Register to continue reading for free

France Retail: news are not uplifting footwear retail

The Footwear Retail Sales Index (by BdF) reached in July its lower score in thirteen months in a row, and data from imports from the same month which will most likely make importers revise their decisions to the downside after the increasing value available for june. Despite a slight relief in consumer confidence in August due to Governmental aid, the increase in prices left little space in the wallet for discretionary footwear purchases. Meanwhile, online retail seems to have gained about 50 percentage points in 30 months in France, but data does not allow us yet to conclude whether the footwear segment shares this performance

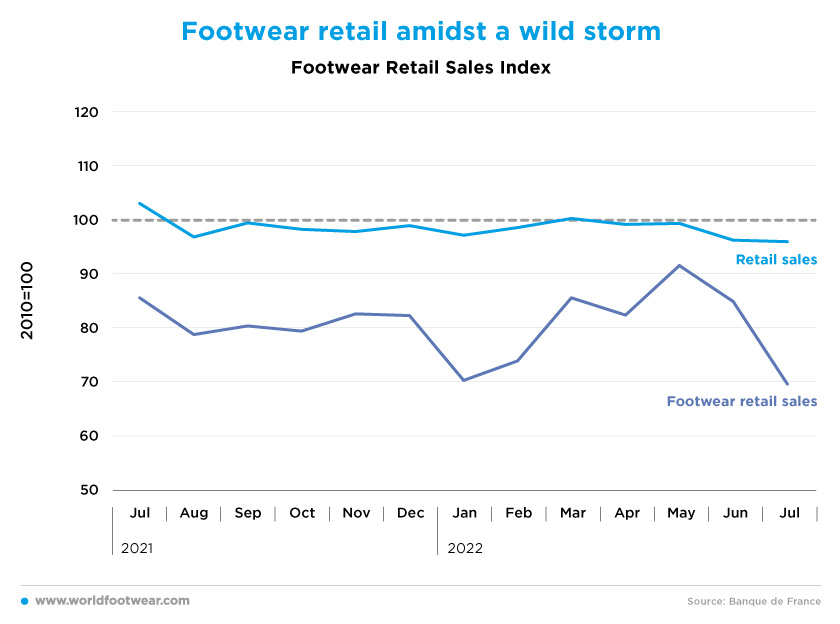

Footwear retail amidst a wild storm

After an upward recovery trend from January through May, the Footwear Retail Sales Index (by BdF) collapsed again, reaching in July the lower score in thirteen months in a row. This is more than 30 percentage points below the 2010 baseline, which is compared to less than 5 percentage points for the overall retail index. The footwear category had the worst performance among all categories (down -18.1%) in the retail index.

“After an upturn in sales in the spring, professionals nevertheless hoped to see sales rebound with the summer sales. But the upturn was short-lived. From the end of May, the market resumed a downward trend. The sales haven't changed anything”, laments Yohann Petiot, director of the Alliance du Commerce, a federation that brings together more than 700 fashion and shoe brands. “It was a cold shower”, he concluded (lesechos.fr).

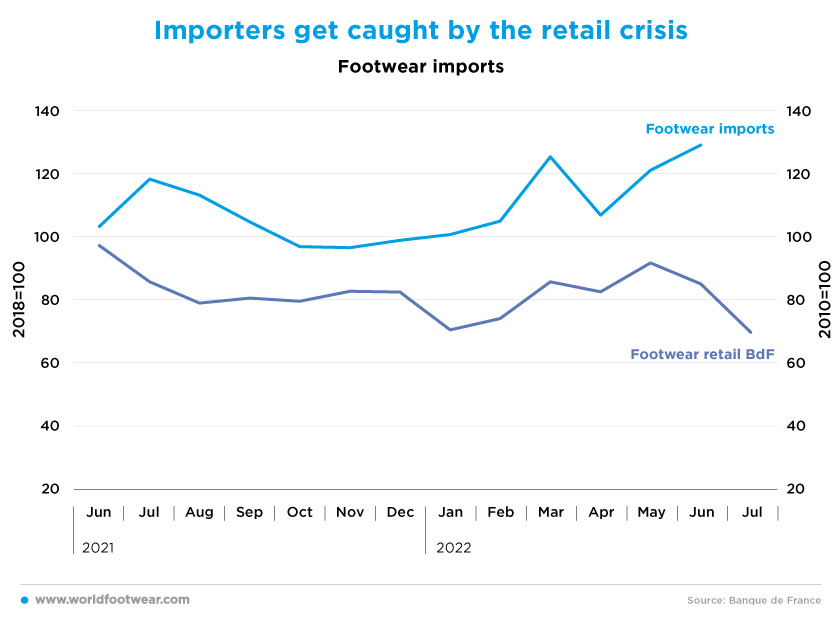

Importers get caught by the retail crisis

The first negative evidence for retail in June was not enough to obliterate footwear imports, most of it coming from distant sources in Asia. However, July brought in alarming numbers regarding footwear retail, which will likely make importers revise their decisions to the downside. Confidence indicators will certainly eliminate remaining doubts that may persist.

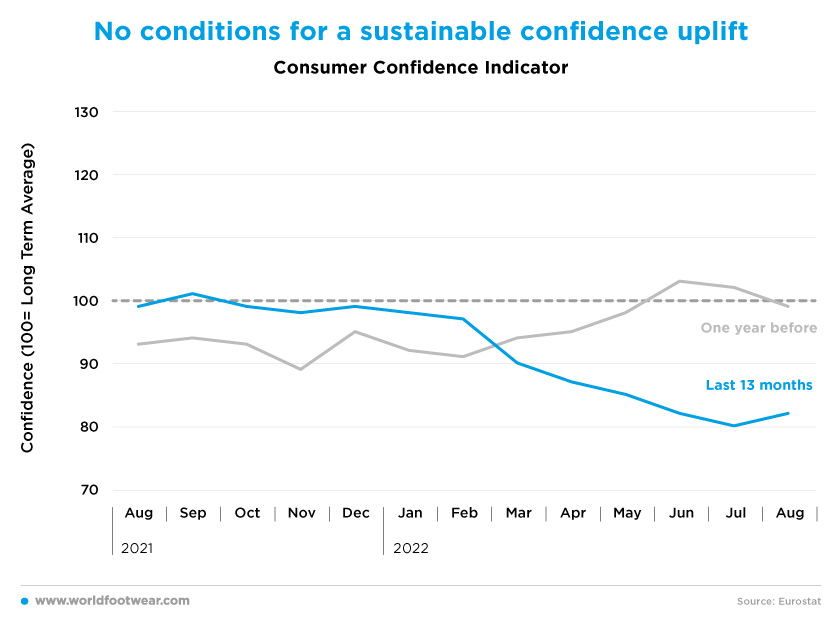

No conditions for a sustainable confidence uplift

Consumer confidence in France (by INSEE) softly deteriorated until March 2022, before Russia’s invasion of Ukraine, but right after it plunged into a crisis mode. A slight relief came in August, yet far below the long-term average, in part fed by the falling back of inflation to 5.8% in that month, and by the impact of the Government measures taken in the summer to help the French withstand the loss of purchasing power in the past year.

According to Sylvain Bersinger, an economist at French economics consultancy Asteres, “household confidence should keep improving in autumn thanks to higher incomes, which should allow for a slight improvement in purchasing power” (reuters.com).

On the same page, the bank BNP Paribas said expecting “inflation to remain below the July peak by the end of the year, due to the purchasing power law passed this summer, which should help purchasing power to bounce back, +1.4% quarter-over-quarter during the third quarter”. However, looking far ahead, “but a positive growth in purchasing power during Q3 will be followed by an expected shock next winter, mainly due to fears about energy suppliers” (economicresearch.bnpparibas.com).

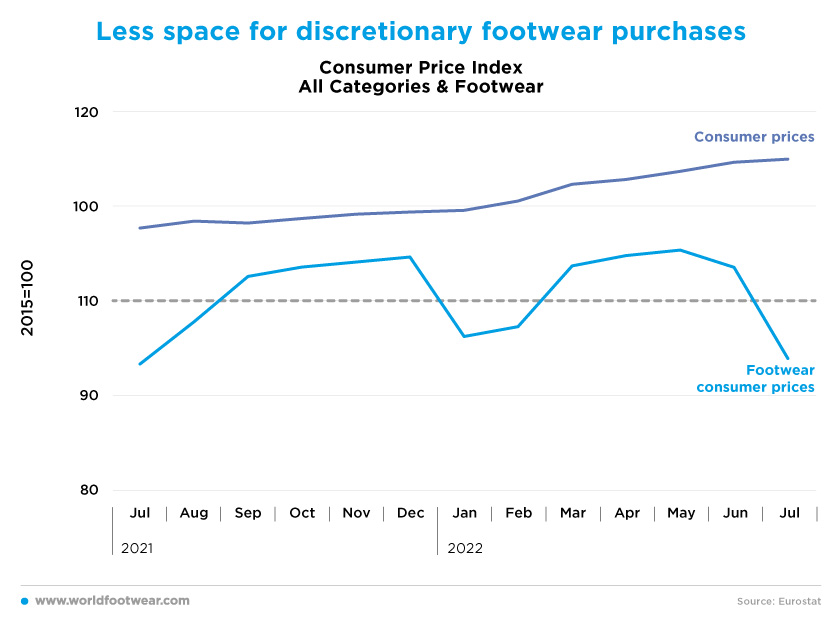

Less space for discretionary footwear purchases

It is hardly possible to feel any sustainable relief for both consumers and retailers while analysing the footwear viewpoint. In the last twelve months, the overall Index of Consumer Prices (by Eurostat) jumped 7 percentage points as compared to the 2015 baseline, leaving little space in the wallet for discretionary footwear purchases. This explains the divorce between overall and footwear prices, translating into even lower margins and higher pessimism for footwear retailers.

In fact, several brands specializing in the so-called “discretionary goods”, that is, the non-essential goods, have already warned the markets that their activity will be less good than expected in 2022 (lavoixdunord). The luxury segment is the only exception, as “consumers have so far been brushing off the rising cost of living and concerns about a looming recession, but industry executives have all acknowledged that the outlook for the rest of the year is uncertain” (reuters.com, commenting the Hermes’ performance for the year).

Bright online performance shared by footwear?

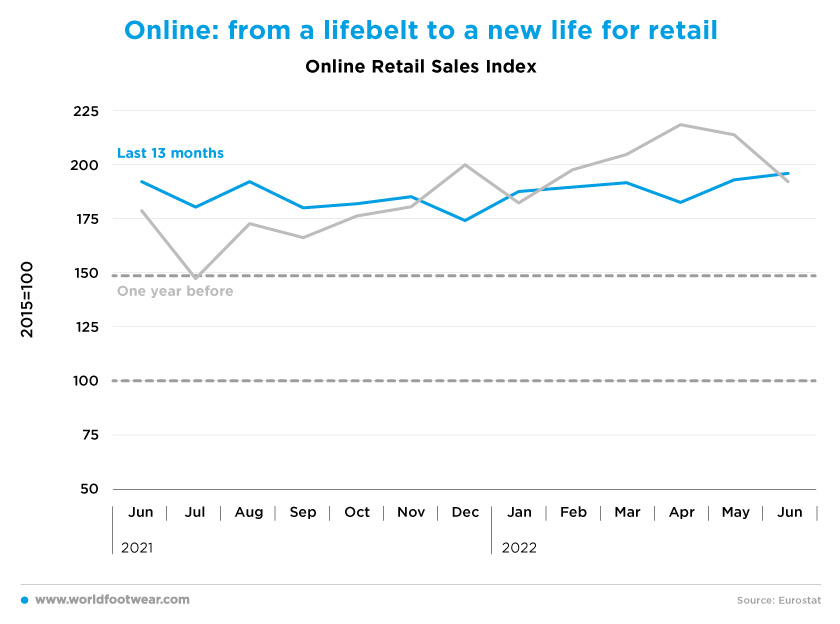

For the time being, and taking the last twelve months through June 2022, overall online sales are quite entrenched between 25 and 50 percentage points above the starting point of February-March 2020, before the pandemic outburst (at the 150 level).Assuming that COVID-19 became just one more seasonal respiratory pathology, online retail seems to have gained about 50 percentage points in 30 months, which is quite a good performance in France.

According to Postnord (2021), clothing and footwear maintained, in France, the TOP1 position in the e-commerce rank, with 22 million consumers, and 50% of all e-commerce consumers, having made purchases in the category. Yet, both figures are lower than the previous year. As no monthly e-statistics for the category are available, it is difficult to say if the gain in the category followed the same performance as the overall online retail. Or, otherwise, whether the share decline of the category observed for total retail also holds for the category in online retail.