Capri is in growth mode

The UK-based group announced double digit growth for fourth quarter's revenue. Capri Holdings is in growth mode and 2020 is expected to be an investment year for the group

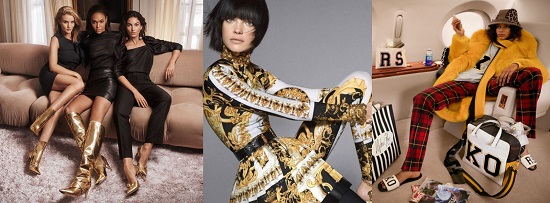

John D. Idol, Chairman and Chief Executive Officer, commented: "Fiscal 2019 was a transformational year for Capri Holdings. We expanded our fashion luxury group with the addition of Versace, one of the world’s most storied Italian luxury brands. Jimmy Choo delivered strong results and we continued to execute against Michael Kors’ three strategic growth pillars of product innovation, brand engagement and customer experience. For the year, we were pleased that our luxury group delivered both double digit revenue and adjusted earnings per share growth”.

Mr. Idol continued: “Looking ahead, Fiscal 2020 will be an investment year for our group, and we believe our initiatives will deliver strong revenue growth for Capri Holdings. Longer term, our three brands position Capri Holdings to accelerate revenue from 6 billion US dollars to 8 billion US dollars, which will be led by Versace and Jimmy Choo, with Michael Kors remaining a strong foundation for Capri Holdings. We expect to grow Versace from 900 million US dollars to 2 billion US dollars in revenue, expand Jimmy Choo from nearly 600 million US dollars to 1 billion US dollars in revenue, while building Michael Kors from 4.5 billion US dollars to 5.0 billion US dollars in revenue. Taken together, we believe our three iconic, founder-led fashion brands position Capri Holdings to deliver multiple years of earnings growth".

Fourth Quarter Overview

Total revenue of 1.344 billion US dollars increased by 13.9% compared to the previous year. On a constant currency basis, total revenue increased by 16.5%. Income from operations was 40 million US dollars and operating margin was 3.0%, compared to 87 million US dollars and 7.4% in the prior year. Adjusted income from operations was 125 million US dollars and operating margin was 9.3%, compared to 154 million US dollars and 13.1% in the prior year. Net income totalled 19 million US dollars, or 0.13 US dollars per diluted share compared to 44 million US dollars, or 0.29 US dollars per diluted share in the prior year. Adjusted net income was 95 million US dollars, or 0.63 US dollars per diluted share, compared to 97 million US dollars or 0.63 US dollars per diluted share in the prior year.Fiscal 2019 Highlights

Full year revenue growth reached 11.0% and adjusted earnings per share of 4.97 US dollars increased 10.0% above prior year.Versace Update

Versace revenue was 137 million US dollars. Compared to Versace stand-alone results from the prior year (Versace was acquired on the 31st of December 2018) revenue increased by high single digits. Versace operating loss was 11 million US dollars and operating margin was (8.0)%. Adjusted operating loss was 6 million US dollars and adjusted operating margin was (4.4)%.Jimmy Choo Update

Jimmy Choo revenue of 139 million US dollars increased by 28.7% compared to the prior year. On a constant currency basis, total revenue increased by 35.1%. On a constant currency basis, comparable store sales increased mid single digits. Jimmy Choo operating loss was 8 million and US dollars operating margin was (5.8)%, compared to an operating loss of 18 million US dollars and operating margin of (16.7)% in the prior year. Adjusted operating loss was 16 million US dollars and adjusted operating margin was (14.8)% in the prior year.Michael Kors Update

Michael Kors revenue of 1.068 billion US dollars decreased 0.4% compared to the prior year. On a constant currency basis, total revenue increased 1.8%. On a constant currency basis, comparable store sales decreased 1.0%. Michael Kors operating income was 166 million US dollars and operating margin was 15.5%, compared to 195 million US dollars and 18.2% in the prior year.

Outlook

Capri Holdings expects total revenue of approximately 6.0 billion US dollars and Operating margin of approximately 15.5%. Diluted earnings per share are expected to reach 4.95 US dollars, including approximately 0.25 dollars per share of dilution from Versace.