First billion dollar quarter in Under Armour’s history

Third quarter net revenue increased 28% reaching 1.20 billion US dollars. The company is raising its 2015 net revenue outlook to approximately 3.91 billion US dollars

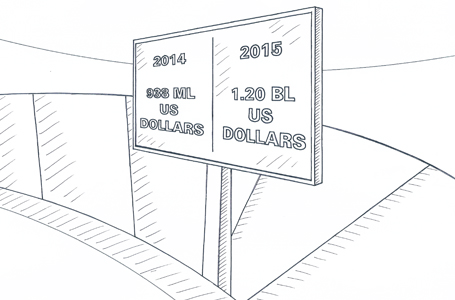

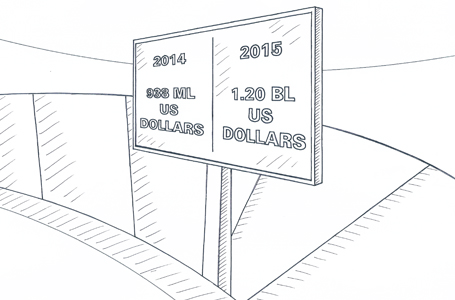

The US-based company has announced net revenue increasing by 28% in the third quarter of 2015 to reach 1.20 billion US dollars compared with net revenue of 938 million US dollars in similar period last year. On a currency neutral basis, net revenue increased 31% compared with the prior year's period.

Net income increased 13% in the third quarter of 2015 to 100 million US dollars compared with 89 million US dollars in the prior year's period and diluted earnings per share for the third quarter of 2015 reached 0.45 US dollars compared with 0.41 US dollars per share in the prior year's period, reflecting the impacts of the Endomondo and MyFitnessPal acquisitions.

Third quarter apparel net revenue increased 23% reaching 866 million driven primarily by enhanced product offerings in baselayer and the expanded Storm innovation platform. Third quarter footwear net revenue increased by 61% to 196 million US dollars, primarily reflecting continued product expansion across the running, basketball and training categories. Third quarter accessories net revenue increased by 22% to 104 million US dollars, driven primarily by new introductions across the bags category.

Direct-to-Consumer net revenue, which represented 26% of total net revenue for the third quarter, grew 28% year-over-year. International net revenue, representing 11% of total net revenue for the third quarter, grew 52% year-over-year.

Kevin Plank, Chairman and CEO of Under Armour, stated: "Our scoreboard in the third quarter not only marked our 22nd straight quarter of at least 20% net revenue growth, but also our first 1 billion US dollars quarter. Our ongoing success in 2015 has been driven by innovative, head-to-toe product, combined with game-changing performances by our athletes."

Based on current visibility, the company expects 2015 net revenue of approximately 3.91 billion US dollars, representing growth of 27% over 2014 and 2015 operating income of approximately 408 million US dollars, representing growth of 15% over 2014. The 2015 guidance continues to reflect the net dilutive impact from the Connected Fitness acquisitions, as well as the impact of the strong dollar negatively affecting our operating margin within our international businesses.

Net income increased 13% in the third quarter of 2015 to 100 million US dollars compared with 89 million US dollars in the prior year's period and diluted earnings per share for the third quarter of 2015 reached 0.45 US dollars compared with 0.41 US dollars per share in the prior year's period, reflecting the impacts of the Endomondo and MyFitnessPal acquisitions.

Third quarter apparel net revenue increased 23% reaching 866 million driven primarily by enhanced product offerings in baselayer and the expanded Storm innovation platform. Third quarter footwear net revenue increased by 61% to 196 million US dollars, primarily reflecting continued product expansion across the running, basketball and training categories. Third quarter accessories net revenue increased by 22% to 104 million US dollars, driven primarily by new introductions across the bags category.

Direct-to-Consumer net revenue, which represented 26% of total net revenue for the third quarter, grew 28% year-over-year. International net revenue, representing 11% of total net revenue for the third quarter, grew 52% year-over-year.

Kevin Plank, Chairman and CEO of Under Armour, stated: "Our scoreboard in the third quarter not only marked our 22nd straight quarter of at least 20% net revenue growth, but also our first 1 billion US dollars quarter. Our ongoing success in 2015 has been driven by innovative, head-to-toe product, combined with game-changing performances by our athletes."

Based on current visibility, the company expects 2015 net revenue of approximately 3.91 billion US dollars, representing growth of 27% over 2014 and 2015 operating income of approximately 408 million US dollars, representing growth of 15% over 2014. The 2015 guidance continues to reflect the net dilutive impact from the Connected Fitness acquisitions, as well as the impact of the strong dollar negatively affecting our operating margin within our international businesses.