Register to continue reading for free

France Retail: prospects for the clothing and footwear sectors are still far from positive

The stabilization of the pattern of weakening French consumer confidence in the first quarter of the year cannot mask the pessimism that is still being felt in the country, especially in the context of social unrest. Moreover, in this reality of high inflation, neither do price increases hide the contraction in volumes sold nor is it possible to ignore the difficulties faced by companies more exposed to the domestic market due to increased operating costs (rents and energy) or even the stagnation of the online channel. Retail prospects for the clothing and footwear sectors are, therefore, still far from positive

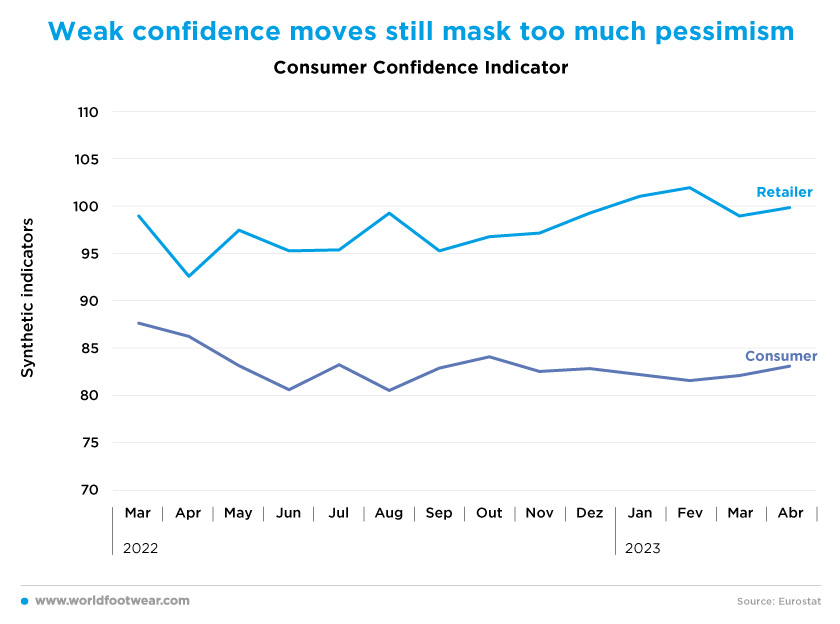

Weak confidence moves still mask too much pessimism

The weakening of Consumer Confidence in France (according to the synthetic indicators by INSEE) appears to be following a stabilizing pattern, after the plunge it experienced in the second and third quarters of last year. Slightly positive consumer sentiment arose in March and April, very much in line with the trend in the Retail Business Climate. However, the media reported less reassuring news.

An OpinionWay survey for La Retail Tech suggests that “French consumers are inclined to reduce their spending on clothing. In 2023, 63% of them have already reduced their fashion purchases, while 19% say they are ready to do so” (fr.fashionnetwork.com).

Moreover, among other trade sources, the professional organization Alliance du Commerce underlined that “the demonstrations and strikes linked to the pension reform have had a strong impact on the frequentation and activity of shops and have put an end to the slight positive dynamic observed since the beginning of the year”. In this context, city centre shops have suffered the most, particularly street shops (with a turnover fall in March of 2.5% year-over-year), which accentuates the major difficulties currently affecting many companies in the clothing sector (alliancecommerce.org and fr.fashionnetwork.com).

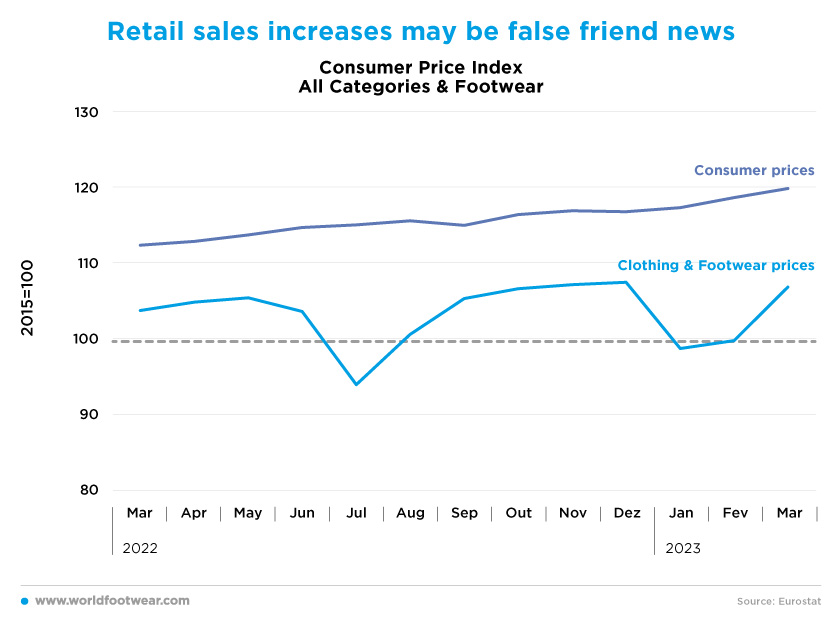

Retail sales increases may be false friend news

In today’s high inflation reality, nominal retail sales increases can be false friends for many retailers, as they can conceal lower volume sales not offset by price increases. This has been a concern for the clothing and footwear industry, in particular.

Procos, the Federation of Specialized Retail pointed it out clearly in its April Report, stating that sales in clothing and footwear shops increased by 0.8% and 3.8%, respectively, despite the contraction seen in the volume of products sold, especially in the clothing sector (procos.org).

In the last 13 months ending in March, not only has the change of the Clothing & Footwear Price index been much lower and flatter than the All-Items Price index, but, since August, its growth rate has always been less than half the overall index. In March, this year, it was 3% against 6.7%.

The Federation Procos, therefore, anticipates that as long as food price increases continue to consume an increasing share of household budgets, the trend of contracting sales volumes is likely to continue, putting pressure on non-food retailers as in the clothing case (procos.org).

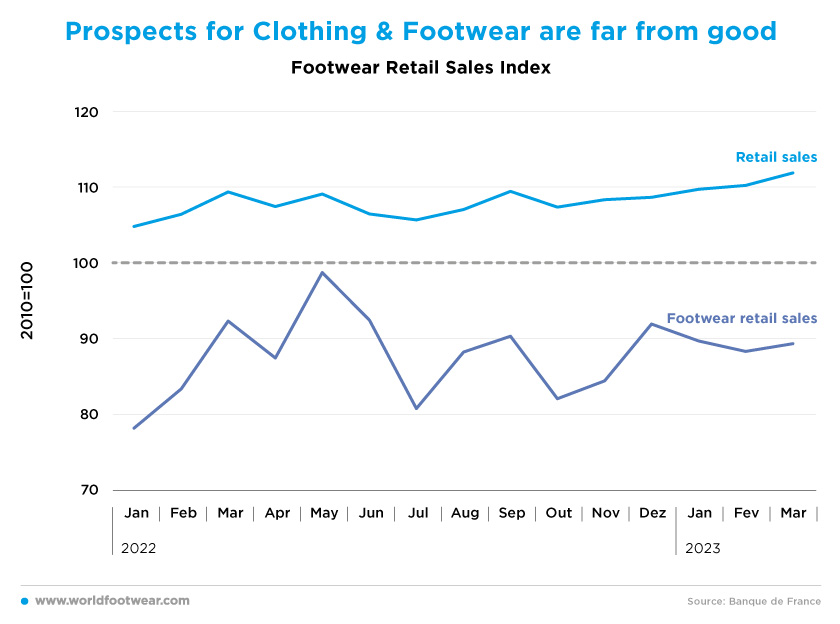

Prospects for Clothing & Footwear are far from good

While in the first quarter of 2023, retail sales, in general, went on up as a result of high inflation, footwear retailing seems now to be trending down, although its prices have also increased, albeit much more modestly. Discounting the price effect, the seasonally-adjusted volume of the category purchased by consumers is hardly growing. Even in value terms, footwear retailing is still about 10 percentage points below the baseline and, at the end of March, its loss was more than 3 percentage points year-over-year.

Furthermore, “only mass fashion retailers (such as Gémo, Kiabi, La Halle) are performing better than in 2019, with sales up by 7.3%, as compared to the pre-crisis period”, says the French Fashion Institute (fr.fashionnetwork.com).

It should be noted that since the beginning of the year, with volumes declining and operating costs (rent and energy) rising, some businesses more exposed to the domestic market were even placed into receivership, such as GoSport France, André and Clergerie (shoeintelligence.com and fashionunited.fr).

So, if high inflation persists as previously anticipated, retail prospects for the clothing and footwear sectors are still far from positive.

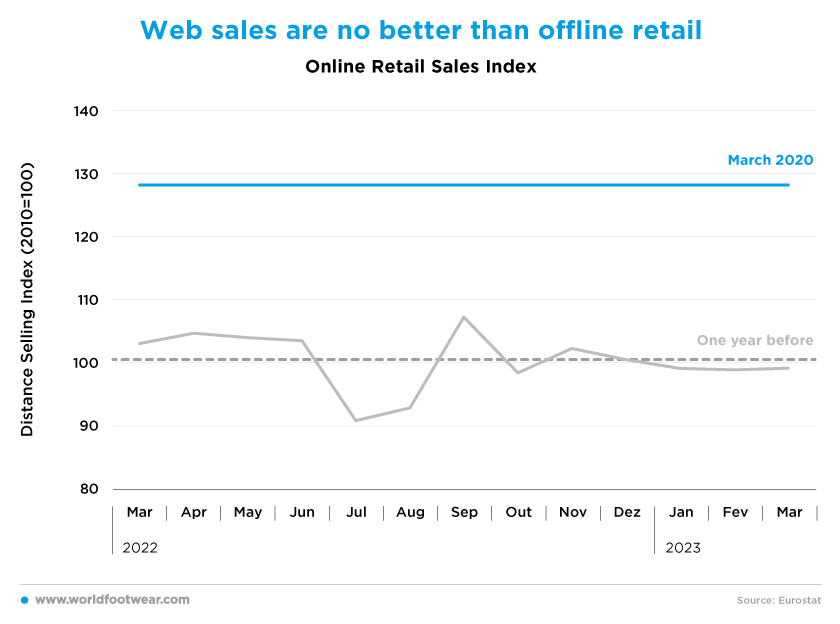

Web sales are no better than offline retail

While retailers like Go Sport France and Kookaï justify their misfortunes with the competition from online businesses or the lack of funds to invest in digital channels (shoeintelligence.com), others, like the French online retailer Spartoo, claim that the decrease (by 1.9%) in its gross merchandise value is due to high inflation and a “slowdown in demand affecting all e-commerce players” (shoeintelligence.com).

By contrast, discounting Showroomprivé’s performance outside of France, its online sales were up by 10.1%, as compared to the first quarter of 2022, with fashion recording growth in its activity (showroomprivegroup.com).

In the first quarter, the Clothing Distance Selling value index (by BdF) was also some 3 to 4 percentage points lower than the previous year, and about 30 percentage points than the pre-COVID-19 value. Commenting on the April figures, the Procos Federation reiterated that the stagnation in clothing & footwear web sales, which considering the impact of price increase, actually means web sales fell on average by 4% between April 2022 and April 2023 (procos.org).

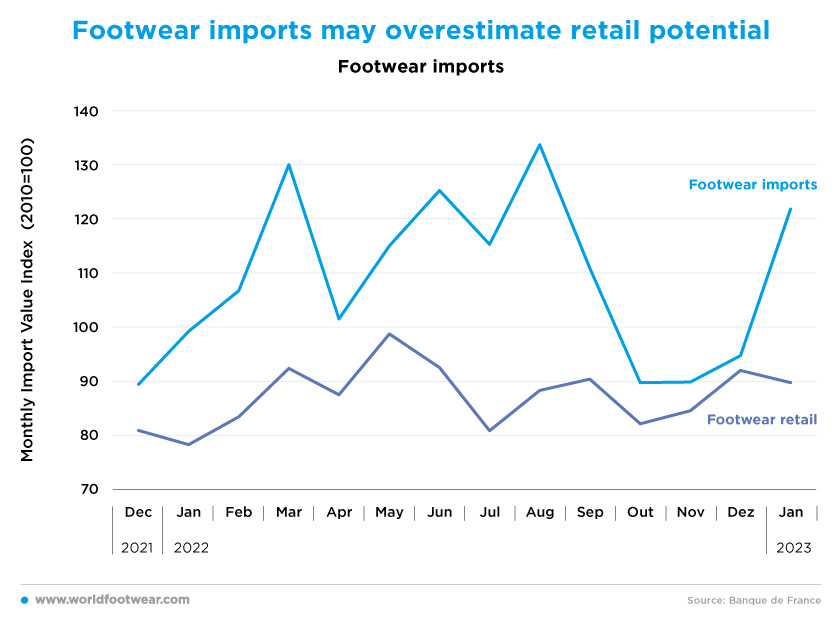

Footwear imports may overestimate the retail potential

Footwear import volumes seem to have adjusted down more aggressively than the downward trajectory of retail might suggest. As we mentioned in the previous WF Retail Flash, there may have been some overshooting of imports during the summer months. Overseas orders may have overestimated a retail market potential that did not materialize in fact, and due correction took effect in September and October.

Knowing the limitations of non-food retail potential in the first quarter of 2023, as long as food prices continue to absorb higher shares of consumer purchasing power, one wonders if footwear imports in January are not again inflating their market potential.