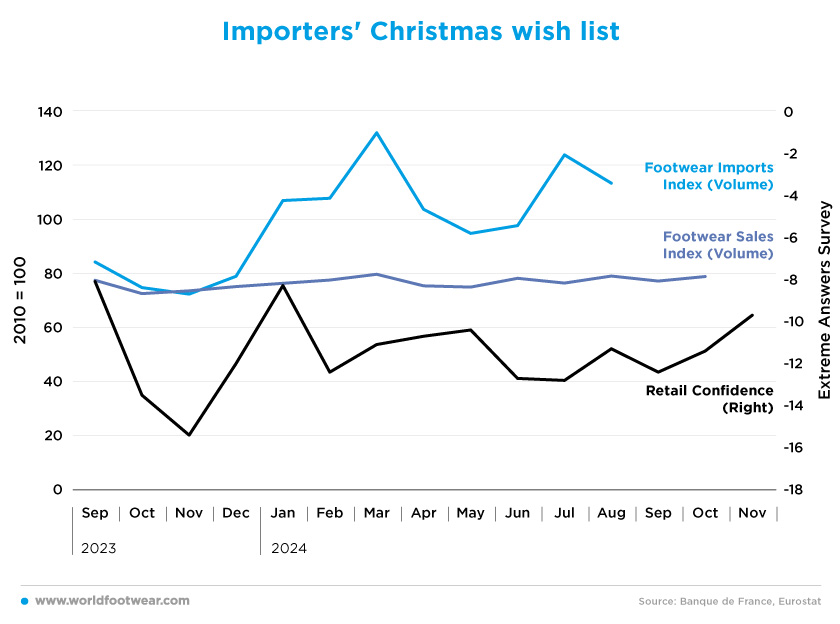

Importers’ Christmas wish list

Although the volume of footwear sales (pairs sold) has remained fairly constant over the last twelve months, footwear imports have been much more volatile. Between January and August, a total of 319 million pairs of shoes (worth 5.6 billion euros) were imported into France. The biggest month was July, with imports worth 806 million euros. Overall, the total value of imports is down by 5% compared to the same period last year and the average price has decreased by about 55 cents (a 3% decrease).But there is light at the end of the tunnel. The year 2023 showed that retail confidence had a huge impact on the value of imports, as the end of the year was particularly difficult for importers, who saw demand fall. However, this time, retail confidence seems to be on the rise again (from minus 12 in October to minus 10 in November, and over 33% better than last year’s November level of minus 15).

This increase could be the key to importers getting their wish and increasing imports again in the last quarter of the year.

This increase could be the key to importers getting their wish and increasing imports again in the last quarter of the year.

To end on a positive note, let’s have a look at the Fevad and Toluna Harris Interactive survey on the Christmas shopping intentions of the French. For Christmas 2024, they are ready to give more presents. The amounts they plan to spend are higher (390 euros compared to 370 euros, an increase of 5.4% in one year), both online and in-store (fashionunited.fr).